MetLife 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The principal risks inherent in holding mortgage-backed securities are prepayment, extension and collateral risks, which will affect the timing of when

cash will be received. The Company’s active monitoring of its mortgage-backed securities mitigates exposure to losses from cash flow risk associated

with interest rate fluctuations.

Asset-Backed Securities. Asset-backed securities, which include home equity loans, credit card receivables, collateralized debt obligations and

automobile receivables, are purchased both to diversify the overall risks of the Company’s fixed maturity assets and to provide attractive returns. The

Company’s asset-backed securities are diversified both by type of asset and by issuer. Home equity loans constitute the largest exposure in the

Company’s asset-backed securities investments. Except for asset-backed securities backed by home equity loans, the asset-backed security invest-

ments generally have little sensitivity to changes in interest rates. Approximately $4,912 million and $3,341 million, or 51.7% and 41.4%, of total asset-

backed securities were rated Aaa/AAA by Moody’s or S&P at December 31, 2002 and 2001, respectively.

The principal risks in holding asset-backed securities are structural, credit and capital market risks. Structural risks include the security’s priority in the

issuer’s capital structure, the adequacy of and ability to realize proceeds from the collateral and the potential for prepayments. Credit risks include

consumer or corporate credits such as credit card holders, equipment lessees, and corporate obligors. Capital market risks include the general level of

interest rates and the liquidity for these securities in the marketplace.

Structured investment transactions. The Company participates in structured investment transactions as part of its risk management strategy,

including asset/liability management, and to enhance the Company’s total return on its investment portfolio. These investments are predominantly made

through bankruptcy-remote special purpose entities (‘‘SPEs’’), which generally acquire financial assets, including corporate equities, debt securities and

purchased options. These investments are referred to as ‘‘beneficial interests.’’

The Company’s exposure to losses related to these SPEs is limited to its carrying value since the Company has not guaranteed the performance,

liquidity or obligations of the SPEs. As prescribed by GAAP, the Company does not consolidate such SPEs since unrelated third parties hold controlling

interests through ownership of the SPEs’ equity, representing at least three percent of the total assets of the SPE throughout the life of the SPE, and such

equity class has the substantive risks and rewards of the residual interests in the SPE.

The Company sponsors financial asset securitizations of high yield debt securities, investment grade bonds and structured finance securities and is

also the collateral manager and a beneficial interest holder in such transactions. As the collateral manager, the Company earns a management fee on the

outstanding securitized asset balance. When the Company transfers assets to an SPE and surrenders control over the transferred assets, the transaction

is accounted for as a sale. Gains or losses on securitizations are determined with reference to the cost or amortized cost of the financial assets

transferred, which is allocated to the assets sold and the beneficial interests retained based on relative fair values at the date of transfer. The Company

has sponsored five securitizations with a total of approximately $1,323 million in financial assets as of December 31, 2002. Two of these transactions

included the transfer of assets totaling approximately $289 million in 2001, resulting in the recognition of an insignificant amount of investment gains. The

Company’s beneficial interests in these SPEs as of December 31, 2002 and 2001 and the related investment income for the years ended December 31,

2002, 2001 and 2000 were insignificant.

The Company also invests in structured investment transactions, which are managed and controlled by unrelated third parties. In instances where

the Company exercises significant influence over the operating and financial policies of an SPE, the beneficial interests are accounted for in accordance

with the equity method of accounting. Where the Company does not exercise significant influence, the structure of the beneficial interests (i.e., debt or

equity securities) determines the method of accounting for the investment. Such beneficial interests generally are structured notes, which are classified as

fixed maturities, and the related income is recognized using the retrospective interest method. Beneficial interests other than structured notes are also

classified as fixed maturities, and the related income is recognized using the level yield method.

The carrying value of all such structured investments, including SPEs, was approximately $870 million and $1.6 billion at December 31, 2002 and

2001, respectively. The related investment income recognized on SPEs was $1 million, $44 million and $62 million for the years ended December 31,

2002, 2001 and 2000, respectively.

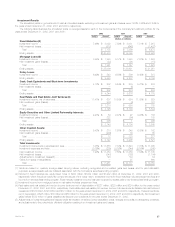

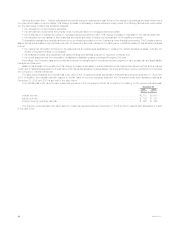

Mortgage Loans on Real Estate

The Company’s mortgage loans on real estate are collateralized by commercial, agricultural and residential properties. Mortgage loans on real estate

comprised 13.2% and 13.9% of the Company’s total cash and invested assets at December 31, 2002 and 2001, respectively. The carrying value of

mortgage loans on real estate is stated at original cost net of repayments, amortization of premiums, accretion of discounts and valuation allowances. The

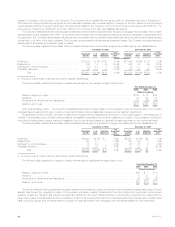

following table shows the carrying value of the Company’s mortgage loans on real estate by type at:

December 31,

2002 2001

Carrying % of Carrying % of

Value Total Value Total

(Dollars in millions)

Commercial ********************************************************************* $19,552 78.0% $17,959 76.0%

Agricultural ********************************************************************** 5,146 20.5 5,268 22.3

Residential ********************************************************************** 388 1.5 394 1.7

Total ******************************************************************* $25,086 100.0% $23,621 100.0%

MetLife, Inc.

32