Kodak 2010 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Mr. Faraci’s award should reflect overall Company performance. With respect to Mr. Jotwani and Ms. McCorvey, as they both were new to

their positions in 2010, the Committee determined that it was appropriate that their awards not be differentiated from the overall Company

results. Finally, Ms. Haag, in the role as General Counsel, supported the overall Company and therefore her results were tied to the results

on whole. Pursuant to the terms of the EXCEL plan, Mr. Sklarsky received no EXCEL award due to his resignation. In considering the

EXCEL award for our CEO, the Committee determined that an award of 20% of target was appropriate in view of the overall corporate

results and performance.

Long-Term Equity Incentive Compensation

Purpose

The objectives of our long-term equity incentive programs are to:

1) Align executive compensation with shareholder interests;

2) Create significant incentives for executive retention;

3) Encourage long-term performance by our executives; and

4) Promote stock ownership.

The Committee reviews our long-term equity incentive programs annually to ensure that they are meeting the intended objectives. All

equity grants are made in accordance with the Board of Directors’ Policy on Equity Awards, discussed further on page 46 of this Proxy

Statement.

2010 Annual Long-Term Incentive Equity Grant Committee Discussion and Analysis

The Committee did not award an annual equity grant to any executive in fiscal year 2010. This decision was consistent with the intent

disclosed in the Company’s 2010 proxy statement. The Committee plans to resume annual grants in 2011.

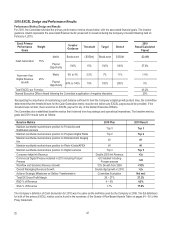

CEO 2010 Performance Share Plan Design and Performance Results

In accordance with the Performance Share Plan defined in Mr. Perez’s letter agreement, the Company allocated 287,380 performance

share units to Mr. Perez on January 4, 2010. The units may be earned from zero to target dependent on performance. There is no upside

opportunity associated with the initial allocation. Once earned, the award has an additional three-year vesting period and cliff vests on

December 31, 2013.

The intended dollar-denominated value of the performance stock award, per Mr. Perez’s letter agreement, was $1.23 million. The number

of units was established by dividing the intended dollar-denominated value on the first trading day of the calendar year by the average 10-

trading day closing stock price leading up to and including the date of grant, which was $4.28.

For 2010, the Committee selected Total Segment EFO as the performance metric for Mr. Perez’s Performance Share Program. The

definition for Total Segment EFO can be found on page 55 of this Proxy Statement and is consistent with last year’s definition.

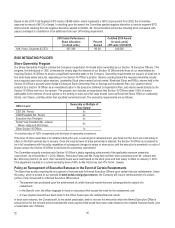

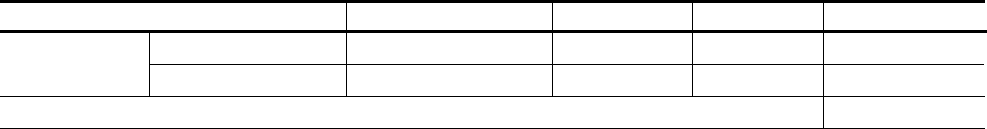

The following table shows the threshold and target associated with the payout percentage and the 2010 results. The Investor Guidance

column represents the midpoint of the performance range shared with investors during the Company’s Investor Meeting on February 4,

2010. The target allocation is the maximum award that Mr. Perez may earn.

2010 Performance Share Plan

Investor Guidance

Threshold

Target

2010 Result

Metric

$400M

$175M

$400M

$369M

Total Segment

EFO

Payout Opportunity

100%

10%

100%

88.9%

Committee Payout Decision following application of Negative Discretion

86.3%

Results are interpolated between threshold and target. The threshold and target units allocated under this program are shown in the

Grants of Plan-Based Awards Table on page 53 of this Proxy Statement.

Committee Discussion and Analysis on Goal and Metric Selection and Award Determination

The Committee selected Total Segment EFO because it provides insight into the Company’s profitability and incents optimization of gross

margin dollars and cost structure. This metric is the third key financial goal discussed with investors. The other key financial goals, Cash

Generation and Digital Revenue Growth, are part of EXCEL.

The Committee established the target for Total Segment EFO at the midpoint of the range communicated to investors. It represents an

improvement of 188% in year-over-year performance. The Committee established the threshold at $175M which represents an

improvement of 26% from prior year performance. No award is earned for performance below the threshold.