Kodak 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

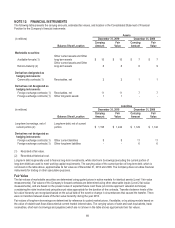

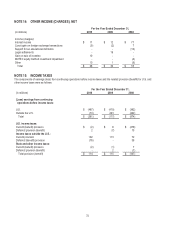

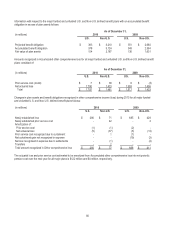

Deferred Tax Assets and Liabilities

The significant components of deferred tax assets and liabilities were as follows:

As of December 31,

(in millions)

2010

2009

Deferred tax assets

Pension and postretirement obligations

$ 809

$ 803

Restructuring programs

7

16

Foreign tax credit

477

350

Inventories

23

15

Investment tax credit

160

159

Employee deferred compensation

80

91

Depreciation

28

-

Research and development costs

184

146

Tax loss carryforwards

1,181

931

Other deferred revenue

-

32

Other

423

486

Total deferred tax assets

$ 3,372

$ 3,029

Deferred tax liabilities

Depreciation

-

26

Leasing

47

51

Other deferred debt

15

-

Other

175

143

Total deferred tax liabilities

237

220

Net deferred tax assets before valuation allowance

3,135

2,809

Valuation allowance

2,335

2,092

Net deferred tax assets

$ 800

$ 717

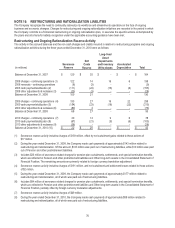

Deferred tax assets (liabilities) are reported in the following components within the Consolidated Statement of Financial Position:

As of December 31,

(in millions)

2010

2009

Deferred income taxes (current)

$ 120

$ 121

Other long-term assets

695

607

Accrued income taxes

(7)

-

Other long-term liabilities

(8)

(11)

Net deferred tax assets

$ 800

$ 717

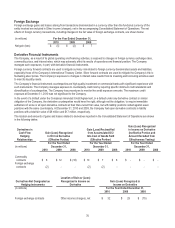

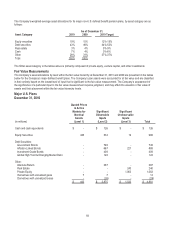

As of December 31, 2010, the Company had available domestic and foreign net operating loss carryforwards for income tax

purposes of approximately $3,690 million, of which approximately $609 million have an indefinite carryforward period. The remaining

$3,081 million expire between the years 2011 and 2030. Utilization of these net operating losses may be subject to limitations in the

event of significant changes in stock ownership of the Company. As of December 31, 2010, the Company had unused foreign tax

credits and investment tax credits of $477 million and $160 million, respectively, with various expiration dates through 2030.

The Company has been granted a tax holiday in certain jurisdictions in China. The Company is eligible for a 50% reduction of the

income tax rate as a tax holiday incentive. The tax rate currently varies by jurisdiction, due to the tax holiday, and will be 25% in all

jurisdictions within China in 2013.

Retained earnings of subsidiary companies outside the U.S. were approximately $2,398 million and $1,842 million as of December

31, 2010 and 2009, respectively. Deferred taxes have not been provided on such undistributed earnings, as it is the Company’s

policy to indefinitely reinvest its retained earnings. Further, it is not practicable to determine the related deferred tax liability.

However, the Company periodically repatriates a portion of these earnings to the extent that it can do so tax-free, or at minimal cost.