Kodak 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

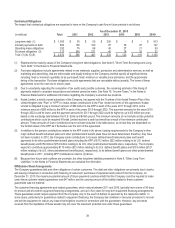

Eastman Kodak Company (“EKC”) also guarantees potential indebtedness to banks and other third parties for some of its

consolidated subsidiaries. The maximum amount guaranteed is $261 million, and the outstanding amount for those guarantees is

$238 million. Of this outstanding amount, $109 million is recorded within Short-term borrowings and current portion of long-term

debt, and Long-term debt, net of current portion. Additionally $12 million is recorded within Other current liabilities and Other long-

term liabilities. The remaining $117 million of outstanding guarantees represent parent guarantees providing financial assurance to

third parties that the Company’s subsidiaries will fulfill their future performance or financial obligations under various contracts, and

do not represent recorded liabilities. These guarantees expire in 2011 through 2019. Pursuant to the terms of the Company's

Amended Credit Agreement, obligations of the Borrowers to the Lenders under the Amended Credit Agreement, as well as secured

agreements in an amount not to exceed $100 million, are guaranteed by the Company and the Company’s U.S. subsidiaries and

included in the above amounts. As of December 31, 2010, these secured agreements totaled $90 million.

During the fourth quarter of 2007, EKC issued a guarantee to Kodak Limited (the “Subsidiary”) and the Trustees (the “Trustees”) of

the Kodak Pension Plan of the United Kingdom (the “Plan”). Under that arrangement, EKC guaranteed to the Subsidiary and the

Trustees the ability of the Subsidiary, only to the extent it becomes necessary to do so, to (1) make contributions to the Plan to

ensure sufficient assets exist to make plan benefit payments, and (2) make contributions to the Plan such that it will achieve full

funded status by the funding valuation for the period ending December 31, 2015. In October 2010, the 2007 guarantee was replaced

by a new guarantee from EKC to the Subsidiary and the Trustees. The new guarantee continues to guarantee the Subsidiary’s ability

to make contributions as set forth in the 2007 guarantee but extends the full funding date to December 31, 2022. The new guarantee

expires (a) upon the conclusion of the funding valuation for the period ending December 31, 2022 if the Plan achieves full funded

status or on payment of the balance if the Plan is underfunded by no more than 60 million British pounds by that date, (b) earlier in

the event that the Plan achieves full funded status for two consecutive funding valuation cycles which are typically performed at least

every three years, or (c) June 30, 2024 on payment of the balance in the event that the Plan is underfunded by more than 60 million

British pounds upon conclusion of the funding valuation for the period ending December 31, 2022. The amount of potential future

contributions is dependent on the funding status of the Plan as it fluctuates over the term of the guarantee and the United Kingdom

Pension Regulator’s approval of a funding plan agreed to by the Subsidiary and the Trustees to close the funding gap identified by

the Plan’s most recent local statutory funding valuation agreed to in March 2009. The funded status of the Plan (calculated in

accordance with U.S. GAAP) is included in Pension and other postretirement liabilities presented in the Consolidated Statement of

Financial Position.

The Company issues indemnifications in certain instances when it sells businesses and real estate, and in the ordinary course of

business with its customers, suppliers, service providers and business partners. Further, the Company indemnifies its directors and

officers who are, or were, serving at the Company's request in such capacities. Historically, costs incurred to settle claims related to

these indemnifications have not been material to the Company’s financial position, results of operations or cash flows. Additionally,

the fair value of the indemnifications that the Company issued during the year ended December 31, 2010 was not material to the

Company’s financial position, results of operations or cash flows.

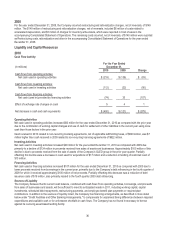

2009

Cash Flow Activity

For the Year Ended

(in millions)

December 31,

2009

2008

Change

Cash flows from operating activities:

Net cash used in continuing operations

$ (136)

$ (128)

$ (8)

Net cash provided by discontinued operations

-

296

(296)

Net cash (used in) provided by operating activities

(136)

168

(304)

Cash flows from investing activities:

Net cash used in investing activities

(22)

(188)

166

Cash flows from financing activities:

Net cash provided by (used in) financing activities

33

(746)

779

Effect of exchange rate changes on cash

4

(36)

40

Net decrease in cash and cash equivalents

$ (121)

$ (802)

$ 681