Kodak 2010 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

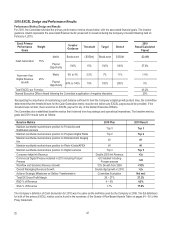

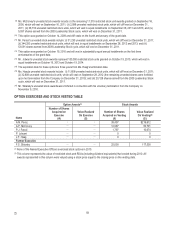

Grant Date

Named

Executive

Officers

Receiving

Award

Grant Date

Fair Value of

Award

($)

Risk-Free

Rate

(%)

Expected

Option

Life

(years)

Expected

Volatility

(%)

Expected

Dividend

Yield

(%)

A.M. Perez

0.91

1.82

6

32.17

7.42

P.J. Faraci

0.91

1.82

6

32.17

7.42

J.P. Haag

0.91

1.82

6

32.17

7.42

12/9/2008

F.S. Sklarsky

0.91

1.82

6

32.17

7.42

A.M. Perez

2.10

2.69

6

45.34

0.00

10/14/2009

P.J. Faraci

2.10

2.69

6

45.34

0.00

10/19/2010

P. Jotwani

2.14

1.45

6

57.52

0.00

12/13/2010

A.P. McCorvey

2.79

2.28

6

57.82

0.00

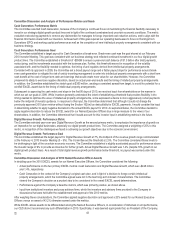

(4) The amounts in this column represent payments under EXCEL for performance in 2008, 2009 and 2010. See the Grants of Plan-

Based Awards in 2010 Table for the potential payouts for each Named Executive Officer, which depend on performance. For a

description of the performance criteria and the 20% of target award payment in 2010, see "2010 EXCEL Design and Performance

Results” on page 42 of this Proxy Statement. Named Executive Officers did not receive any non-equity incentive compensation for

2008 because no EXCEL awards were earned.

(5) This column reports the aggregate change in the present value of the Named Executive Officer's accumulated benefits under

KRIP, KURIP and supplemental individual retirement arrangements, to the extent a Named Executive Officer participates, and the

estimated above-market interest, if any, earned during the year on deferred compensation balances. The breakdown of these

figures is shown in the table below:

2008

2009

2010

Executive

Change in

Pension

Value

Above-

Market

Interest(a)

Total

Value

Change in

Pension

Value

Above-

Market

Interest(a)

Total

Value

Change in

Pension

Value(b)

Above-

Market

Interest(a)

Total

Value

A.M. Perez

$3,434,567

$3,728

$3,438,295

$2,468,046

$0

$2,468,046

$2,259,538

$0

$2,259,538

A.P. McCorvey

—

—

—

—

—

—

58,007

0

58,007

P.J. Faraci

341,208

—

341,208

692,301

—

692,301

595,728

—

595,728

P. Jotwani

—

—

—

—

—

—

5,321

—

5,321

J.P. Haag

—

—

—

478,878

0

478,878

382,347

0

382,347

Former Executive

F.S. Sklarsky

119,720

—

119,720

191,801

—

191,801

0

—

0

(a) A Named Executive Officer's deferral account balances are credited with interest at the "prime rate" as reported in the Wall

Street Journal, compounded monthly. Above-market interest is calculated as the difference between the prime rate and 120% of

the Applicable Federal Rate (AFR) for the corresponding month.

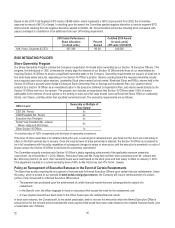

(b) The primary actuarial assumption change used to calculate Pension Values was a decrease in the discount rate. There was no

change in the lump sum interest rate from last year-end. Due to the fact that Mr. Perez is now age 65 and his benefits are

payable as a lump sum, the decrease in discount rate has no impact on his value for 2010. Mr. Perez’s Pension Value

decreased from 2009 to 2010 because he reached age 65, at which time there is a decrease in the rate at which he is earning

pension service. The Pension Values for Mr. Faraci and Mmes. McCorvey and Haag were increased by the decrease in

discount rate. However, the 2010 Pension Values for Mr. Faraci and Ms. Haag were still smaller than the 2009 Pension Values

because the decline in discount rates from 2008 to 2009 was much larger than the decline from 2009 to 2010. Mr. Jotwani’s

Pension Value is driven primarily by his KRIP cash balance accrual for his partial year of service since being hired September

28, 2010. The change in Pension Value for Mr. Sklarsky in 2010 is $0 because he departed voluntarily on November 5, 2010

and was not vested in the supplemental retirement benefit under his letter agreement. He therefore forfeited this supplemental

benefit. Further, he received a $45,840 payout in 2010 for his KRIP cash balance. Therefore, he has a lower accumulated

Pension Value than at the end of 2009, with his only remaining pension amount attributable to the $194,357 KURIP payment he

will receive in June 2011.