MetLife 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

policyholder dividend scales in effect for 1999, if the experience underlying such dividend scales continues, and for appropriate adjustments in such

scales if the experience changes. At least annually, the Company compares actual and projected experience against the experience assumed in the

then-current dividend scales. Dividend scales are adjusted periodically to give effect to changes in experience.

The closed block assets, the cash flows generated by the closed block assets and the anticipated revenues from the policies in the closed block will

benefit only the holders of the policies in the closed block. To the extent that, over time, cash flows from the assets allocated to the closed block and

claims and other experience related to the closed block are, in the aggregate, more or less favorable than what was assumed when the closed block was

established, total dividends paid to closed block policyholders in the future may be greater than or less than the total dividends that would have been paid

to these policyholders if the policyholder dividend scales in effect for 1999 had been continued. Any cash flows in excess of amounts assumed will be

available for distribution over time to closed block policyholders and will not be available to stockholders. If the closed block has insufficient funds to make

guaranteed policy benefit payments, such payments will be made from assets outside of the closed block. The closed block will continue in effect as

long as any policy in the closed block remains in-force. The expected life of the closed block is over 100 years.

The Company uses the same accounting principles to account for the participating policies included in the closed block as it used prior to the date

of demutualization. However, the Company establishes a policyholder dividend obligation for earnings that will be paid to policyholders as additional

dividends as described below. The excess of closed block liabilities over closed block assets at the effective date of the demutualization (adjusted to

eliminate the impact of related amounts in accumulated other comprehensive income) represents the estimated maximum future earnings from the

closed block expected to result from operations attributed to the closed block after income taxes. Earnings of the closed block are recognized in income

over the period the policies and contracts in the closed block remain in-force. Management believes that over time the actual cumulative earnings of the

closed block will approximately equal the expected cumulative earnings due to the effect of dividend changes. If, over the period the closed block

remains in existence, the actual cumulative earnings of the closed block is greater than the expected cumulative earnings of the closed block, the

Company will pay the excess of the actual cumulative earnings of the closed block over the expected cumulative earnings to closed block policyholders

as additional policyholder dividends unless offset by future unfavorable experience of the closed block and, accordingly, will recognize only the expected

cumulative earnings in income with the excess recorded as a policyholder dividend obligation. If over such period, the actual cumulative earnings of the

closed block is less than the expected cumulative earnings of the closed block, the Company will recognize only the actual earnings in income. However,

the Company may change policyholder dividend scales in the future, which would be intended to increase future actual earnings until the actual

cumulative earnings equal the expected cumulative earnings. Amounts reported for the period after demutualization are as of April 1, 2000 and for the

period beginning on April 1, 2000 (the effect of transactions from April 1, 2000 through April 6, 2000 is not considered material).

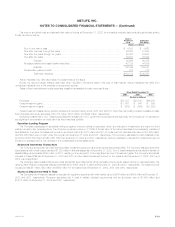

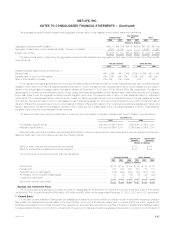

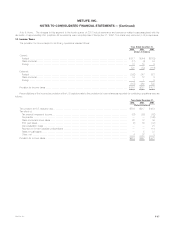

Closed block liabilities and assets designated to the closed block are as follows:

December 31,

2002 2001

(Dollars in millions)

CLOSED BLOCK LIABILITIES

Future policy benefits ************************************************************************ $41,207 $40,325

Other policyholder funds ********************************************************************* 279 321

Policyholder dividends payable **************************************************************** 719 757

Policyholder dividend obligation **************************************************************** 1,882 708

Payables under securities loaned transactions *************************************************** 4,851 3,350

Other liabilities ****************************************************************************** 433 90

Total closed block liabilities *********************************************************** 49,371 45,551

ASSETS DESIGNATED TO THE CLOSED BLOCK

Investments:

Fixed maturities available-for-sale, at fair value (amortized cost: $28,334 and $25,761, respectively) **** 29,981 26,331

Equity securities, at fair value (amortized cost: $236 and $240, respectively) ************************ 218 282

Mortgage loans on real estate *************************************************************** 7,032 6,358

Policy loans ****************************************************************************** 3,988 3,898

Short-term investments********************************************************************* 24 170

Other invested assets********************************************************************** 604 159

Total investments******************************************************************** 41,847 37,198

Cash and cash equivalents ******************************************************************* 435 1,119

Accrued investment income******************************************************************* 540 550

Deferred income taxes *********************************************************************** 1,151 1,060

Premiums and other receivables *************************************************************** 130 244

Total assets designated to the closed block ********************************************* 44,103 40,171

Excess of closed block liabilities over assets designated to the closed block************************** 5,268 5,380

Amounts included in accumulated other comprehensive loss:

Net unrealized investment gains, net of deferred income tax of $577 and $219, respectively ********** 1,047 389

Unrealized derivative gains, net of deferred income tax of $7 and $9, respectively ******************* 13 17

Allocated to policyholder dividend obligation, net of deferred income tax of $668 and $255, respectively (1,214) (453)

(154) (47)

Maximum future earnings to be recognized from closed block assets and liabilities********************* $ 5,114 $ 5,333

MetLife, Inc.

F-28