Kodak 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

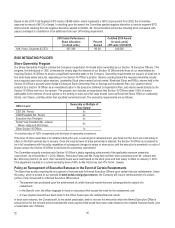

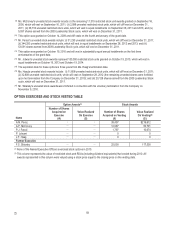

(6) The table below shows the components of the All Other Compensation column for 2010:

Name

401(k) Match

Financial

Counseling

Security

Services/

Systems(a)

Personal

Aircraft

Usage(b)

Other

Total

A.M. Perez

$0

$7,000

$3,034

$309,407

$753(c)

$320,194

A.P. McCorvey

7,350

8,430

0

0

619(d)

16,399

P.J. Faraci

1,610

0

0

2,136

475(e)

4,221

P. Jotwani

0

0

0

0

0

0

J.P. Haag

0

8,430

0

0

1,522,842(f)

1,531,272

Former Executive

F.S. Sklarsky

7,350

0

0

0

475(g)

7,825

(a) Reimbursement of home security services for all Named Executive Officers other than Mr. Perez was discontinued after January

2009.

(b) The incremental cost to the Company for personal use of Company aircraft is calculated based on the direct operating costs to

the Company, including fuel costs, FBO handling and landing fees, vendor maintenance costs, catering, travel fees and other

miscellaneous direct costs. Fixed costs that do not change based on usage, such as salaries and benefits of crew, training of

crew, utilities, taxes and general maintenance and repairs, are excluded. Effective January 1, 2011, the Committee placed

limitations on the non-business use of corporate aircraft by Mr. Perez, such that the Company will provide this perquisite at a

maximum level of $100,000 annually. Mr. Perez is responsible for costs associated with his personal use of the aircraft in

excess of this threshold under a time-sharing agreement. During the course of 2010, Mr. Perez was required to travel due to

emergency medical issues concerning an immediate family member, which led to an increase in his personal use of the

Company aircraft relative to prior years. Mr. Faraci’s incremental cost was related to expenses associated with a business trip

that was extended for personal reasons.

(c) For Mr. Perez, this amount includes personal executive protection services and personal umbrella liability insurance coverage.

(d) For Ms. McCorvey, this amount includes photographic equipment and personal umbrella liability insurance coverage.

(e) For Mr. Faraci, this amount includes personal umbrella liability insurance coverage.

(f) For Ms. Haag, this amount includes photographic equipment, theme park passes, personal umbrella liability insurance coverage

and cash severance of $1,521,960 related to her termination from the Company on December 31, 2010 as discussed in the

Form 8-K filed on November 12, 2010.

(g) For Mr. Sklarsky, this amount includes personal umbrella liability insurance coverage.

(7) Ms. McCorvey was elected CFO of the Company effective on November 5, 2010.

(8) Mr. Jotwani joined the Company on September 28, 2010.

(9) Mr. Sklarsky’s last date of employment with the Company was November 5, 2010.