MetLife 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

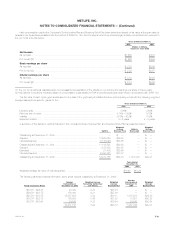

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

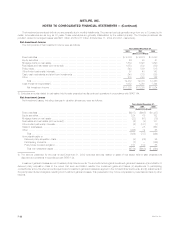

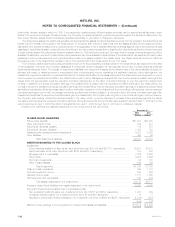

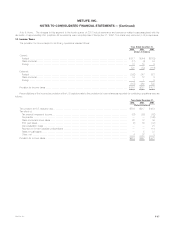

10. Company-Obligated Mandatorily Redeemable Securities of Subsidiary Trusts

MetLife Capital Trust I. In April 2000, MetLife Capital Trust I, a Delaware statutory business trust wholly-owned by the Holding Company, issued

20,125,000 8.00% equity security units (‘‘units’’). Each unit consists of (i) a purchase contract under which the holder agrees to purchase, for $50.00,

shares of common stock of the Holding Company on May 15, 2003 (59,771,250 shares at December 31, 2002 and 2001 based on the average market

price at December 31, 2002 and 2001) and (ii) a capital security, with a stated liquidation amount of $50.00 and mandatorily redeemable on May 15,

2005. The number of shares to be purchased at such date will be determined based on the average trading price of the Holding Company’s common

stock. The proceeds from the sale of the units were used to acquire $1,006 million 8.00% debentures of the Holding Company (‘‘MetLife debentures’’).

The capital securities represent undivided beneficial ownership interests in MetLife Capital Trust I’s assets, which consist solely of the MetLife debentures.

These securities are pledged to collateralize the obligations of the unit holder under the related purchase contracts. Holders of the capital securities are

entitled to receive cumulative cash distributions accruing from April 2000 and payable quarterly in arrears commencing August 15, 2000 at an annual rate

of 8.00%. The Holding Company irrevocably guarantee, on a senior and unsecured basis, the payment in full of distributions on the capital securities and

the stated liquidation amount of the capital securities, in each case to the extent of available trust funds. Holders of the capital securities generally have no

voting rights. Capital securities outstanding were $988 million and $980 million, net of unamortized discounts of $18 million and $26 million, at

December 31, 2002 and 2001, respectively.

The MetLife debentures bear interest at an annual rate of 8.00% of the principal amount, payable quarterly in arrears commencing August 15, 2000

and mature on May 15, 2005. These debentures are unsecured. The Holding Company’s right to participate in the distribution of assets of any subsidiary

upon the subsidiary’s liquidation, reorganization or otherwise, is subject to the prior claims of creditors of the subsidiary, except to the extent the Holding

Company may be recognized as a creditor of that subsidiary. Accordingly, the Holding Company’s obligations under the debentures are effectively

subordinated to all existing and future liabilities of its subsidiaries. Interest expense on the capital securities is included in other expenses and was

$81 million, $81 million and $59 million for the years ended December 31, 2002, 2001 and 2000, respectively.

In February 2003, the Company dissolved MetLife Capital Trust I, distributed the MetLife debentures to the holders of the capital securities in

exchange for the capital securities and the interest rate on the MetLife debentures was reset in connection with the remarketing of the debentures. See

Note 23.

GenAmerica Capital I. In June 1997, GenAmerica Corporation (‘‘GenAmerica’’) issued $125 million of 8.525% capital securities through a

wholly-owned subsidiary trust, GenAmerica Capital I. GenAmerica has fully and unconditionally guaranteed, on a subordinated basis, the obligation of the

trust under the capital securities and is obligated to mandatorily redeem the securities on June 30, 2027. GenAmerica may prepay the securities any time

after June 30, 2007. Capital securities outstanding were $119 million and $118 million, net of unamortized discounts of $6 million and $7 million, at

December 31, 2002 and 2001, respectively. Interest expense on these instruments is included in other expenses and was $11 million for each of the

years ended December 31, 2002, 2001 and 2000.

RGA Capital Trust I. In December 2001, a subsidiary of the Company, RGA, through its wholly-owned trust RGA Capital Trust I (the ‘‘Trust’’)

issued 4,500,000 Preferred Income Equity Redeemable Securities (‘‘PIERS’’) Units. Each PIERS unit consists of (i) a preferred security issued by the

Trust, having a stated liquidation amount of $50 per unit, representing an undivided beneficial ownership interest in the assets of the Trust, which consist

solely of junior subordinated debentures issued by RGA which have a principal amount at maturity of $50 and a stated maturity of March 18, 2051, and

(ii) a warrant to purchase, at any time prior to December 15, 2050, 1.2508 shares of RGA stock at an exercise price of $50. The fair market value of the

warrant on the issuance date was $14.87 and is detachable from the preferred security. RGA fully and unconditionally guarantees, on a subordinated

basis, the obligations of the Trust under the preferred securities. The preferred securities and subordinated debentures were issued at a discount (original

issue discount) to the face or liquidation value of $14.87 per security. The securities will accrete to their $50 face/liquidation value over the life of the

security on a level yield basis. The weighted average effective interest rate on the preferred securities and the subordinated debentures is 8.25% per

annum. Capital securities outstanding were $158 million, net of unamortized discount of $67 million, at both December 31, 2002 and 2001.

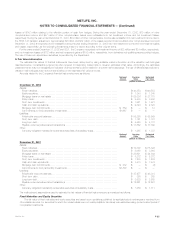

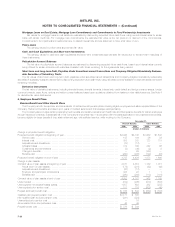

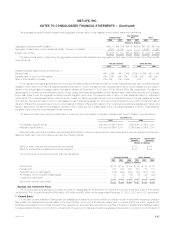

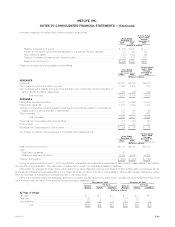

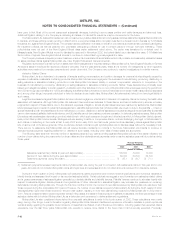

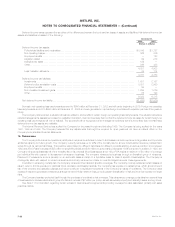

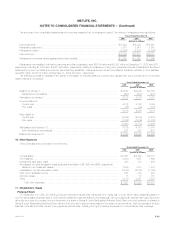

11. Commitments, Contingencies and Guarantees

Litigation

Sales Practices Claims

Over the past several years, Metropolitan Life, New England Mutual Life Insurance Company (‘‘New England Mutual’’) and General American Life

Insurance Company (‘‘General American’’) have faced numerous claims, including class action lawsuits, alleging improper marketing and sales of

individual life insurance policies or annuities. These lawsuits are generally referred to as ‘‘sales practices claims.’’

In December 1999, a federal court approved a settlement resolving sales practices claims on behalf of a class of owners of permanent life insurance

policies and annuity contracts or certificates issued pursuant to individual sales in the United States by Metropolitan Life, Metropolitan Insurance and

Annuity Company or Metropolitan Tower Life Insurance Company between January 1, 1982 and December 31, 1997. The class includes owners of

approximately six million in-force or terminated insurance policies and approximately one million in-force or terminated annuity contracts or certificates.

Similar sales practices class actions against New England Mutual, with which Metropolitan Life merged in 1996, and General American, which was

acquired in 2000, have been settled. In October 2000, a federal court approved a settlement resolving sales practices claims on behalf of a class of

owners of permanent life insurance policies issued by New England Mutual between January 1, 1983 through August 31, 1996. The class includes

owners of approximately 600,000 in-force or terminated policies. A federal court has approved a settlement resolving sales practices claims on behalf of

a class of owners of permanent life insurance policies issued by General American between January 1, 1982 through December 31, 1996. An appellate

court has affirmed the order approving the settlement. The class includes owners of approximately 250,000 in-force or terminated policies. Implementa-

tion of the General American class action settlement is proceeding.

Certain class members have opted out of the class action settlements noted above and have brought or continued non-class action sales practices

lawsuits. In addition, other sales practices lawsuits have been brought. As of December 31, 2002, there are approximately 420 sales practices lawsuits

pending against Metropolitan Life, approximately 60 sales practices lawsuits pending against New England Mutual and approximately 35 sales practices

lawsuits pending against General American. Metropolitan Life, New England Mutual and General American continue to defend themselves vigorously

against these lawsuits. Some individual sales practices claims have been resolved through settlement, won by dispositive motions, or, in a few instances,

MetLife, Inc. F-31