Kodak 2010 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

DETERMINING EXECUTIVE TARGET TOTAL DIRECT COMPENSATION

The Committee reviews the total direct compensation opportunity of each Named Executive Officer on an annual basis. In the course of

the Committee’s review, the Committee seeks the advice and input of its compensation consultant, Frederic W. Cook & Co., Inc.

(Consultant) as well as Company management. For information regarding the role of the Consultant, see page 21 of this Proxy Statement.

Use of Market Reference Data

As part of the Committee’s review in 2010, management provided the Committee with market median reference data for each Named

Executive Officer. The Committee uses national survey data, in lieu of a peer company benchmarking approach, because the Company

consists of a portfolio of businesses that are in different stages of transformation and operate under different business models. In view of

these variables, it is premature to identify a sustainable set of similarly sized, domestically based peer companies. The Committee believes

these surveys provide a competitive frame of reference for compensation decisions because they offer a reasonable representation of the

cost to hire and retain talent. The surveys we reference include three independent external survey providers: the Towers Watson Executive

Compensation Survey, the Hewitt Executive Compensation Survey and the Radford Technology Survey. The data in each survey was

compiled for each Named Executive Officer position, adjusted to be representative of companies with similar revenues, and averaged. The

Committee does not review or have access to the names of the individual companies that participate in these surveys.

After a review of market median reference data, the CEO provides a recommendation on target total direct compensation for each Named

Executive Officer, with the exception of the CEO. In the case of our CEO, the Consultant gathers and analyzes the market median

reference data and discusses a recommendation with the Committee Chair. The Committee considers these recommendations and

exercises its judgment to make a decision. In making these decisions, the Committee considers a range greater and less than ten percent

of market median, as representative of the market median.

Use of Factors to Determine Value and Mix

The Committee considers a broad range of facts and circumstances when determining executive compensation, including: 1) market

competitiveness; 2) experience and skill relative to typical market peers; 3) the importance of the position within the Company relative to

other senior management positions; 4) sustained individual performance; 5) readiness for promotion to a higher level and/or role in the

Company’s senior management succession plans; and 6) retention of critical talent. The significance of any individual factor will vary from

year-to-year and may vary among Named Executive Officers. The Committee uses these facts and circumstances to set the target total

direct compensation of our Named Executive Officers which consists of base salary, annual EXCEL opportunity at target, and the dollar-

denominated value of long-term equity awards. Target total direct compensation is exclusive of ad hoc equity awards.

The Committee considers target total direct compensation holistically in light of the above factors on an annual basis. For these reasons,

the Committee does not have a pre-defined target for each element of total direct compensation as a portion of the whole, nor does the

Committee consider awards granted or earned in past years when setting annual target total direct compensation levels for our Named

Executive Officers. The Committee does, however, consider equity awards granted in past years to evaluate the relative value of the

Company’s long-term equity incentives and as an input to the annual mix of long-term equity incentives.

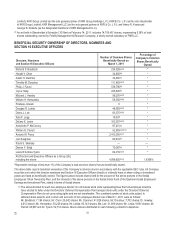

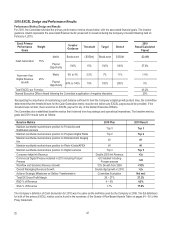

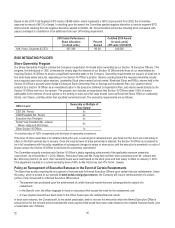

The 2010 target total direct compensation for our Named Executive Officers is as follows:

Named Executive Officer

Base Salary

Annual

Variable as a %

of Base Salary

Long-Term

Variable

Target Total Direct

Compensation

A.M. Perez, Chairman & CEO

$1,100,000

155%

$5,787,000

$8,592,000

A.P. McCorvey, CFO & SVP

450,000

75%

1,000,000

1,787,500

P.J. Faraci, President & COO

700,000

85%

1,900,000

3,195,000

P. Jotwani, President CDG, CMO & SVP

600,000

75%

1,600,000

2,650,000

J. P. Haag, SVP and GC

461,200

65%

720,000

1,480,980

Former Executive

F.S. Sklarsky, CFO & EVP

600,000

75%

1,600,000

2,650,000

Committee Discussion and Analysis

The Committee maintained the target total direct compensation for 2010 equivalent to 2009 for the then current Named Executive Officers

(Messrs. Perez, Sklarsky and Faraci and Ms. Haag). The Committee also maintained the 2009 mix of target total direct compensation for

our Named Executive Officers because it resulted in a well balanced mix of fixed versus variable pay and cash versus equity

compensation. Consistent with the intent explained in our 2010 proxy statement, the Committee did not make an annual equity grant in the

2010 fiscal year under the Company’s long term incentive program.