MetLife 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

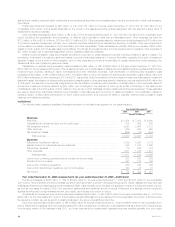

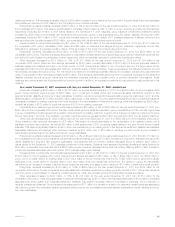

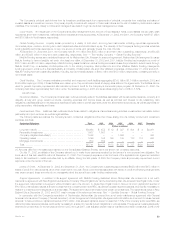

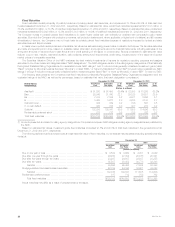

International

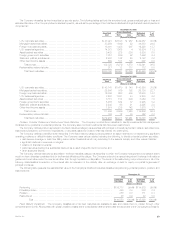

The following table presents consolidated financial information for the International segment for the years indicated:

Year Ended December 31,

2002 2001 2000

(Dollars in millions)

Revenues

Premiums ************************************************************************** $1,511 $ 846 $ 660

Universal life and investment-type product policy fees ************************************* 144 38 53

Net investment income *************************************************************** 461 267 254

Other revenues ********************************************************************* 14 16 9

Net investment (losses) gains ********************************************************* (9) (16) 18

Total revenues ****************************************************************** 2,121 1,151 994

Expenses

Policyholder benefits and claims ******************************************************* 1,388 689 562

Interest credited to policyholder account balances **************************************** 79 51 56

Policyholder dividends**************************************************************** 35 36 32

Payments to former Canadian policyholders ********************************************* — — 327

Other expenses ********************************************************************* 507 329 292

Total expenses****************************************************************** 2,009 1,105 1,269

Income (loss) before provision for income taxes ****************************************** 112 46 (275)

Provision for income taxes ************************************************************ 28 32 10

Net income (loss) ******************************************************************* $ 84 $ 14 $ (285)

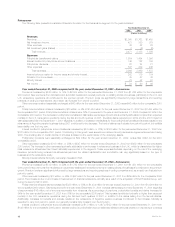

Year ended December 31, 2002 compared with the year ended December 31, 2001—International

Premiums increased by $665 million, or 79%, to $1,511 million for the year ended December 31, 2002 from $846 million for the comparable 2001

period. The June 2002 acquisition of Hidalgo and the 2001 acquisitions in Chile and Brazil increased premiums by $228 million, $102 million and

$8 million, respectively. In addition, a portion of the increase in premiums is attributable to a $108 million increase due to the sale of an annuity contract in

the first quarter of 2002 to a Canadian trust company. South Korea’s premiums increased by $91 million primarily due to a larger professional sales force

and improved agent productivity. Mexico’s premiums (excluding Hidalgo), increased by $66 million, primarily due to increases in its group life, major

medical and individual life businesses. Excluding the aforementioned sale of an annuity contract, Canada’s premiums increased by $26 million due to the

restructuring of a pension contract from an investment-type product to a long-term annuity. Spain’s and Taiwan’s premiums increased by $25 million and

$13 million, respectively, due primarily to continued growth in the direct auto business and in the individual life insurance business. Hong Kong’s

premiums increased $5 million primarily due to continued growth in the group life and traditional life businesses. These increases are partially offset by a

decrease in Argentina’s premiums of $9 million due to the reduction in business caused by the Argentine economic environment. The remainder of the

variance is attributable to minor fluctuations in other countries.

Universal life and investment type-product policy fees increased by $106 million, or 279%, to $144 million for the year ended December 31, 2002

from $38 million for the comparable 2001 period. The acquisition of Hidalgo and the acquisitions in Chile resulted in increases of $102 million and

$5 million, respectively. These increases were partially offset by a $9 million decrease in Spain due to a reduction in fees caused by a decline in assets

under management, as a result of the cessation of product lines offered through a joint venture with Banco Santander in 2001. The remainder of the

variance is attributable to minor fluctuations in several countries.

Other revenues decreased by $2 million, or 13%, to $14 million for the year ended December 31, 2002 from $16 million for the comparable 2001

period. Canada’s other revenues in 2001 included $1 million due primarily to the settlement of two legal cases in 2001. The remainder of the variance is

attributable to minor fluctuations in several countries. The acquisition of Hidalgo and the acquisitions in Chile and Brazil had no material impact on this

variance.

Policyholder benefits and claims increased by $699 million, or 101%, to $1,388 million for the year ended December 31, 2002 from $689 million for

the comparable 2001 period. The acquisition of Hidalgo and the acquisitions in Chile increased policyholder benefits and claims by $224 million and

$169 million, respectively. In addition, $108 million of this increase in policyholder benefits and claims is attributable to the aforementioned sale of an

annuity contract in Canada. South Korea’s, Mexico’s (excluding Hidalgo), Taiwan’s and Spain’s policyholder benefits and claims increased by $69 million,

$67 million, $18 million and $15 million, respectively, commensurate with the overall premium increases discussed above. Excluding the aforementioned

sale of an annuity contract, Canada’s policyholder benefits and claims increased by $32 million primarily due to the restructuring of a pension contract

from an investment-type product to a long-term annuity. The remainder of the variance is attributable to minor fluctuations in several countries.

Interest credited to policyholder account balances increased by $28 million, or 55%, to $79 million for the year ended December 31, 2002 from

$51 million for the comparable 2001 period. The acquisition of Hidalgo contributed $51 million. This increase was partially offset by a decrease of

$17 million in Argentina. This decrease is primarily due to modifications to policy contracts as authorized by the Argentinean government and a reduction

of investment-type policies in-force. In addition, Spain’s interest credited decreased by $7 million primarily due to a decrease in the assets under

management for life products with guarantees associated with the sale of a block of policies to Banco Santander in May 2001. The remainder of the

variance is attributable to minor fluctuations in several countries.

Policyholder dividends remained essentially unchanged at $35 million for the year ended December 31, 2002 versus $36 million for the comparable

2001 period. The acquisition of Hidalgo and the acquisitions in Chile and Brazil had no material impact on this variance.

Other expenses increased by $178 million, or 54%, to $507 million for the year ended December 31, 2002 from $329 million for the comparable

2001 period. The acquisition of Hidalgo and the acquisitions in Chile and Brazil contributed $82 million, $21 million and $5 million, respectively. South

Korea’s, Mexico’s (excluding Hidalgo), and Hong Kong’s other expenses increased by $29 million, $19 million and $7 million, respectively. These

increases are primarily due to increased non-deferrable commissions from higher sales as discussed above, particularly in South Korea where fixed sales

compensation is paid to new sales management as part of the professional agency expansion. Argentina’s other expenses increased by $9 million due to

MetLife, Inc. 19