MetLife 2002 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

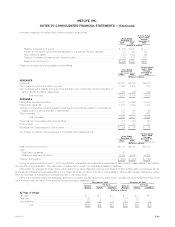

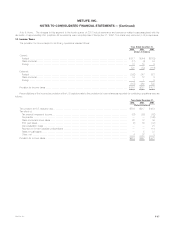

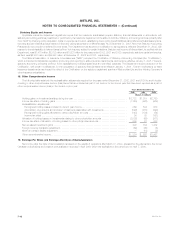

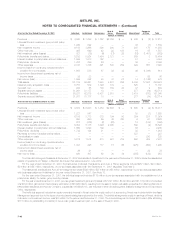

The amounts in the consolidated statements of income are presented net of reinsurance ceded. The effects of reinsurance were as follows:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Direct premiums ********************************************************************** $18,392 $16,332 $15,661

Reinsurance assumed ***************************************************************** 3,018 2,907 2,918

Reinsurance ceded ******************************************************************* (2,324) (2,027) (2,262)

Net premiums ************************************************************************ $19,086 $17,212 $16,317

Reinsurance recoveries netted against policyholder benefits ********************************** $ 3,043 $ 2,255 $ 1,942

Reinsurance recoverables, included in premiums and other receivables, were $3,574 million and $3,393 million at December 31, 2002 and 2001,

respectively, including $1,348 million and $1,356 million, respectively, relating to reinsurance of long-term guaranteed interest contracts and structured

settlement lump sum contracts accounted for as a financing transaction. Reinsurance and ceded commissions payables, included in other liabilities,

were $50 million and $112 million at December 31, 2002 and 2001, respectively.

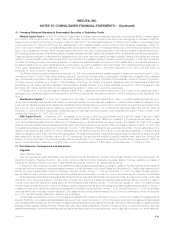

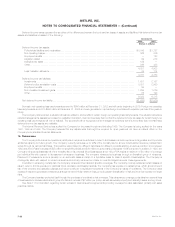

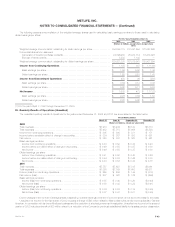

The following provides an analysis of the activity in the liability for benefits relating to property and casualty and group accident and non-medical

health policies and contracts:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Balance at January 1 ******************************************************************** $ 4,597 $ 4,226 $ 3,790

Reinsurance recoverables ************************************************************** (457) (410) (415)

Net balance at January 1 **************************************************************** 4,140 3,816 3,375

Incurred related to:

Current year ************************************************************************* 4,215 4,182 3,786

Prior years *************************************************************************** (85) (84) (112)

4,130 4,098 3,674

Paid related to:

Current year ************************************************************************* (2,559) (2,538) (2,215)

Prior years *************************************************************************** (1,332) (1,236) (1,018)

(3,891) (3,774) (3,233)

Net Balance at December 31 ************************************************************* 4,379 4,140 3,816

Add: Reinsurance recoverables ********************************************************* 481 457 410

Balance at December 31 **************************************************************** $ 4,860 $ 4,597 $ 4,226

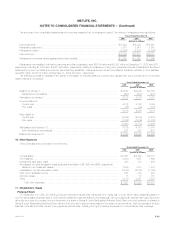

16. Other Expenses

Other expenses were comprised of the following:

Years Ended December 31,

2002 2001 2000

(Dollars in millions)

Compensation************************************************************************** $ 2,481 $ 2,459 $ 2,712

Commissions ************************************************************************** 2,000 1,651 1,696

Interest and debt issue costs ************************************************************* 403 332 436

Amortization of policy acquisition costs (excludes amortization of $5, $25 and ($95), respectively,

related to net investment losses) ******************************************************** 1,639 1,413 1,478

Capitalization of policy acquisition costs **************************************************** (2,340) (2,039) (1,863)

Rent, net of sublease income ************************************************************* 295 282 230

Minority interest************************************************************************* 73 57 115

Other ********************************************************************************* 2,510 2,867 2,597

Total other expenses **************************************************************** $ 7,061 $ 7,022 $ 7,401

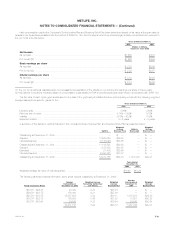

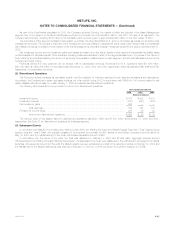

17. Stockholders’ Equity

Preferred Stock

On September 29, 1999, the Holding Company adopted a stockholder rights plan (the ‘‘rights plan’’) under which each outstanding share of

common stock issued between April 4, 2000 and the distribution date (as defined in the rights plan) will be coupled with a stockholder right. Each right

will entitle the holder to purchase one one-hundredth of a share of Series A Junior Participating Preferred Stock. Each one one-hundredth of a share of

Series A Junior Participating Preferred Stock will have economic and voting terms equivalent to one share of common stock. Until it is exercised, the right

itself will not entitle the holder thereof to any rights as a stockholder, including the right to receive dividends or to vote at stockholder meetings.

MetLife, Inc. F-39