Kodak 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

2008

For the year ended December 31, 2008, the Company incurred restructuring and rationalization charges, net of reversals, of $149

million. The $149 million of restructuring and rationalization charges, net of reversals, included $6 million of costs related to

accelerated depreciation, and $3 million of charges for inventory write-downs, which were reported in Cost of sales in the

accompanying Consolidated Statement of Operations. The remaining costs incurred, net of reversals, of $140 million were reported

as Restructuring costs, rationalization and other in the accompanying Consolidated Statement of Operations for the year ended

December 31, 2008.

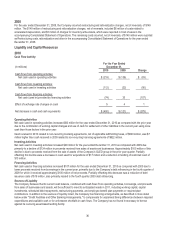

Liquidity and Capital Resources

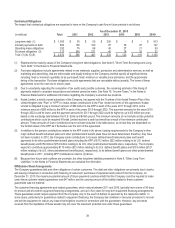

2010

Cash Flow Activity

For the Year Ended

(in millions)

December 31,

2010

2009

Change

Cash flows from operating activities:

Net cash used in operating activities

$ (219)

$ (136)

$ (83)

Cash flows from investing activities:

Net cash used in investing activities

(112)

(22)

(90)

Cash flows from financing activities:

Net cash (used in) provided by financing activities

(74)

33

(107)

Effect of exchange rate changes on cash

5

4

1

Net decrease in cash and cash equivalents

$ (400)

$ (121)

$ (279)

Operating Activities

Net cash used in operating activities increased $83 million for the year ended December 31, 2010 as compared with the prior year

due to the combination of working capital changes and use of cash for settlement of other liabilities in the current year using more

cash than those factors in the prior year.

Cash received in 2010 related to non-recurring licensing agreements, net of applicable withholding taxes, of $629 million, was $7

million higher than cash received in 2009 related to non-recurring licensing agreements of $622 million.

Investing Activities

Net cash used in investing activities increased $90 million for the year ended December 31, 2010 as compared with 2009 due

primarily to a decline of $124 million in proceeds received from sales of assets and businesses. Approximately $100 million of this

decline is due to proceeds received from the sale of assets of the Company’s OLED group in the prior year quarter. Partially

offsetting this decline were a decrease in cash used for acquisitions of $17 million and a reduction in funding of restricted cash of

$13 million.

Financing Activities

Net cash used in financing activities increased $107 million for the year ended December 31, 2010 as compared with 2009 due to

lower proceeds received from borrowings in the current year, primarily due to the Company’s debt refinancing in the fourth quarter of

2009 for which it received approximately $100 million of net proceeds. Partially offsetting this decrease was a reduction of debt

issuance costs of $18 million, also primarily related to the fourth quarter 2009 debt refinancing.

Sources of Liquidity

The Company believes that its current cash balance, combined with cash flows from operating activities, borrowings, and proceeds

from sales of businesses and assets, will be sufficient to meet its anticipated needs in 2011, including working capital, capital

investments, scheduled debt repayments, restructuring payments, and employee benefit plan payments or required plan

contributions. In addition to the sources of liquidity noted, the Company has financing arrangements, as described in more detail

below under "Credit Facilities and Other Banking Arrangements," to compensate for unplanned timing differences between required

expenditures and available cash or for unforeseen shortfalls in cash flows. The Company has not found it necessary to borrow

against its revolving asset-based lending facility.