Kodak 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

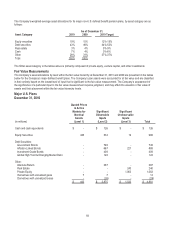

The Company’s valuation allowance as of December 31, 2010 was $2,335 million. Of this amount, $280 million was attributable to

the Company’s net deferred tax assets outside the U.S. of $849 million, and $2,055 million related to the Company’s net deferred tax

assets in the U.S. of $2,286 million, for which the Company believes it is not more likely than not that the assets will be realized. The

net deferred tax assets in excess of the valuation allowance of $800 million relate primarily to net operating loss carryforwards,

certain tax credits, and pension related tax benefits for which the Company believes it is more likely than not that the assets will be

realized.

The valuation allowance as of December 31, 2009 was $2,092 million. Of this amount, $445 million was attributable to the

Company’s net deferred tax assets outside the U.S. of $910 million, and $1,647 million related to the Company’s net deferred tax

assets in the U.S. of $1,899 million, for which the Company believes it is not more likely than not that the assets will be realized. The

net deferred tax assets in excess of the valuation allowance of $717 million related primarily to net operating loss carryforwards and

certain tax credits for which the Company believes it is more likely than not that the assets will be realized.

Accounting for Uncertainty in Income Taxes

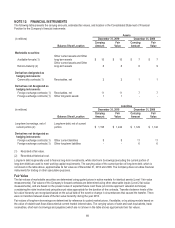

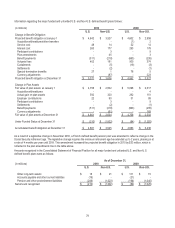

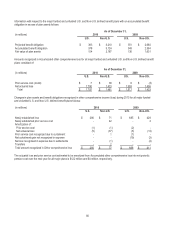

A reconciliation of the beginning and ending amount of the Company’s liability for income taxes associated with unrecognized tax

benefits is as follows:

(in millions)

2010

2009

2008

Balance as of January 1

$ 256

$ 296

$ 303

Tax positions related to the current year:

Additions

1

10

54

Tax positions related to prior years:

Additions

-

8

16

Reductions

(11)

(58)

(74)

Settlements with taxing authorities

-

-

(3)

Lapses in statutes of limitations

(1)

-

-

Balance as of December 31

$ 245

$ 256

$ 296

The Company’s policy regarding interest and/or penalties related to income tax matters is to recognize such items as a component

of income tax (benefit) expense. During the years ended December 31, 2010, 2009 and 2008, the Company recognized interest and

penalties of approximately $5 million, $8 million and $10 million, respectively, in income tax (benefit) expense. Additionally, the

Company had approximately $74 million and $69 million of interest and penalties associated with uncertain tax benefits accrued as

of December 31, 2010 and 2009, respectively.

If the unrecognized tax benefits were recognized, they would favorably affect the effective income tax rate in the period recognized.

The Company has classified certain income tax liabilities as current or noncurrent based on management’s estimate of when these

liabilities will be settled. These current liabilities are recorded in Accrued income and other taxes in the Consolidated Statement of

Financial Position. Noncurrent income tax liabilities are recorded in Other long-term liabilities in the Consolidated Statement of

Financial Position.

It is reasonably possible that the liability associated with the Company’s unrecognized tax benefits will increase or decrease within

the next twelve months. These changes may be the result of settling ongoing audits or the expiration of statutes of limitations. Such

changes to the unrecognized tax benefits could range from $100 to $200 million based on current estimates. Audit outcomes and the

timing of audit settlements are subject to significant uncertainty. Although management believes that adequate provision has been

made for such issues, there is the possibility that the ultimate resolution of such issues could have an adverse effect on the earnings

of the Company. Conversely, if these issues are resolved favorably in the future, the related provision would be reduced, thus having

a positive impact on earnings. It is anticipated that audit settlements will be reached during 2011 that could have a significant

earnings impact. Due to the uncertainty of amounts and in accordance with its accounting policies, the Company has not recorded

any potential impact of these settlements.

The Company files numerous consolidated and separate income tax returns in the U.S. federal jurisdiction and in many state and

foreign jurisdictions. The Company has substantially concluded all U.S. federal income tax matters for years through 2000. The

Company’s U.S. tax matters for the years 2001 through 2009 remain subject to examination by the IRS. Substantially all material

state, local, and foreign income tax matters have been concluded for years through 2000. The Company’s tax matters for the years

2001 through 2009 remain subject to examination by the respective state, local, and foreign tax jurisdiction authorities.