Kodak 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

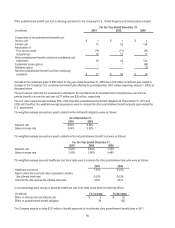

NOTE 22: DISCONTINUED OPERATIONS

The components of earnings from discontinued operations, net of income taxes, are as follows:

For the Year Ended December 31,

(in millions)

2010

2009

2008

(Provision) benefit for income taxes related to discontinued operations

$ (10)

$ 8

$ 288

All other items, net

(2)

9

(3)

(Loss) earnings from discontinued operations, net of income taxes

$ (12)

$ 17

$ 285

In the second quarter of 2008, the Company received a tax refund from the U.S. Internal Revenue Service. The refund was related

to the audit of certain claims filed for tax years 1993-1998. A portion of the refund related to past federal income taxes paid in

relation to the 1994 sale of a subsidiary, Sterling Winthrop Inc., which was reported in discontinued operations. The refund had a

positive impact on the Company’s earnings from discontinued operations, net of income taxes, for the year ended December 31,

2008 of $295 million. See Note 15, “Income Taxes,” in the Notes to Financial Statements for further discussion of the tax refund.

NOTE 23: EXTRAORDINARY ITEM

The terms of the purchase agreement of the 2004 acquisition of NexPress Solutions LLC called for additional consideration to be

paid by the Company if sales of certain products exceeded a stated minimum number of units sold during a five-year period following

the close of the transaction. In May 2009, the earn-out period lapsed with no additional consideration required to be paid by the

Company. Negative goodwill, representing the contingent consideration obligation of $17 million, was therefore reduced to zero. The

reversal of negative goodwill reduced Property, plant and equipment, net by $2 million and Research and development expense by

$7 million and resulted in an extraordinary gain of $6 million, net of tax, during the year ended December 31, 2009.

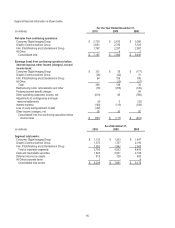

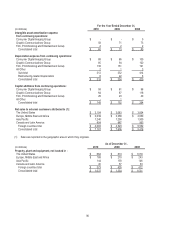

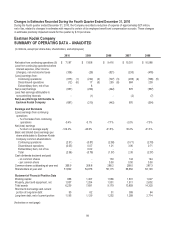

NOTE 24: SEGMENT INFORMATION

Current Segment Reporting Structure

For 2010, the Company had three reportable segments: Consumer Digital Imaging Group (“CDG”), Graphic Communications Group

(“GCG”), and Film, Photofinishing and Entertainment Group (“FPEG”). The balance of the Company's continuing operations, which

individually and in the aggregate do not meet the criteria of a reportable segment, are reported in All Other. A description of the

segments is as follows:

Consumer Digital Imaging Group Segment (“CDG”): CDG encompasses digital still and video cameras, digital devices such as

picture frames, kiosks, APEX drylab systems, and related consumables and services, consumer inkjet printing systems, Kodak

Gallery products and services, and imaging sensors. CDG also includes the licensing activities related to the Company's intellectual

property in digital imaging products.

Graphic Communications Group Segment (“GCG”): GCG encompasses workflow software and digital controllers; digital

printing, which includes commercial inkjet and electrophotographic products, including equipment, consumables and service;

prepress consumables; prepress equipment and packaging solutions; business solutions and consulting services; and document

scanners.

Film, Photofinishing and Entertainment Group Segment (“FPEG”): FPEG encompasses consumer and professional film, one-

time-use cameras, aerial and industrial materials, and entertainment imaging products and services. In addition, this segment also

includes paper and output systems, and photofinishing services.

All Other: This category includes the results of the Company’s display business, up to the date of sale of assets of this business in

the fourth quarter of 2009.

Transactions between segments, which are immaterial, are made on a basis intended to reflect the market value of the products,

recognizing prevailing market prices and distributor discounts. Differences between the reportable segments’ operating results and

assets and the Company’s consolidated financial statements relate primarily to items held at the corporate level, and to other items

excluded from segment operating measurements.