Kodak 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

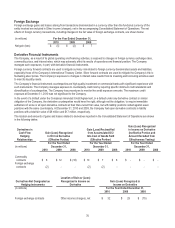

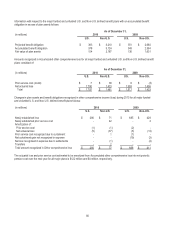

Foreign Exchange

Foreign exchange gains and losses arising from transactions denominated in a currency other than the functional currency of the

entity involved are included in Other income (charges), net in the accompanying Consolidated Statement of Operations. The net

effects of foreign currency transactions, including changes in the fair value of foreign exchange contracts, are shown below:

(in millions)

For the Year Ended December 31,

2010

2009

2008

Net gain (loss)

$ (5)

$ (2)

$ 7

Derivative Financial Instruments

The Company, as a result of its global operating and financing activities, is exposed to changes in foreign currency exchange rates,

commodity prices, and interest rates, which may adversely affect its results of operations and financial position. The Company

manages such exposures, in part, with derivative financial instruments.

Foreign currency forward contracts are used to mitigate currency risk related to foreign currency denominated assets and liabilities,

especially those of the Company’s International Treasury Center. Silver forward contracts are used to mitigate the Company’s risk to

fluctuating silver prices. The Company’s exposure to changes in interest rates results from its investing and borrowing activities used

to meet its liquidity needs.

The Company’s financial instrument counterparties are high-quality investment or commercial banks with significant experience with

such instruments. The Company manages exposure to counterparty credit risk by requiring specific minimum credit standards and

diversification of counterparties. The Company has procedures to monitor the credit exposure amounts. The maximum credit

exposure at December 31, 2010 was not significant to the Company.

In the event of a default under the Company’s Amended Credit Agreement, or a default under any derivative contract or similar

obligation of the Company, the derivative counterparties would have the right, although not the obligation, to require immediate

settlement of some or all open derivative contracts at their then-current fair value, but with liability positions netted against asset

positions with the same counterparty. At December 31, 2010 and 2009, the Company had open derivative contracts in liability

positions with a total fair value of $8 million and $17 million, respectively.

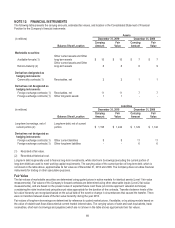

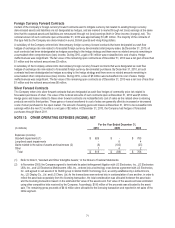

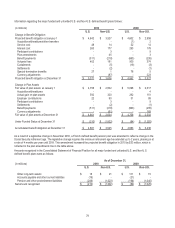

The location and amounts of gains and losses related to derivatives reported in the Consolidated Statement of Operations are shown

in the following tables:

Derivatives in

Cash Flow

Hedging

Relationships

Gain (Loss) Recognized

in OCI on Derivative

(Effective Portion)

Gain (Loss) Reclassified

from Accumulated OCI

Into Cost of Goods Sold

(Effective Portion)

Gain (Loss) Recognized

in Income on Derivative

(Ineffective Portion and

Amount Excluded from

Effectiveness Testing)

(in millions)

For the Year Ended

December 31,

For the Year Ended

December 31,

For the Year Ended

December 31,

2010

2009

2008

2010

2009

2008

2010

2009

2008

Commodity

contracts

$ 6

$ 12

$ (16)

$ 10

$ 7

$ 8

$ -

$ -

$ -

Foreign exchange

contracts

(2)

-

-

(2)

(2)

-

-

-

-

Derivatives Not Designated as

Hedging Instruments

Location of Gain or (Loss)

Recognized in Income on

Derivative

Gain (Loss) Recognized in

Income on Derivative

(in millions)

For the Year Ended December 31,

2010

2009

2008

Foreign exchange contracts

Other income (charges), net

$ 32

$ 29

$ (75)