Kodak 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

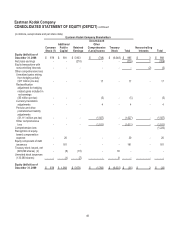

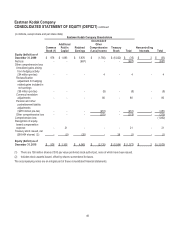

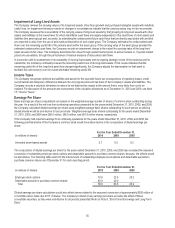

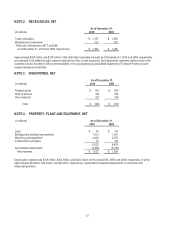

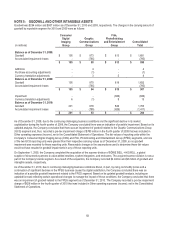

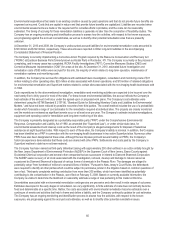

NOTE 5: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill was $294 million and $907 million as of December 31, 2010 and 2009, respectively. The changes in the carrying amount of

goodwill by reportable segment for 2010 and 2009 were as follows:

Consumer

Film,

Digital

Graphic

Photofinishing

Imaging

Communications

and Entertainment

Consolidated

(in millions)

Group

Group

Group

Total

Balance as of December 31, 2008:

Goodwill

$ 195

$ 873

$ 613

$ 1,681

Accumulated impairment losses

-

(785)

-

(785)

$ 195

$ 88

$ 613

$ 896

Additions

-

4

-

4

Purchase accounting adjustments

-

(1)

-

(1)

Currency translation adjustments

-

3

5

8

Balance as of December 31, 2009:

Goodwill

195

879

618

1,692

Accumulated impairment losses

-

(785)

-

(785)

$ 195

$ 94

$ 618

$ 907

Impairment

-

-

(626)

(626)

Currency translation adjustments

6

(1)

8

13

Balance as of December 31, 2010:

Goodwill

201

878

626

1,705

Accumulated impairment losses

-

(785)

(626)

(1,411)

$ 201

$ 93

$ -

$ 294

As of December 31, 2008, due to the continuing challenging business conditions and the significant decline in its market

capitalization during the fourth quarter of 2008, the Company concluded there was an indication of possible impairment. Based on its

updated analysis, the Company concluded that there was an impairment of goodwill related to the Graphic Communications Group

(GCG) segment and, thus, recorded a pre-tax impairment charge of $785 million in the fourth quarter of 2008 that was included in

Other operating expenses (income), net in the Consolidated Statement of Operations. The fair values of reporting units within the

Company’s Consumer Digital Imaging Group (CDG) and Film, Photofinishing and Entertainment Group (FPEG) segments, and one

of the two GCG reporting units were greater than their respective carrying values as of December 31, 2008, so no goodwill

impairment was recorded for these reporting units. Reasonable changes in the assumptions used to determine these fair values

would not have resulted in goodwill impairments in any of these reporting units.

On September 1, 2009, the Company completed the acquisition of the scanner division of BÖWE BELL + HOWELL, a global

supplier of documents scanners to value-added resellers, system integrators, and end-users. The acquired scanner division is now a

part of the Company’s GCG segment. As a result of the acquisition, the Company recorded $4 million and $8 million of goodwill and

intangible assets, respectively.

As of December 31, 2010, due to continuing challenging business conditions driven, in part, by rising commodity prices and a

continuation of significant declines in the FPEG business caused by digital substitution, the Company concluded there was an

indication of a possible goodwill impairment related to the FPEG segment. Based on its updated goodwill analysis, including an

updated forecast reflecting certain operational changes to manage the impact of these conditions, the Company concluded that there

was an impairment of goodwill related to the FPEG segment as of December 31, 2010. The Company recorded a pre-tax impairment

charge of $626 million in the fourth quarter of 2010 that was included in Other operating expenses (income), net in the Consolidated

Statement of Operations.