Kodak 2010 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

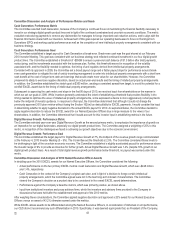

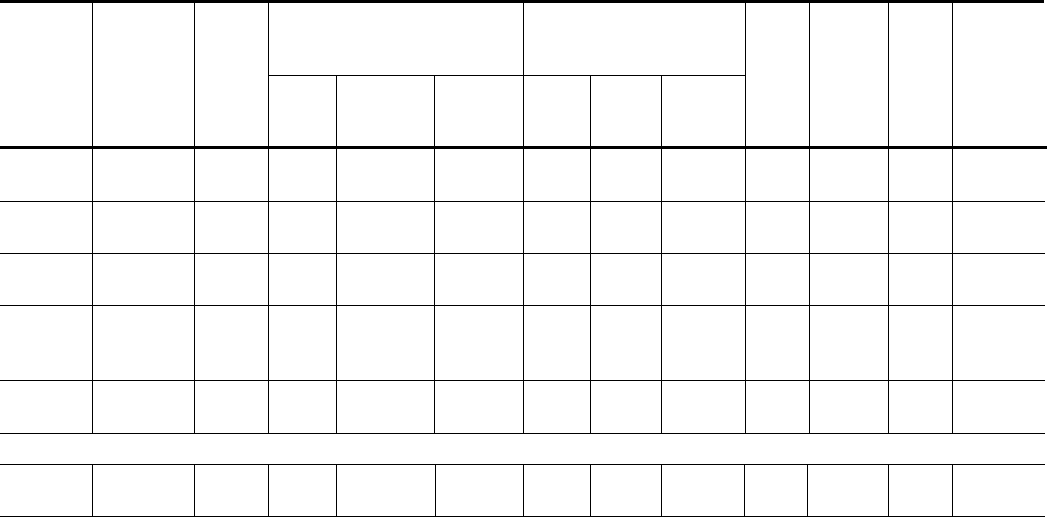

GRANTS OF PLAN-BASED AWARDS IN 2010

The compensation plans under which the grants were made in 2010 that are shown in the following table include the Company’s annual

variable pay plan (EXCEL), and the 2005 Omnibus Long-Term Compensation Plan.

Estimated Future Payouts Under

Non-Equity Incentive Plan

Awards (1)

Estimated Future Payouts

Under Equity Incentive Plan

Awards(2)

Name

Award

Description

Grant

Date

Thresh-

old

($)

Target

($)

Max.

($)(3)

Thresh-

old

(#)

Target

(#)

Max.

(#)

All Other

Stock

Awards

Or Units

(#)

All Other

Option

Awards

(#)

Exercise

or Base

Price of

Option

Awards

($)

Grant Date

Fair Value

of Stock &

Option

Awards

($)(4)

A.M. Perez

EXCEL

2010 PSU(5)

—

1/4/10

—

$1,705,000

$5,000,000

28,738

287,380

287,380

$1,701,290

A.P.

McCorvey

EXCEL

Option Grant

—

12/13/10

—

238,665(6)

—

15,000

$5.05

41,850

P.J. Faraci

EXCEL

—

—

595,000

3,500,000

P. Jotwani

EXCEL

Option Grant

RSU Grant

—

10/19/10

10/19/10

—

117,123(7)

3,000,000

100,000

250,000

3.96

535,000

396,000

J.P. Haag

EXCEL

—

—

299,780

2,306,000

Former Executive

F. S.

Sklarsky

EXCEL

—

—

0(8)

—

(1) The amounts shown for the "threshold", "target" and "maximum" levels represent the possible payouts for 2010 under EXCEL.

There is no amount in the "threshold" level for EXCEL as the potential payouts can range from zero to the maximum amount

allowable under the plan based on performance.

(2) The amounts shown represent the "threshold", "target" and "maximum" number of shares of common stock that Mr. Perez may

earn under his 2010 performance stock unit award, which was granted pursuant to his individual letter agreement amendment in

2009. Mr. Perez’s actual award earned for the 2010 performance stock plan was 248,009 shares.

(3) The maximum amounts for EXCEL represent the maximum payout permitted under the plan in accordance with the formula

established under the plan. The maximum EXCEL payout for Covered Employees is the lesser of: (i) 10% of the corporate funding

pool determined in accordance with performance against pre-established performance targets; (ii) 500% of a Covered Employee's

annual base salary as of December 31, 2009; or (iii) $5 million. The maximum amount shown for EXCEL is the lesser of 500% of

annual base salary or $5 million since the amount representing 10% of the corporate funding pool is not determinable as of the

beginning of the year. Given Mr. Jotwani was not employed by the Company on December 31, 2009, the maximum payout

reflected for Mr. Jotwani is 500% of his starting base salary on September 28, 2010. There is no maximum payout for Ms.

McCorvey or Mr. Sklarsky as the CFO is not a Covered Employee for purposes of Section 162(m) and thus their awards are not

capped under EXCEL.

(4) The amounts shown represent the full grant date fair value, as calculated in accordance with Accounting Standards Codification

Topic 718, excluding forfeiture assumptions.

(5) This figure represents the special 2010 performance stock unit grant provided to Mr. Perez, per the 2009 amendment to his

individual letter agreement; the maximum number of shares that may be earned is equal to the target.

(6) This amount is based on Ms. McCorvey’s base salary as Director of Investor Relations for 311 out of 365 days in 2010 and as

CFO for 54 out of 365 days in 2010, multiplied by her target bonus percentage of 75%.

(7) Mr. Jotwani was hired on September 28, 2010. This amount is based on his quoted salary, prorated for 95 out of 365 days worked

during the year, multiplied by his target bonus percentage.

(8) Mr. Sklarsky was not eligible for a 2010 EXCEL award based on his voluntary termination from the Company on November 5,

2010.