MetLife 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The Company has not recorded any liability for these indemnities, guarantees and commitments in the accompanying consolidated balance sheets

for the years ended December 31, 2002 or 2001.

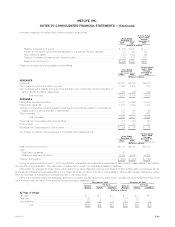

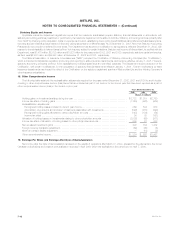

12. Acquisitions and Dispositions

Dispositions

In July 2001, the Company completed its sale of Conning Corporation (‘‘Conning’’), an affiliate acquired in the acquisition of GenAmerica Financial

Corporation (‘‘GenAmerica’’). Conning specialized in asset management for insurance company investment portfolios and investment research. The

Company received $108 million in the transaction and reported a gain of approximately $25 million in the third quarter of 2001.

In October 2000, the Company completed the sale of its 48% ownership interest in its affiliates, Nvest, L.P. and Nvest Companies L.P. This

transaction resulted in an investment gain of $663 million.

Acquisitions

In June 2002, the Company acquired Aseguradora Hidalgo S.A. (‘‘Hidalgo’’), an insurance company based in Mexico with approximately $2.5 billion

in assets as of the date of acquisition. The purchase price is subject to adjustment under certain provisions of the purchase agreement. The Company

does not expect that any purchase price adjustment will have an impact on its consolidated statements of income. The Company is in the process of

integrating Hidalgo and Seguros Genesis, S.A., MetLife’s wholly-owned Mexican subsidiary headquartered in Mexico City, to operate as a combined

entity under the name MetLife Mexico.

In November 2001, the Company acquired Compania de Seguros de Vida Santander S.A. and Compania de Reaseguros de Vida Soince Re S.A.,

wholly-owned subsidiaries of Santander Hispano in Chile. These acquisitions marked MetLife’s entrance into the Chilean insurance market.

In January 2000, Metropolitan Life completed its acquisition of GenAmerica, a holding company which included General American Life Insurance

Company, approximately 49% of the outstanding shares of RGA common stock, and 61% of the outstanding shares of Conning common stock which

was subsequently sold in 2001. Metropolitan Life owned 9% of the outstanding shares of RGA common stock prior to the completion of the GenAmerica

acquisition. During 2002, the Company purchased an additional 327,600 shares of RGA’s outstanding common stock at an aggregate price of

$9.5 million to offset potential future dilution of the Company’s holding of RGA’s common stock arising from the issuance by RGA of company-obligated

mandatorily redeemable securities of a subsidiary trust in December 2001. These purchases increased the Company’s ownership percentage of

outstanding shares of RGA common stock from approximately 58% at December 31, 2001 to approximately 59% at December 31, 2002.

In April 2000, Metropolitan Life acquired the outstanding shares of Conning common stock not already owned by Metropolitan Life for $73 million.

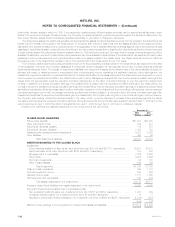

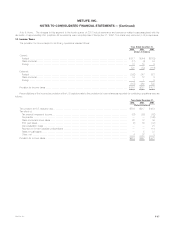

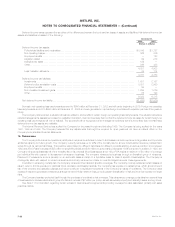

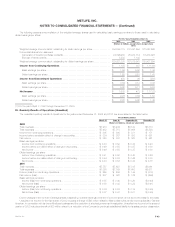

13. Business Realignment Initiatives

During the fourth quarter of 2001, the Company implemented several business realignment initiatives, which resulted from a strategic review of

operations and an ongoing commitment to reduce expenses. The following tables represent the original expenses recorded in the fourth quarter of 2001

and the remaining liability as of December 31, 2002:

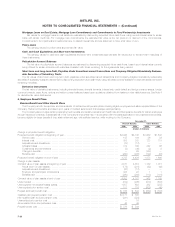

Pre-tax Charges Recorded in the Fourth Quarter of 2001

Institutional Individual Auto & Home Total

(Dollars in millions)

Severance and severance-related costs **************************************** $9 $32 $3 $44

Facilities’ consolidation costs ************************************************** 365 — 68

Business exit costs ********************************************************** 387 — — 387

Total ************************************************************** $399 $97 $ 3 $499

Remaining Liability as of December 31, 2002

Institutional Individual Auto & Home Total

(Dollars in millions)

Severance and severance-related costs **************************************** $— $ 1 $— $ 1

Facilities’ consolidation costs ************************************************** —17 —17

Business exit costs ********************************************************** 40 — — 40

Total ************************************************************** $40 $18 $— $58

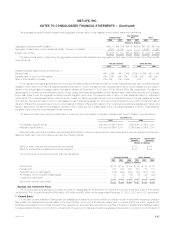

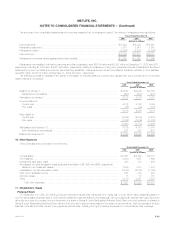

The business realignment initiatives resulted in savings of approximately $95 million, net of income tax, during 2002, comprised of approximately

$33 million, $57 million and $5 million in the Institutional, Individual and Auto & Home segments, respectively.

Institutional. The charges to this segment in the fourth quarter of 2001 include costs associated with exiting a business, including the write-off of

goodwill, severance and severance-related costs, and facilities’ consolidation costs. These expenses are the result of the discontinuance of certain

401(k) recordkeeping services and externally-managed guaranteed index separate accounts. These actions resulted in charges to policyholder benefits

and claims and other expenses of $215 million and $184 million, respectively. During the fourth quarter of 2002, approximately $30 million of the charges

recorded in 2001 were released into income primarily as a result of the accelerated implementation of the Company’s exit from the large market

401(k) business. The business realignment initiatives will ultimately result in the elimination of approximately 930 positions. As of December 31, 2002,

there were approximately 340 terminations to be completed. The Company continues to carry a liability as of December 31, 2002 since the exit plan

could not be completed within one year due to circumstances outside the Company’s control and since certain of its contractual obligations extended

beyond one year.

Individual. The charges to this segment in the fourth quarter of 2001 include facilities’ consolidation costs, severance and severance-related costs,

which predominately stem from the elimination of approximately 560 non-sales positions and 190 operations and technology positions supporting this

segment. As of December 31, 2002, there were approximately 25 terminations to be completed. These costs were recorded in other expenses. The

remaining liability as of December 31, 2002 is due to certain contractual obligations that extended beyond one year.

MetLife, Inc.

F-36