MetLife 2002 Annual Report Download - page 24

Download and view the complete annual report

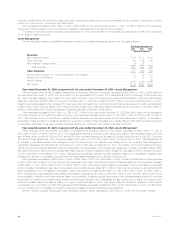

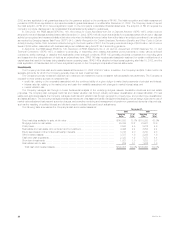

Please find page 24 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.additional loss recognition in connection with ongoing economic circumstances in the country. Poland’s other expenses increased by $5 million primarily

due to costs incurred in the fourth quarter of 2002 associated with the closing of this operation. The remainder of the variance is attributable to minor

fluctuations in several countries.

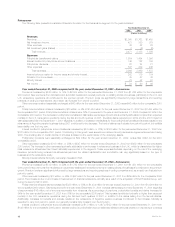

Year ended December 31, 2001 compared with the year ended December 31, 2000—International

Premiums increased by $186 million, or 28%, to $846 million for the year ended December 31, 2001 from $660 million for the comparable 2000

period. Mexico’s premiums grew by $89 million due to additional sales in group life, major medical and individual life products. Protection-type product

sales fostered by the continued expansion of the professional sales force in South Korea accounted for an additional $41 million in premiums. Spain’s

premiums rose by $18 million primarily due to continued growth in the direct auto business. Higher individual life sales resulted in an additional $17 million

in Taiwanese premiums. The 2001 acquisitions in Brazil and Chile increased premiums by $12 million and $7 million, respectively, in those countries.

Hong Kong’s premiums grew by $5 million primarily due to continued growth in the direct marketing, group life, and traditional life businesses. These

variances were partially offset by a $3 million decline in Argentinean individual life premiums, reflecting the impact of economic and political events in that

country. The remainder of the variance is attributable to minor fluctuations in several countries.

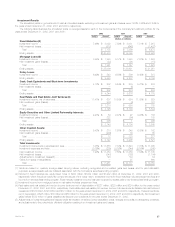

Universal life and investment-type product policy fees decreased by $15 million, or 28%, to $38 million for the year ended December 31, 2001 from

$53 million for the comparable 2000 period. This decline is primarily attributable to a $19 million reduction in fees in Spain caused by a reduction in

assets under management, as a result of a planned cessation of product lines offered through a joint venture with Banco Santander. The remainder of the

variance is attributable to minor fluctuations in several countries.

Other revenues increased by $7 million, or 78%, to $16 million for the year ended December 31, 2001 from $9 million for the comparable 2000

period. Argentina’s other revenues grew by $5 million primarily due to foreign currency transaction gains in the private pension business, which was

introduced in the third quarter of 2001. The required accounting for foreign currency translation fluctuations in Indonesia, a highly inflationary economy,

resulted in a $3 million increase in other revenues. These variances were partially offset by a $3 million decrease in Taiwan due to higher group

reinsurance commissions received in 2000. The remainder of the increase is attributable to minor variances in several countries.

Policyholder benefits and claims increased by $127 million, or 23%, to $689 million for the year ended December 31, 2001 from $562 million for the

comparable 2000 period. Mexico’s, South Korea’s and Taiwan’s policyholder benefits and claims grew by $74 million, $24 million and $15 million,

respectively, commensurate with the overall premium variance discussed above. The 2001 acquisitions in Brazil and Chile contributed $9 million and

$7 million, respectively, to this variance. These variances are partially offset by a $7 million decline in Argentina’s policyholder benefits and claims as a

result of the impact of economic and political events in that country. The remainder of the variance is attributable to minor fluctuations in several countries.

Interest credited to policyholder account balances decreased by $5 million, or 9%, to $51 million for the year ended December 31, 2001 from $56

million for the comparable 2000 period. An overall decline in crediting rates on interest-sensitive products in 2001 as a result of the low interest rate

environment is primarily responsible for a $6 million reduction in South Korea. Spain’s interest credited dropped by $6 million due to a reduction in assets

under management, as a result of a planned cessation of product lines offered through a joint venture with Banco Santander. These variances were

partially offset by a $2 million increase in both Mexico and Argentina, due to an increase in average customer account balances.

Policyholder dividends increased by $4 million, or 13%, to $36 million for the year ended December 31, 2001 from $32 million for the comparable

2000 period. The growth in Mexico’s group life sales mentioned above resulted in an increase in policyholder dividends of $2 million. Taiwan’s individual

life sales contributed an additional $2 million in policyholder dividends. The remainder of the variance is attributable to minor fluctuations in several

countries.

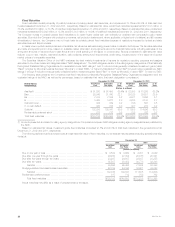

Payments of $327 million related to Metropolitan Life’s demutualization were made during the second quarter of 2000 to holders of certain policies

transferred to Clarica Life Insurance Company in connection with the sale of a substantial portion of the Company’s Canadian operations in 1998.

Other expenses increased by $37 million, or 13%, to $329 million for the year ended December 31, 2001 from $292 million in the comparable 2000

period. Argentina’s other expenses rose by $15 million due to a write-off of deferred policy acquisition costs, resulting from a revision in the calculation of

estimated gross margins and profits caused by the anticipated impact of economic and political events in that country. Mexico and South Korea’s other

expenses grew by $13 million and $10 million, respectively, primarily due to the growth in business in these countries. The 2001 acquisitions in Brazil and

Chile contributed $7 million and $3 million, respectively, to this variance. These variances were partially offset by an $11 million decrease in Spain’s other

expenses due to a reduction in payroll, commissions, and administrative expenses as a result of a planned cessation of product lines offered through a

joint venture with Banco Santander. The remainder of the variance is attributable to minor fluctuations in several countries.

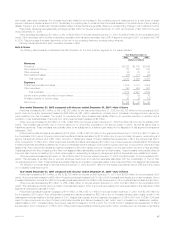

Corporate & Other

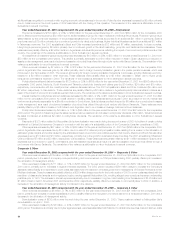

Year ended December 31, 2002 compared with the year ended December 31, 2001 — Corporate & Other

Other revenues increased by $16 million, or 19%, to $101 million for the year ended December 31, 2002 from $85 million for the comparable 2001

period, primarily due to the sale of a company-occupied building, and income earned on COLI purchased during 2002, partially offset by an increase in

the elimination of intersegment activity.

Other expenses increased by $111 million, or 17%, to $768 million for the year ended December 31, 2002 from $657 million for the comparable

2001 period, primarily due to increases in legal and interest expenses. The 2002 period includes a $266 million charge to increase the Company’s

asbestos-related liability and expenses to cover costs associated with the resolution of federal government investigations of General American’s former

Medicare business. These increases are partially offset by a $250 million charge recorded in the fourth quarter of 2001 to cover costs associated with the

resolution of class action lawsuits and a regulatory inquiry pending against Metropolitan Life, involving alleged race-conscious insurance underwriting

practices prior to 1973. The increase in interest expenses is primarily due to increases in long-term debt resulting from the issuance of $1.25 billion and

$1 billion of senior debt in November 2001 and December 2002, respectively, partially offset by a decrease in commercial paper in 2002. In addition, a

decrease in the elimination of intersegment activity contributed to the variance.

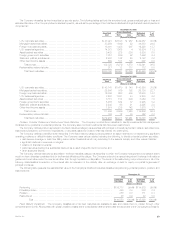

Year ended December 31, 2001 compared with the year ended December 31, 2000 — Corporate & Other

Other revenues decreased by $6 million, or 7%, to $85 million for the year ended December 31, 2001 from $91 million for the comparable 2000

period, primarily due the sales of certain subsidiaries in 2000, partially offset by the recognition of a refund earned on a reinsurance treaty in 2001 and a

decrease in the elimination of intersegment activity.

Demutualization costs of $230 million were incurred during the year ended December 31, 2000. These costs are related to Metropolitan Life’s

demutualization on April 7, 2000.

Other expenses increased by $198 million, or 43%, to $657 million for the year ended December 31, 2001 from $459 million for the comparable

2000 period. This variance is primarily due to higher legal expenses, expenses associated with MetLife, Inc. shareholder services cost and start-up costs

MetLife, Inc.

20