MetLife 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

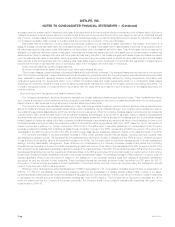

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

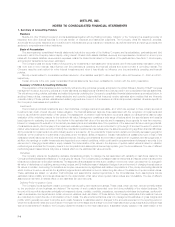

Policyholder Dividends

Policyholder dividends are approved annually by the insurance subsidiaries’ boards of directors. The aggregate amount of policyholder dividends is

related to actual interest, mortality, morbidity and expense experience for the year, as well as management’s judgment as to the appropriate level of

statutory surplus to be retained by the insurance subsidiaries.

Participating Business

Participating business represented approximately 16% and 18% of the Company’s life insurance in-force, and 55% and 78% of the number of life

insurance policies in-force, at December 31, 2002 and 2001, respectively. Participating policies represented approximately 43% and 45%, 43% and

45%, and 47% and 50% of gross and net life insurance premiums for the years ended December 31, 2002, 2001 and 2000, respectively. The

percentages indicated are calculated excluding the business of the Reinsurance segment.

Income Taxes

The Holding Company and its includable life insurance and non-life insurance subsidiaries file a consolidated U.S. federal income tax return in

accordance with the provisions of the Internal Revenue Code of 1986, as amended (the ‘‘Code’’). Non-includable subsidiaries file either separate tax

returns or separate consolidated tax returns. Under the Code, the amount of federal income tax expense incurred by mutual life insurance companies

includes an equity tax calculated based upon a prescribed formula that incorporates a differential earnings rate between stock and mutual life insurance

companies. Metropolitan Life has not been subject to the equity tax since the date of demutualization. The future tax consequences of temporary

differences between financial reporting and tax bases of assets and liabilities are measured at the balance sheet dates and are recorded as deferred

income tax assets and liabilities.

Reinsurance

The Company has reinsured certain of its life insurance and property and casualty insurance contracts with other insurance companies under

various agreements. Amounts due from reinsurers are estimated based upon assumptions consistent with those used in establishing the liabilities related

to the underlying reinsured contracts. Policy and contract liabilities are reported gross of reinsurance credits. Deferred policy acquisition costs are

reduced by amounts recovered under reinsurance contracts. Amounts received from reinsurers for policy administration are reported in other revenues.

The Company assumes and retrocedes financial reinsurance contracts, which represent low mortality risk reinsurance treaties. These contracts are

reported as deposits and are included in other assets. The amount of revenue reported on these contracts represents fees and the cost of insurance

under the terms of the reinsurance agreement.

Separate Accounts

Separate accounts are established in conformity with insurance laws and are generally not chargeable with liabilities that arise from any other

business of the Company. Separate account assets are subject to general account claims only to the extent the value of such assets exceeds the

separate account liabilities. Investments (stated at estimated fair value) and liabilities of the separate accounts are reported separately as assets and

liabilities. Deposits to separate accounts, investment income and recognized and unrealized gains and losses on the investments of the separate

accounts accrue directly to contractholders and, accordingly, are not reflected in the Company’s consolidated statements of income and cash flows.

Mortality, policy administration and surrender charges to all separate accounts are included in revenues.

Stock Based Compensation

The Company accounts for the stock-based compensation plans using the accounting method prescribed by Accounting Principles Board Opinion

(‘‘APB’’) No. 25, Accounting for Stock Issued to Employees (‘‘APB 25’’) and has included in Note 17 the pro forma disclosures required by SFAS No. 123,

Accounting for Stock-Based Compensation (‘‘SFAS 123’’).

Foreign Currency Translation

Balance sheet accounts of foreign operations are translated at the exchange rates in effect at each year-end and income and expense accounts are

translated at the average rates of exchange prevailing during the year. The local currencies of foreign operations are the functional currencies unless the

local economy is highly inflationary. Translation adjustments are charged or credited directly to other comprehensive income or loss. Gains and losses

from foreign currency transactions are reported in earnings.

Discontinued Operations

The results of operations of a component of the Company that either has been disposed of or is classified as held-for-sale on or after January 1,

2002 are reported in discontinued operations if the operations and cash flows of the component have been or will be eliminated from the ongoing

operations of the Company as a result of the disposal transaction and the Company will not have any significant continuing involvement in the operations

of the component after the disposal transaction.

Earnings Per Share

Earnings per share amounts, on a basic and diluted basis, have been calculated based upon the weighted average common shares outstanding or

deemed to be outstanding only for the period after the date of demutualization.

Basic earnings per share is computed based on the weighted average number of shares outstanding during the period. Diluted earnings per share

includes the dilutive effect of the assumed conversion of forward purchase contracts and exercise of stock options, using the treasury stock method.

Under the treasury stock method, exercise of the stock options and the forward purchase contracts is assumed with the proceeds used to purchase

common stock at the average market price for the period. The difference between the number of shares assumed issued and number of shares

assumed purchased represents the dilutive shares.

MetLife, Inc. F-15