Kodak 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

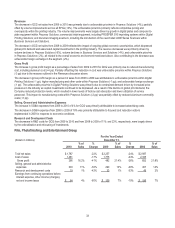

SUMMARY OF OPERATING DATA

A summary of operating data for 2010 and for the four years prior is shown on page 99.

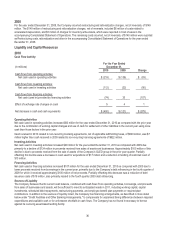

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company, as a result of its global operating and financing activities, is exposed to changes in foreign currency exchange rates,

commodity prices, and interest rates, which may adversely affect its results of operations and financial position. In seeking to

minimize the risks associated with such activities, the Company may enter into derivative contracts. The Company does not utilize

financial instruments for trading or other speculative purposes.

Foreign currency forward contracts are used to hedge existing foreign currency denominated assets and liabilities, especially those

of the Company’s International Treasury Center, as well as forecasted foreign currency denominated intercompany sales. Silver

forward contracts are used to mitigate the Company’s risk to fluctuating silver prices.

The Company’s exposure to changes in interest rates results from its investing and borrowing activities used to meet its liquidity

needs. Long-term debt is generally used to finance long-term investments, while short-term debt is used to meet working capital

requirements.

Using a sensitivity analysis based on estimated fair value of open foreign currency forward contracts using available forward rates, if

the U.S. dollar had been 10% stronger at December 31, 2010 and 2009, the fair value of open forward contracts would have

decreased $35 million and $17 million, respectively. Such changes in fair value would be substantially offset by the revaluation or

settlement of the underlying positions hedged.

Using a sensitivity analysis based on estimated fair value of open silver forward contracts using available forward prices, if available

forward silver prices had been 10% lower at December 31, 2010 and 2009, the fair value of open forward contracts would have

decreased $1 million and $4 million, respectively. Such changes in fair value, if realized, would be offset by lower costs of

manufacturing silver-containing products.

The Company is exposed to interest rate risk primarily through its borrowing activities and, to a lesser extent, through investments in

marketable securities. The Company may utilize borrowings to fund its working capital and investment needs. The majority of short-

term and long-term borrowings are in fixed-rate instruments. There is inherent roll-over risk for borrowings and marketable securities

as they mature and are renewed at current market rates. The extent of this risk is not predictable because of the variability of future

interest rates and business financing requirements.

Using a sensitivity analysis based on estimated fair value of short-term and long-term borrowings, if available market interest rates

had been 10% (about 76 basis points) lower at December 31, 2010, the fair value of short-term and long-term borrowings would

have increased less than $1 million and $50 million, respectively. Using a sensitivity analysis based on estimated fair value of short-

term and long-term borrowings, if available market interest rates had been 10% (about 121 basis points) lower at December 31,

2009, the fair value of short-term and long-term borrowings would have increased less than $1 million and $59 million, respectively.

The Company’s financial instrument counterparties are high-quality investment or commercial banks with significant experience with

such instruments. The Company manages exposure to counterparty credit risk by requiring specific minimum credit standards and

diversification of counterparties. The Company has procedures to monitor the credit exposure amounts. The maximum credit

exposure at December 31, 2010 was not significant to the Company.