Kodak 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

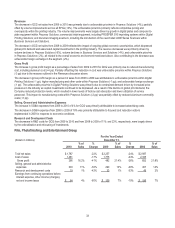

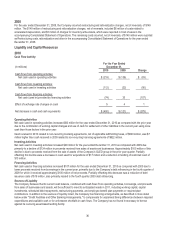

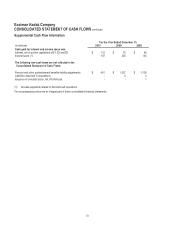

Operating Activities

Net cash used in continuing operations from operating activities increased $8 million for the year ended December 31, 2009 as

compared with the prior year. Cash received in 2009 related to non-recurring licensing agreements, net of applicable withholding

taxes, of $622 million, was $472 million higher than cash received in 2008 related to a non-recurring licensing agreement of $150

million. Additionally, cash expended in 2008 for 2007 bonus programs of $95 million had no comparable amount paid in 2009 for

2008 bonus programs. These benefits to cash flows from operating activities for 2009 were partially offset by the receipt of the

interest portion of an IRS tax refund in 2008 of $275 million, with no comparable receipt in 2009. The combination of these and other

factors led to the use of cash in operating activities of $136 million in 2009, as compared with cash used on the same basis of $128

million in 2008. Net cash provided by discontinued operations decreased $296 million in 2009 as compared with 2008 due primarily

to the receipt of the refund of past federal income taxes referred to above.

Investing Activities

Net cash used in investing activities decreased $166 million for the year ended December 31, 2009 as compared with 2008 due

primarily to a decline of $102 million in additions to properties and increased cash proceeds received from sales of assets and

businesses of $64 million, primarily from the sale of assets of the Company’s OLED group.

Financing Activities

Net cash provided by financing activities increased $779 million for the year ended December 31, 2009 as compared with 2008 due

primarily to approximately $650 million of net proceeds from two new debt issuances in 2009, of which $563 million was used to

repurchase 2033 Convertible Senior Notes. Also, scheduled debt repayments in 2008 were $250 million higher than in 2009, share

repurchases were $301 million in 2008, for which there were no comparable payments in 2009, and dividend payments were $139

million in 2008, for which there were no comparable payments in 2009.

Other

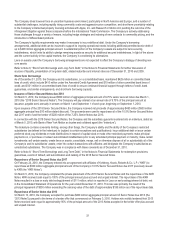

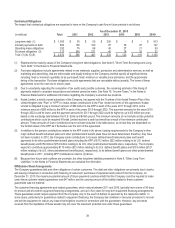

Refer to Note 10, "Commitments and Contingencies," in the Notes to Financial Statements for discussion regarding the Company's

undiscounted liabilities for environmental remediation costs, and other commitments and contingencies, including legal matters.