MetLife 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc. Annual Report 2002

Table of contents

-

Page 1

MetLife, Inc. Annual Report 2002 -

Page 2

-

Page 3

... offerings to compensate for the lower demand for variable products. Increases in whole life, universal life and term life insurance sales offset declines in equity-linked insurance products, while the launch of a new line of annuity products created new market opportunities in the agent and broker... -

Page 4

...in production by: MetLife Investors Group, up 98%; New England Financial, up 32%; MetLife Resources, up 16%; and, MetLife Financial Services, up 6%. Fixed annuity deposits were $1.47 billion and variable annuity deposits were $6.42 billion. In the international arena, MetLife's acquisition of Mexico... -

Page 5

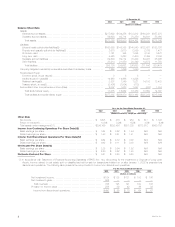

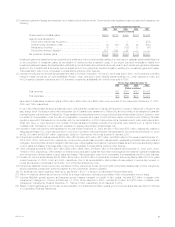

...Income Data Revenues: Premiums 19,086 Universal life and investment-type product policy fees 2,139 Net investment income(1 11,329 Other revenues 1,377 Net investment (losses) gains(1)(2)(3 784) Total revenues(3)(4 Expenses: Policyholder beneï¬ts and claims(5 Interest credited to policyholder... -

Page 6

..., 2000 (Dollars in millions) 1999 1998 Balance Sheet Data Assets: General account assets Separate account assets Total assets Liabilities: Life and health policyholder liabilities(8 Property and casualty policyholder liabilities(8 Short-term debt Long-term debt Separate account liabilities... -

Page 7

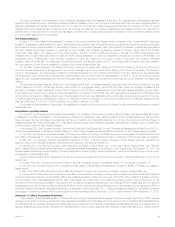

... tax imposed on mutual life insurance companies under Section 809 of the Internal Revenue Code. Policyholder liabilities include future policy beneï¬ts and other policyholder funds. Life and health policyholder liabilities also include policyholder account balances, policyholder dividends payable... -

Page 8

...discussion, the terms ''Company'' or ''MetLife'' refer, at all times prior to the date of demutualization (as hereinafter deï¬ned), to Metropolitan Life Insurance Company (''Metropolitan Life''), a mutual life insurance company organized under the laws of the State of New York, and its subsidiaries... -

Page 9

... Common Stock held in the MetLife Policyholder Trust, cash or an adjustment to their policy values in the form of policy credits, as provided in the plan. In addition, Metropolitan Life's Canadian branch made cash payments to holders of certain policies transferred to Clarica Life Insurance Company... -

Page 10

...ï¬ts The Company establishes liabilities for amounts payable under insurance policies, including traditional life insurance, annuities and disability insurance. Generally, amounts are payable over an extended period of time and the proï¬tability of the products is dependent on the pricing of the... -

Page 11

... due to sales growth in its group life, dental, disability and long-term care businesses, a sale of a signiï¬cant retirement and savings contract in the second quarter of 2002, as well as new sales throughout 2002 in this segment's structured settlements and traditional annuity products. The June... -

Page 12

... equity market performance despite growth in annuity deposits. Management would expect policy fees from annuity and investment-type products to continue to be adversely impacted while revenues from insurance fees on variable life products would be expected to rise if average separate account asset... -

Page 13

... from sales growth in new annuity and investment-type products. In addition, a decrease of $39 million in Asset Management is primarily due to the sale of Conning in July 2001. Primarily as a result of changes in expected rate of return and discount rate assumptions effective for 2003, the Company... -

Page 14

... Auto & Home segment. A $110 million decline in the Individual segment is attributable to lower sales of traditional life insurance policies, which reï¬,ects a continued shift in customer preference from those policies to variable life products. Universal life and investment-type product policy fees... -

Page 15

... growth in the group life, dental, disability and long-term care insurance businesses, commensurate with the variance in premiums, partially offset by a decrease in policyholder beneï¬ts and claims related to the retirement and savings business. Policyholder beneï¬ts and claims for the Reinsurance... -

Page 16

... 2000 (Dollars in millions) Revenues Premiums Universal life and investment-type product policy fees Net investment income Other revenues Net investment (losses) gains Total revenues Expenses Policyholder beneï¬ts and claims Interest credited to policyholder account balances Policyholder... -

Page 17

... comparable 2000 period. Policy fees from insurance products rose by $149 million. This growth is primarily due to increases in variable life products reï¬,ecting a continued shift in customer preferences from traditional life products. Policy fees from annuity and investment-type products decreased... -

Page 18

... life, dental, disability and long-term care businesses. Retirement and savings premiums increased by $461 million primarily due to the sale of a signiï¬cant contract in the second quarter of 2002, as well as new sales throughout 2002 from structured settlements and traditional annuity products... -

Page 19

... insurance coverages purchased by existing customers with funds received in the demutualization. Retirement and savings premiums decreased by $292 million, primarily as a result of $270 million in premiums received in 2000 from existing customers. Universal life and investment-type product policy... -

Page 20

... period. Contributing to this growth were several new deferred annuity reinsurance agreements executed during 2002. The crediting rate on certain blocks of annuities is based on the performance of the underlying assets. Policyholder dividends were essentially unchanged at $22 million for the year... -

Page 21

... cash-value contracts. The increase is primarily related to an increase in the underlying account balances due to a new block of single premium deferred annuities reinsured in 2001. Additionally, the crediting rate on certain blocks of annuities is based on the performance of the underlying assets... -

Page 22

..., investment portfolio performance, new business sales and growth in revenues and proï¬ts. The variable compensation plans reward the employees for growth in their businesses, but also require them to share in the impact of any declines. Increased sales commissions arising from higher mutual fund... -

Page 23

...a pension contract from an investment-type product to a long-term annuity. Spain's and Taiwan's premiums increased by $25 million and $13 million, respectively, due primarily to continued growth in the direct auto business and in the individual life insurance business. Hong Kong's premiums increased... -

Page 24

...as a result of the low interest rate environment is primarily responsible for a $6 million reduction in South Korea. Spain's interest credited dropped by $6 million due to a reduction in assets under management, as a result of a planned cessation of product lines offered through a joint venture with... -

Page 25

...tability under statutory accounting practices. Management of the Holding Company cannot provide assurance that Metropolitan Life will have statutory earnings to support payment of dividends to the Holding Company in an amount sufï¬cient to fund its cash requirements and pay cash dividends or that... -

Page 26

...insurance premiums, annuity considerations and deposit funds. A primary liquidity concern with respect to these cash inï¬,ows is the risk of early contractholder and policyholder withdrawal. The Company seeks to include provisions limiting withdrawal rights on many of its products, including general... -

Page 27

...cash funding requirements. Support Agreements. In addition to its support agreement with MetLife Funding described above, Metropolitan Life entered into a net worth maintenance agreement with New England Life Insurance Company (''New England Life'') at the time Metropolitan Life acquired New England... -

Page 28

... in the group life, dental, disability and long-term care businesses, the sale of a signiï¬cant retirement and savings contract in the second quarter of 2002, as well as additional sales of structured settlements and traditional annuity products. In addition, a large annuity contract sold in the... -

Page 29

$3,514 million increase in policyholder account balances primarily from sales of annuity products, $2,550 million of cash payments to policyholders in 2000 related to the Company's demutualization, the paydown of $2,365 million of short-term debt in 2000 and the issuance of $1,393 million in ... -

Page 30

... and management of certain non-guaranteed elements of its products, such as the resetting of credited interest and dividend rates for policies that permit such adjustments. The following table summarizes the Company's cash and invested assets at: December 31, 2002 Carrying Value % of Total 2001... -

Page 31

...are based on quarterly average asset carrying values, excluding recognized and unrealized gains and losses, and for yield calculation purposes, average assets exclude collateral associated with the Company's securities lending program. (2) Included in fixed maturities are equity-linked notes of $834... -

Page 32

... ratings and rating agency designations are published by the NAIC. Based on estimated fair values, investment grade ï¬xed maturities comprised 91.5% and 90.8% of total ï¬xed maturities in the general account at December 31, 2002 and 2001, respectively. The following table shows the amortized cost... -

Page 33

... in the interest rate, an extension of the maturity date, an exchange of debt for equity or a partial forgiveness of principal or interest. The following table presents the estimated fair value of the Company's total ï¬xed maturities classiï¬ed as performing, potential problem, problem and... -

Page 34

... information obtained from regulators and rating agencies. The Company records writedowns as investment losses and adjusts the cost basis of the ï¬xed maturities accordingly. The Company does not change the revised cost basis for subsequent recoveries in value. Writedowns of ï¬xed maturities were... -

Page 35

... 80.4% and 79.5%, respectively, of total mortgage-backed securities, and a majority of this amount represented agency-issued pass-through and collateralized mortgage obligations guaranteed or otherwise supported by the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation... -

Page 36

... of when cash will be received. The Company's active monitoring of its mortgage-backed securities mitigates exposure to losses from cash ï¬,ow risk associated with interest rate ï¬,uctuations. Asset-Backed Securities. Asset-backed securities, which include home equity loans, credit card receivables... -

Page 37

... commercial mortgage loans by both geographic region and property type, and manages these investments through a network of regional ofï¬ces overseen by its investment department. The following table presents the distribution across geographic regions and property types for commercial mortgage loans... -

Page 38

... future cash ï¬,ows discounted at the loan's original effective interest rate or the value of the loan's collateral. The Company records valuation allowances as investment losses. The Company records subsequent adjustments to allowances as investment gains or losses. The following table presents... -

Page 39

.... The Company classiï¬es its investments in common stocks as available-for-sale and marks them to market, except for non-marketable private equities, which are generally carried at cost. The Company uses the equity method of accounting for investments in limited partnership interests in which... -

Page 40

... and rating agencies. Equity securities or other limited partnership interests which are deemed to be other-than-temporarily impaired are written down to fair value. The Company records writedowns as investment losses and adjusts the cost basis of the equity securities accordingly. The Company does... -

Page 41

...security type in common stock (80%) and mutual funds (15%); and concentrated by industry in ï¬nancial (80%) and domestic broad market mutual funds (15%) (calculated as a percentage of gross unrealized loss). The signiï¬cant factors considered at December 31, 2002 in the review of equity securities... -

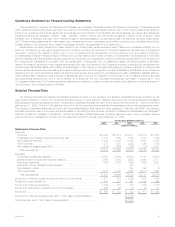

Page 42

... fees and surrender charges. Quantitative and Qualitative Disclosures About Market Risk The Company must effectively manage, measure and monitor the market risk associated with its invested assets and interest rate sensitive insurance contracts. It has developed an integrated process for managing... -

Page 43

... rates. In addition, these models include asset cash ï¬,ow projections reï¬,ecting interest payments, sinking fund payments, principal payments, bond calls, mortgage prepayments and defaults. New York Insurance Department regulations require that MetLife perform some of these analyses annually... -

Page 44

... a material adverse effect on the fair value of its interest rate sensitive invested assets. The equity and foreign currency portfolios do not expose the Company to material market risk. The table below illustrates the potential loss in fair value of the Company's interest rate sensitive ï¬nancial... -

Page 45

... for the years ended December 31, 2002, 2001 and 2000: Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Stockholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Page F-2 F-3 F-4 F-5 F-6 F-8 MetLife, Inc. F-1 -

Page 46

... of their operations and their consolidated cash flows for each of the three years in the period ended December 31, 2002, in conformity with accounting principles generally accepted in the United States of America. DELOITTE & TOUCHE LLP New York, New York February 19, 2003 F-2 MetLife, Inc. -

Page 47

... Other limited partnership interests 2,395 Short-term investments 1,921 Other invested assets 3,727 Total investments Cash and cash equivalents Accrued investment income Premiums and other receivables Deferred policy acquisition costs Other assets Separate account assets Total assets 188... -

Page 48

...per share data) 2002 2001 2000 REVENUES Premiums Universal life and investment-type product policy fees Net investment income Other revenues Net investment losses (net of amounts allocable to other accounts of ($145), ($134) and ($54), respectively) ** Total revenues EXPENSES Policyholder bene... -

Page 49

...Losses) Gains Adjustment Adjustment Common Stock Additional Paid-in Capital Retained Earnings Treasury Stock at Cost Total Balance at December 31, 1999 Policy credits and cash payments to eligible policyholders ** Common stock issued in demutualization Initial public offering of common stock... -

Page 50

... discounts associated with investments, net 519) Losses from sales of investments and businesses, net 931 Interest credited to other policyholder account balances 2,950 Universal life and investment-type product policy fees 2,139) Change in premiums and other receivables 795) Change in deferred... -

Page 51

...debt issued 1,008 Long-term debt repaid 211) Common stock issued Treasury stock acquired 471) Net proceeds from issuance of company-obligated mandatorily redeemable securities of subsidiary trust **** - Cash payments to eligible policyholders Dividends on common stock 147) Net cash provided by... -

Page 52

... section of individual and institutional customers. The Company offers life insurance, annuities, automobile and property insurance and mutual funds to individuals and group insurance, reinsurance, as well as retirement and savings products and services to corporations and other institutions. Basis... -

Page 53

...which include the discount rate, expected return on plan assets and rate of future compensation increases as determined by the Company. Management determines these assumptions based upon currently available market and industry data, historical performance of the plan and its assets, and consultation... -

Page 54

... acquired upon foreclosure of commercial and agricultural mortgage loans is recorded at the lower of estimated fair value or the carrying value of the mortgage loan at the date of foreclosure. Policy loans are stated at unpaid principal balances. Short-term investments are stated at amortized cost... -

Page 55

... permitted by its derivatives use plan that was approved by the New York Insurance Department (the ''Department''). The Company's derivative hedging strategy employs a variety of instruments, including ï¬nancial futures, ï¬nancial forwards, interest rate, credit default and foreign currency swaps... -

Page 56

...the production of new business are deferred. Such costs, which consist principally of commissions, agency and policy issue expenses, are amortized with interest over the expected life of the contract for participating traditional life, universal life and investment-type products. Generally, deferred... -

Page 57

... costs. Presenting investment gains and losses net of related amortization of VOBA and deferred policy acquisition costs provides information useful in evaluating the operating performance of the Company. This presentation may not be comparable to presentations made by other insurers. MetLife... -

Page 58

...amount of expected future policy beneï¬t payments. Premiums related to non-medical health contracts are recognized on a pro rata basis over the applicable contract term. Deposits related to universal life and investment-type products are credited to policyholder account balances. Revenues from such... -

Page 59

... tax returns. Under the Code, the amount of federal income tax expense incurred by mutual life insurance companies includes an equity tax calculated based upon a prescribed formula that incorporates a differential earnings rate between stock and mutual life insurance companies. Metropolitan Life... -

Page 60

... the form of policy credits aggregating $408 million, as provided in the plan. In addition, Metropolitan Life's Canadian branch made cash payments of $327 million in the second quarter of 2000 to holders of certain policies transferred to Clarica Life Insurance Company in connection with the sale of... -

Page 61

...also exist through mortgage loans and investments in real estate. The carrying value of the Company's investment portfolio exposed to industries affected by the tragedies was approximately $3.7 billion at December 31, 2002. The long-term effects of the tragedies on the Company's businesses cannot be... -

Page 62

METLIFE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 3. Investments Fixed Maturities and Equity Securities Fixed maturities and equity securities at December 31, 2002 were as follows: Cost or Amortized Cost Gross Unrealized Gain Loss (Dollars in millions) Estimated Fair Value ... -

Page 63

... beneï¬cial interests in these SPEs as of December 31, 2002 and 2001 and the related investment income for the years ended December 31, 2002, 2001 and 2000 were insigniï¬cant. The Company also invests in structured notes and similar type instruments, which generally provide equity-based returns on... -

Page 64

...properties were located in California, New York and Florida, respectively. Generally, the Company (as the lender) requires that a minimum of one-fourth of the purchase price of the underlying real estate be paid by the borrower. Certain of the Company's real estate joint ventures have mortgage loans... -

Page 65

... 21% and 13% of the Company's real estate holdings were located in New York, California and Texas, respectively. Changes in real estate and real estate joint ventures held-for-sale valuation allowance were as follows: Years Ended December 31, 2002 2001 2000 (Dollars in millions) Balance at January... -

Page 66

... loans on real estate 22) Real estate and real estate joint ventures(1 6) Other limited partnership interests 2) Sales of businesses Other 206) Total Amounts allocable to: Deferred policy acquisition costs Participating contracts Policyholder dividend obligation Total net investment losses... -

Page 67

... 7,371 Equity securities 45 Derivatives 24) Other invested assets 17 Total Amounts allocable to: Future policy beneï¬t loss recognition Deferred policy acquisition costs Participating contracts Policyholder dividend obligation Deferred income taxes Total Net unrealized investment gains... -

Page 68

... TYPE Financial futures Interest rate swaps Floors Caps Financial forwards Foreign currency swaps Options Foreign currency forwards Written covered calls Credit default swaps Total contractual commitments BY DERIVATIVE STRATEGY Liability hedging Invested asset hedging Portfolio... -

Page 69

... Policy loans Short-term investments Cash and cash equivalents Mortgage loan commitments 859 Commitments to fund partnership investments 1,667 Liabilities: Policyholder account balances Short-term debt Long-term debt Payable under securities loaned transactions Other: Company-obligated... -

Page 70

...fair value of policyholder account balances are estimated by discounting expected future cash ï¬,ows, based upon interest rates currently being offered for similar contracts with maturities consistent with those remaining for the agreements being valued. Short-term and Long-term Debt, Payables Under... -

Page 71

...ï¬cant effect on the amounts reported for health care plans. A one-percentage point change in assumed health care cost trend rates would have the following effects: One Percent One Percent Increase Decrease (Dollars in millions) Effect on total of service and interest cost components Effect on... -

Page 72

...fair value (amortized cost: $236 and $240, respectively Mortgage loans on real estate Policy loans Short-term investments Other invested assets Total investments Cash and cash equivalents Accrued investment income Deferred income taxes Premiums and other receivables Total assets designated... -

Page 73

... assets or liabilities. Metropolitan Life charges the closed block with federal income taxes, state and local premium taxes, and other additive state or local taxes, as well as investment management expenses relating to the closed block as provided in the plan of demutualization. Metropolitan Life... -

Page 74

... guarantees either a minimum return or account value to the policyholder. Fees charged to the separate accounts by the Company (including mortality charges, policy administration fees and surrender charges) are reï¬,ected in the Company's revenues as universal life and investment-type product policy... -

Page 75

... Metropolitan Life merged in 1996, and General American, which was acquired in 2000, have been settled. In October 2000, a federal court approved a settlement resolving sales practices claims on behalf of a class of owners of permanent life insurance policies issued by New England Mutual between... -

Page 76

... participating life insurance policies, as well as persons who purchased participating policies for use in pension plans or through work site marketing. These policyholders were not part of the New England Mutual class action settlement noted above. The action was transferred to a federal court... -

Page 77

... effect on the Company's liquidity. Each asbestos-related policy contains an experience fund and a reference fund that provides for payments to Metropolitan Life at the commutation date if the reference fund is greater than zero at commutation or pro rata reductions from time to time in the loss... -

Page 78

...class action was ï¬led in New York state court in New York County on behalf of a purported class of beneï¬ciaries of Metropolitan Life annuities purchased to fund structured settlements claiming that the class members should have received common stock or cash in connection with the demutualization... -

Page 79

METLIFE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Life was negligent in the performance of certain of its obligations and duties under the sale agreement. Metropolitan Life is vigorously defending itself against this lawsuit. A putative class action lawsuit is pending in the ... -

Page 80

...Chile. These acquisitions marked MetLife's entrance into the Chilean insurance market. In January 2000, Metropolitan Life completed its acquisition of GenAmerica, a holding company which included General American Life Insurance Company, approximately 49% of the outstanding shares of RGA common stock... -

Page 81

... 31, 2002 2001 2000 (Dollars in millions) Tax provision at U.S. statutory rate Tax effect of: Tax exempt investment income Surplus tax State and local income taxes Prior year taxes Demutualization costs Payment to former Canadian policyholders Sales of businesses Other, net Provision... -

Page 82

... and group life claims in excess of $2 million per policy, as well as excess property and casualty losses, among others. See Note 11 for information regarding certain excess of loss reinsurance agreements providing coverage for risks associated primarily with sales practices claims. F-38 MetLife... -

Page 83

... each outstanding share of common stock issued between April 4, 2000 and the distribution date (as deï¬ned in the rights plan) will be coupled with a stockholder right. Each right will entitle the holder to purchase one one-hundredth of a share of Series A Junior Participating Preferred Stock. Each... -

Page 84

...31, 2002, could pay the Holding Company dividends of $104 million without prior approval. Stock Compensation Plans Under the MetLife, Inc. 2000 Stock Incentive Plan (the ''Stock Incentive Plan''), awards granted may be in the form of non-qualiï¬ed or incentive stock options qualifying under Section... -

Page 85

... in future years. (2) Includes the Company's ownership share of compensation costs related to RGA's incentive stock plan determined in accordance with SFAS 123. The fair value of each option grant is estimated on the date of the grant using the Black-Scholes options-pricing model with the following... -

Page 86

...31, 2001, New York Statutory Accounting Practices did not provide for deferred income taxes. The Department has adopted a modiï¬cation to its regulations, effective December 31, 2002, with respect to the admissibility of deferred taxes by New York insurers, subject to certain limitations. Statutory... -

Page 87

... changes in the number of average shares outstanding, quarterly earnings per share of common stock do not add to the totals for the years. Unaudited net income for the ï¬rst quarter of 2002 includes a charge of $48 million related to Metropolitan Life's wholly-owned subsidiary, General American, in... -

Page 88

...159 million related to a class action lawsuit and a related regulatory inquiry pending against Metropolitan Life, $330 million related to business realignment initiatives and $74 million related to the establishment of a policyholder liability for certain group annuity policies. F-44 MetLife, Inc. -

Page 89

... and investment products, including life insurance, annuities and mutual funds. Institutional offers a broad range of group insurance and retirement and savings products and services, including group life insurance, non-medical health insurance such as short and long-term disability, long-term care... -

Page 90

... Total Auto & Asset Home Management (Dollars in millions) Corporate & Other Premiums Universal life and investment-type product policy fees Net investment income Other revenues Net investment gains (losses Policyholder beneï¬ts and claims Interest credited to policyholder account balances... -

Page 91

... connection with MetLife, Inc.'s initial public offering in April 2000, the Holding Company and MetLife Capital Trust I (the ''Trust'') issued equity security units (the ''units''). Each unit originally consisted of (i) a contract to purchase, for $50, shares of the Holding Company's common stock on... -

Page 92

-

Page 93

... and Financial Services businesses CATHERINE A. REIN Retired Chairman of the Board Nellcor Puritan Bennett, Inc. Member, Audit Committee and Corporate Social Responsibility Committee JAMES R. HOUGHTON Co-Chief Operating Ofï¬cer, President and Executive Vice Chairman New York Stock Exchange, Inc... -

Page 94