MetLife 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

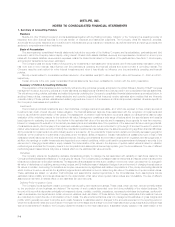

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

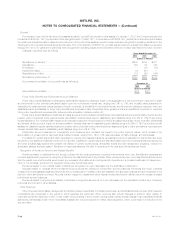

The Company may enter into contracts that are not themselves derivative instruments but contain embedded derivatives. For each contract, the

Company assesses whether the economic characteristics of the embedded derivative are clearly and closely related to those of the host contract and

determines whether a separate instrument with the same terms as the embedded instrument would meet the definition of a derivative instrument.

If it is determined that the embedded derivative possesses economic characteristics that are not clearly and closely related to the economic

characteristics of the host contract, and that a separate instrument with the same terms would qualify as a derivative instrument, the embedded derivative

is separated from the host contract and accounted for as a stand-alone derivative. Such embedded derivatives are recorded on the consolidated

balance sheet at fair value and changes in their fair value are recorded currently in net investment gains or losses. If the Company is unable to properly

identify and measure an embedded derivative for separation from its host contract, the entire contract is carried on the consolidated balance sheet at fair

value, with changes in fair value recognized in the current period as net investment gains or losses.

The Company also uses derivatives to synthetically create investments that are either more expensive to acquire or otherwise unavailable in the cash

markets. These securities, called replication synthetic asset transactions (‘‘RSATs’’), are a combination of a derivative and a cash security to synthetically

create a third replicated security. These derivatives are not designated as hedges. As of December 31, 2002 and 2001, 19 and 15, respectively, of such

RSATs, with notional amounts totaling $285 million and $205 million, respectively, have been created through the combination of a credit default swap

and a U.S. Treasury security. The Company records the premiums received on the credit default swaps in investment income over the life of the contract

and changes in fair value are recorded in net investment gains and losses.

The Company enters into written covered calls and net written covered collars to generate additional investment income on the underlying assets it

holds. These derivatives are not designated as hedges. The Company records the premiums received as net investment income over the life of the

contract and changes in fair value of such options and collars as net investment gains and losses.

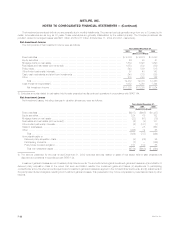

Cash and Cash Equivalents

The Company considers all investments purchased with an original maturity of three months or less to be cash equivalents.

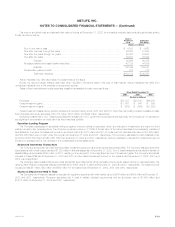

Property, Equipment, Leasehold Improvements and Computer Software

Property, equipment and leasehold improvements, which are included in other assets, are stated at cost, less accumulated depreciation and

amortization. Depreciation is determined using either the straight-line or sum-of-the-years-digits method over the estimated useful lives of the assets. The

estimated life for company occupied real estate property is 40 years. Estimated lives range from five to ten years for leasehold improvements and three to

five years for all other property and equipment. Accumulated depreciation and amortization of property, equipment and leasehold improvements was

$428 million and $552 million at December 31, 2002 and 2001, respectively. Related depreciation and amortization expense was $85 million, $99 million

and $90 million for the years ended December 31, 2002, 2001 and 2000, respectively.

Computer software, which is included in other assets, is stated at cost, less accumulated amortization. Purchased software costs, as well as internal

and external costs incurred to develop internal-use computer software during the application development stage, are capitalized. Such costs are

amortized generally over a three-year period using the straight-line method. Accumulated amortization of capitalized software was $317 million and

$169 million at December 31, 2002 and 2001, respectively. Related amortization expense was $155 million, $110 million and $45 million for the years

ended December 31, 2002, 2001 and 2000, respectively.

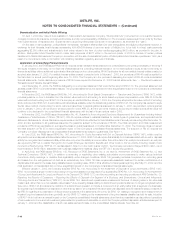

Deferred Policy Acquisition Costs

The costs of acquiring new insurance business that vary with, and are primarily related to, the production of new business are deferred. Such costs,

which consist principally of commissions, agency and policy issue expenses, are amortized with interest over the expected life of the contract for

participating traditional life, universal life and investment-type products. Generally, deferred policy acquisition costs are amortized in proportion to the

present value of estimated gross margins or profits from investment, mortality, expense margins and surrender charges. Interest rates are based on rates

in effect at the inception or acquisition of the contracts.

Actual gross margins or profits can vary from management’s estimates resulting in increases or decreases in the rate of amortization. Management

utilizes the reversion to the mean assumption, a standard industry practice, in its determination of the amortization of deferred policy acquisition costs.

This practice assumes that the expectation for long-term appreciation is not changed by minor short-term market fluctuations, but that it does change

when large interim deviations have occurred. Management periodically updates these estimates and evaluates the recoverability of deferred policy

acquisition costs. When appropriate, management revises its assumptions of the estimated gross margins or profits of these contracts, and the

cumulative amortization is re-estimated and adjusted by a cumulative charge or credit to current operations.

Deferred policy acquisition costs for non-participating traditional life, non-medical health and annuity policies with life contingencies are amortized in

proportion to anticipated premiums. Assumptions as to anticipated premiums are made at the date of policy issuance or acquisition and are consistently

applied during the lives of the contracts. Deviations from estimated experience are included in operations when they occur. For these contracts, the

amortization period is typically the estimated life of the policy.

Policy acquisition costs related to internally replaced contracts are expensed at the date of replacement.

Deferred policy acquisition costs for property and casualty insurance contracts, which are primarily comprised of commissions and certain

underwriting expenses, are deferred and amortized on a pro rata basis over the applicable contract term or reinsurance treaty.

Value of business acquired (‘‘VOBA’’), included as part of deferred policy acquisition costs, represents the present value of future profits generated

from existing insurance contracts in force at the date of acquisition and is amortized over the expected policy or contract duration in relation to the present

value of estimated gross profits from such policies and contracts.

MetLife, Inc.

F-12