MetLife 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

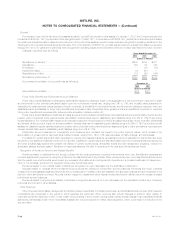

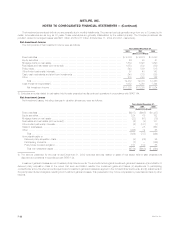

Effective January 1, 2002, the Company adopted SFAS No. 142, Goodwill and Other Intangible Assets (‘‘SFAS 142’’). SFAS 142 eliminates the

systematic amortization and establishes criteria for measuring the impairment of goodwill and certain other intangible assets by reporting unit. The

Company did not amortize goodwill during 2002. Amortization of goodwill was $47 million and $50 million for the years ended December 31, 2001 and

2000, respectively. Amortization of other intangible assets was not material for the years ended December 31, 2002, 2001 and 2000. The Company has

completed the required impairment tests of goodwill and indefinite-lived intangible assets. As a result of these tests, the Company recorded a $5 million

charge to earnings relating to the impairment of certain goodwill assets in the third quarter of 2002 as a cumulative effect of a change in accounting.

There was no impairment of identified intangible assets or significant reclassifications between goodwill and other intangible assets at January 1, 2002.

Effective July 1, 2001, the Company adopted SFAS No. 141, Business Combinations (‘‘SFAS 141’’). SFAS 141 requires the purchase method of

accounting for all business combinations and separate recognition of intangible assets apart from goodwill if such intangible assets meet certain criteria.

In accordance with SFAS 141, the elimination of $5 million of negative goodwill was reported in net income in the first quarter of 2002 as a cumulative

effect of a change in accounting.

In July 2001, the U.S. Securities and Exchange Commission (‘‘SEC’’) released Staff Accounting Bulletin (‘‘SAB’’) No. 102, Selected Loan Loss

Allowance and Documentation Issues (‘‘SAB 102’’). SAB 102 summarizes certain of the SEC’s views on the development, documentation and

application of a systematic methodology for determining allowances for loan and lease losses. The application of SAB 102 by the Company did not have

a material impact on the Company’s consolidated financial statements.

Effective April 1, 2001, the Company adopted certain additional accounting and reporting requirements of SFAS No. 140, Accounting for Transfers

and Servicing of Financial Assets and Extinguishments of Liabilities — a Replacement of FASB Statement No. 125, relating to the derecognition of

transferred assets and extinguished liabilities and the reporting of servicing assets and liabilities. The initial adoption of these requirements did not have a

material impact on the Company’s consolidated financial statements.

Effective April 1, 2001, the Company adopted EITF 99-20, Recognition of Interest Income and Impairment on Certain Investments. This pronounce-

ment requires investors in certain asset-backed securities to record changes in their estimated yield on a prospective basis and to apply specific

evaluation methods to these securities for an other-than-temporary decline in value. The initial adoption of EITF 99-20 did not have a material impact on

the Company’s consolidated financial statements.

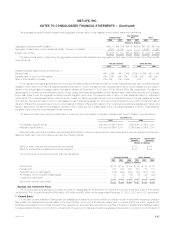

Effective January 1, 2001, the Company adopted SFAS 133 which established new accounting and reporting standards for derivative instruments,

including certain derivative instruments embedded in other contracts, and for hedging activities. The cumulative effect of the adoption of SFAS 133, as of

January 1, 2001, resulted in a $33 million increase in other comprehensive income, net of income taxes of $18 million, and had no material impact on net

income. The increase to other comprehensive income is attributable to net gains on cash flow-type hedges at transition. Also at transition, the amortized

cost of fixed maturities decreased and other invested assets increased by $22 million, representing the fair value of certain interest rate swaps that were

accounted for prior to SFAS 133 using fair value-type settlement accounting. During the year ended December 31, 2001, $18 million of the pre-tax gain

reported in accumulated other comprehensive income at transition was reclassified into net investment income. The FASB continues to issue additional

guidance relating to the accounting for derivatives under SFAS 133, which may result in further adjustments to the Company’s treatment of derivatives in

subsequent accounting periods.

Effective October 1, 2000, the Company adopted SAB No. 101, Revenue Recognition in Financial Statements (‘‘SAB 101’’). SAB 101 summarizes

certain of the Securities and Exchange Commission’s views in applying GAAP to revenue recognition in financial statements. The requirements of

SAB 101 did not have a material effect on the Company’s consolidated financial statements.

Effective January 1, 2000, the Company adopted Statement of Position (‘‘SOP’’) No. 98-7, Accounting for Insurance and Reinsurance Contracts

That Do Not Transfer Insurance Risk (‘‘SOP 98-7’’). SOP 98-7 provides guidance on the method of accounting for insurance and reinsurance contracts

that do not transfer insurance risk, defined in the SOP as the deposit method. SOP 98-7 classifies insurance and reinsurance contracts for which the

deposit method is appropriate into those that (i) transfer only significant timing risk, (ii) transfer only significant underwriting risk, (iii) transfer neither

significant timing nor underwriting risk and (iv) have an indeterminate risk. Adoption of SOP 98-7 did not have a material effect on the Company’s

consolidated financial statements.

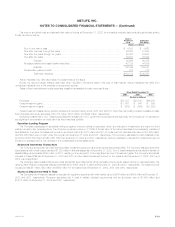

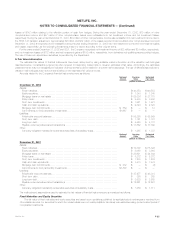

2. September 11, 2001 Tragedies

On September 11, 2001 terrorist attacks occurred in New York, Washington, D.C. and Pennsylvania (the ‘‘tragedies’’) triggering a significant loss of

life and property which had an adverse impact on certain of the Company’s businesses. The Company has direct exposure to these events with claims

arising from its Individual, Institutional, Reinsurance and Auto & Home insurance coverages, and it believes the majority of such claims have been

reported or otherwise analyzed by the Company.

The Company’s original estimate of the total insurance losses related to the tragedies, which was recorded in the third quarter of 2001, was

$208 million, net of income taxes of $117 million. Net income for the year ended December 31, 2002 includes a $17 million, net of income taxes of

$9 million, benefit from the reduction of the liability associated with the tragedies. The revision to the liability is the result of an analysis completed during

the fourth quarter of 2002, which focused on the emerging incidence experienced over the past 12 months associated with certain disability products.

As of December 31, 2002, the Company’s remaining liability for unpaid and future claims associated with the tragedies was $47 million, principally related

to disability coverages. This estimate has been and will continue to be subject to revision in subsequent periods, as claims are received from insureds

and the claims to reinsurers are identified and processed. Any revision to the estimate of gross losses and reinsurance recoveries in subsequent periods

will affect net income in such periods. Reinsurance recoveries are dependent on the continued creditworthiness of the reinsurers, which may be

adversely affected by their other reinsured losses in connection with the tragedies.

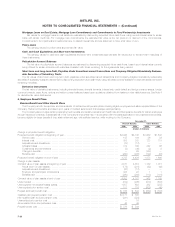

The Company’s general account investment portfolios include investments, primarily comprised of fixed maturities, in industries that were affected by

the tragedies, including airline, other travel, lodging and insurance. Exposures to these industries also exist through mortgage loans and investments in

real estate. The carrying value of the Company’s investment portfolio exposed to industries affected by the tragedies was approximately $3.7 billion at

December 31, 2002.

The long-term effects of the tragedies on the Company’s businesses cannot be assessed at this time. The tragedies have had significant adverse

effects on the general economic, market and political conditions, increasing many of the Company’s business risks. This may have a negative effect on

MetLife’s businesses and results of operations over time. In particular, the declines in share prices experienced after the reopening of the U.S. equity

markets following the tragedies have contributed, and may continue to contribute, to a decline in separate account assets, which in turn may have an

adverse effect on fees earned in the Company’s businesses. In addition, the Company has received and expects to continue to receive disability claims

from individuals resulting from the tragedies.

MetLife, Inc. F-17