Kodak 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

83

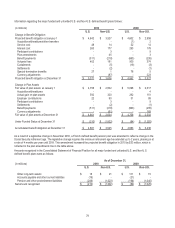

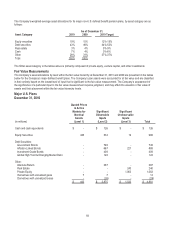

The Company's weighted-average asset allocations for its major non-U.S. defined benefit pension plans, by asset category are as

follows:

As of December 31,

Asset Category

2010

2009

2010 Target

Equity securities

19%

15%

12%-19%

Debt securities

43%

46%

44%-52%

Real estate

3%

4%

0%-9%

Cash

7%

4%

0%-6%

Other

28%

31%

27%-37%

Total

100%

100%

The Other asset category in the tables above is primarily composed of private equity, venture capital, and other investments.

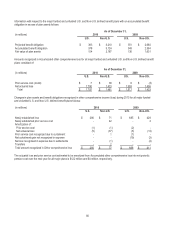

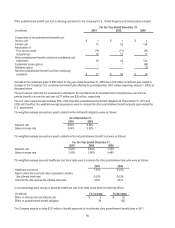

Fair Value Measurements

The Company’s asset allocations by level within the fair value hierarchy at December 31, 2010 and 2009 are presented in the tables

below for the Company’s major defined benefit plans. The Company’s plan assets were accounted for at fair value and are classified

in their entirety based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of

the significance of a particular input to the fair value measurement requires judgment, and may affect the valuation of fair value of

assets and their placement within the fair value hierarchy levels.

Major U.S. Plans

December 31, 2010

(in millions)

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Cash and cash equivalents

$ -

$ 126

$ -

$ 126

Equity Securities

436

534

19

989

Debt Securities:

Government Bonds

-

749

-

749

Inflation-Linked Bonds

-

667

221

888

Investment Grade Bonds

-

409

-

409

Global High Yield & Emerging Market Debt

-

122

-

122

Other:

Absolute Return

-

287

-

287

Real Estate

-

-

240

240

Private Equity

-

-

1,063

1,063

Derivatives with unrealized gains

7

7

-

14

Derivatives with unrealized losses

-

(26)

-

(26)

$ 443

$ 2,875

$ 1,543

$ 4,861