Kodak 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

Interest Expense

The increase in interest expense for 2010 as compared with 2009 was primarily attributable to higher weighted-average effective

interest rates on the Company’s outstanding debt, resulting from the refinancing of a portion of the Company’s debt portfolio in the

third quarter of 2009 (as discussed below) and first quarter of 2010.

The increase in interest expense in 2009 as compared with 2008 was primarily due to the issuances in the third quarter of 2009 of

$300 million aggregate principal amount of 10.5% Senior Secured Notes due 2017 and $400 million aggregate principal amount of

7% Convertible Senior Notes due 2017.

Loss on Early Extinguishment of Debt, Net

On March 5, 2010, the Company issued $500 million of aggregate principal amount of 9.75% senior secured notes due March 1,

2018. The net proceeds of this issuance were used to repurchase all of the $300 million of 10.5% senior secured notes due 2017

previously issued to Kohlberg, Kravis, Roberts & Co. L.P. (the “KKR Notes”) and $200 million of 7.25% senior notes due 2013

(collectively the “Notes”). The Company recognized a net loss of $102 million on the early extinguishment of the Notes in the first

quarter of 2010, representing the difference between the carrying values of the Notes and the costs to repurchase. This difference

between the carrying values and costs to repurchase was primarily due to the original allocation of the proceeds received from the

issuance of the KKR Notes to Additional paid-in-capital for the value of the detachable warrants issued to the holders of the KKR

Notes.

Other Income (Charges), Net

The other income (charges), net category primarily includes interest income, income and losses from equity investments, and foreign

exchange gains and losses. The decrease in other income (charges), net from 2008 to 2009 was primarily attributable to a decrease

in interest income due to lower interest rates and lower cash balances in 2009 as compared with 2008, partially offset by the

favorable impact of legal settlements in 2009. The change in other income (charges), net from 2009 to 2010 was not significant.

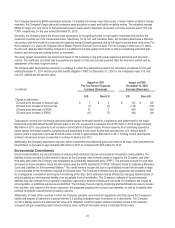

Income Tax Provision

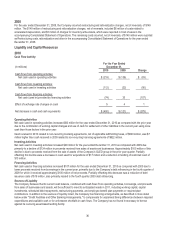

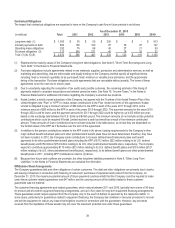

For the Year Ended

(dollars in millions)

December 31,

2010

2009

2008

Loss from continuing operations before income taxes

($561)

($117)

($874)

Provision (benefit) for income taxes

$114

$115

($147)

Effective tax rate

(20.3)%

(98.3)%

16.8%

The change in the Company’s effective tax rate from continuing operations for 2010 as compared with 2009 is primarily attributable

to: (1) a pre-tax goodwill impairment charge of $626 million that resulted in a tax benefit of only $2 million due to the limited amount

of tax deductible goodwill that existed as of December 31, 2010; (2) a benefit associated with the release of deferred tax asset

valuation allowances in certain jurisdictions outside of the U.S. during 2010; (3) incremental withholding taxes related to non-

recurring licensing agreements entered into during 2010 as compared with 2009; (4) changes to the geographical mix of earnings

from operations outside the U.S.; (5) losses generated in the U.S. and in certain jurisdictions outside the U.S. for which no benefit

was recognized due to management’s conclusion that it was more likely than not that the tax benefits would not be realized; and (6)

changes in audit reserves and settlements.

The change in the Company’s effective tax rate from continuing operations for 2009 as compared with 2008 is primarily attributable

to: (1) a benefit recognized upon the receipt in 2008 of the interest portion on an IRS tax refund; (2) a pre-tax goodwill impairment

charge of $785 million that resulted in a tax benefit of only $4 million due to a full valuation allowance in the U.S. and limited amount

of tax deductible goodwill that existed as of December 31, 2008; (3) losses generated in the U.S. and in certain jurisdictions outside

the U.S. for which no benefit was recognized due to management’s conclusion that it was more likely than not that the tax benefits

would not be realized; (4) the impact of previously established valuation allowances in jurisdictions with current earnings; (5) the

geographical mix of earnings from operations outside the U.S.; (6) withholding taxes related to a non-recurring licensing agreement

entered into in 2009; and (7) changes in audit reserves and settlements.