Kodak 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

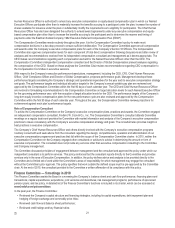

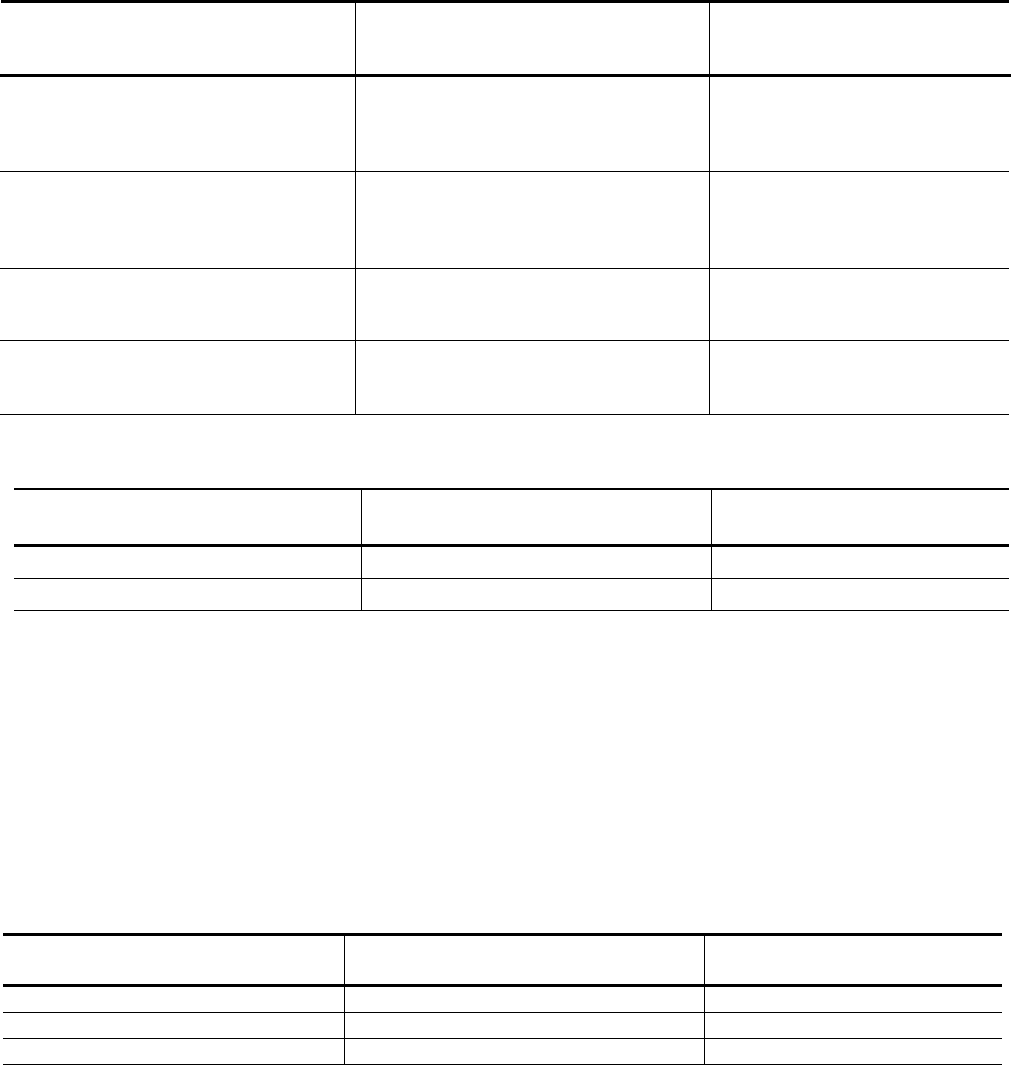

BENEFICIAL OWNERSHIP

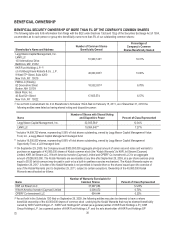

BENEFICIAL SECURITY OWNERSHIP OF MORE THAN 5% OF THE COMPANY’S COMMON SHARES

The following table sets forth information from filings with the SEC under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934,

as amended, as to each person or group who beneficially owns more than 5% of our outstanding common shares:

Shareholder’s Name and Address

Number of Common Shares

Beneficially Owned

Percentage of

Company’s Common

Shares Beneficially Owned

Legg Mason Capital Management, Inc.

LMM LLC

100 International Drive

Baltimore, MD 21202

51,920,124(1)

19.31%

KKR Fund Holdings L.P. (2)

c/o Kohlberg Kravis Roberts & Co., L.P.

9 West 57th Street, Suite 4200

New York, NY 10019

40,000,000(3)

13.00%

FMR LLC (Fidelity)

82 Devonshire Street

Boston, MA 02109

18,592,031(4)

6.78%

Black Rock, Inc.

40 East 52nd Street

New York, NY 10022

17,655,574

6.57%

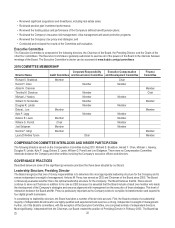

(1) As set forth in Amendment No. 9 of Shareholder’s Schedule 13G/A filed on February 15, 2011, as of December 31, 2010 the

following entities were listed as having shared voting and dispositive power:

Name

Number of Shares with Shared Voting

and Dispositive Power

Percent of Class Represented

Legg Mason Capital Management, Inc.

32,365,584*

12.04%

LMM LLC

19,554,540**

7.27%

* Includes 14,999,720 shares, representing 5.58% of total shares outstanding, owned by Legg Mason Capital Management Value

Trust, Inc., a Legg Mason Capital Management managed fund.

** Includes 18,500,000 shares, representing 6.88% of total shares outstanding, owned by Legg Mason Capital Management

Opportunity Trust, a LLM managed fund.

(2) On September 29, 2009, the Company issued $300,000,000 aggregate principal amount of senior secured notes and warrants to

purchase an aggregate of 40,000,000 shares of Kodak common stock (the “Kodak Warrants”) to KKR Jet Stream (Cayman)

Limited, KKR Jet Stream LLC, 8 North America Investor (Cayman) Limited and OPERF Co-Investment LLC for an aggregate

amount of $288,000,000. The Kodak Warrants are exercisable at any time after September 29, 2009, at a per share exercise price

equal to $5.50 (which amount may be paid in cash or by a built-in cashless exercise mechanism). The Kodak Warrants expire on

September 29, 2017. A holder of the Kodak Warrants is not permitted to transfer them or the shares issued upon the exercise of

any of the Kodak Warrants prior to September 29, 2011, subject to certain exceptions. Ownership of the 40,000,000 Kodak

Warrants was allocated as follows:

Name

Number of Warrants Exercisable for

Common Shares

Percent of Class Represented

KKR Jet Stream LLC

37,297,084

12.20%

8 North America Investor (Cayman) Limited

2,008,472

0.70%

OPERF Co-Investment LLC

694,444

0.20%

(3) As set forth in the Schedule 13D filed on September 29, 2009, the following entities may also be deemed to have or share

beneficial ownership of the 40,000,000 shares of common stock underlying the Kodak Warrants that may be deemed beneficially

owned by KKR Fund Holdings L.P.: KKR Fund Holdings GP Limited (as a general partner of KKR Fund Holdings L.P.); KKR

Group Holdings L.P. (as a general partner of KKR Fund Holdings L.P. and the sole shareholder of KKR Fund Holdings GP