Kodak 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

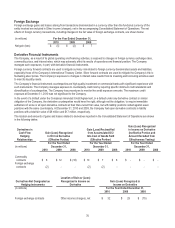

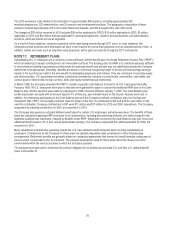

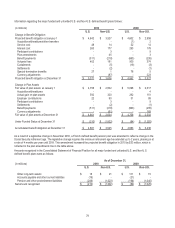

The differences between income taxes computed using the U.S. federal income tax rate and the provision (benefit) for income taxes

for continuing operations were as follows:

For the Year Ended December 31,

(in millions)

2010

2009

2008

Amount computed using the statutory rate

$ (196)

$ (41)

$ (306)

Increase (reduction) in taxes

resulting from:

State and other income taxes, net of federal

1

1

4

Impact of goodwill impairment

217

-

229

Operations outside the U.S.

140

45

31

Valuation allowance

(46)

117

146

Tax settlements and adjustments, including interest

3

(4)

(248)

Other, net

(5)

(3)

(3)

Provision (benefit) for income taxes

$ 114

$ 115

$ (147)

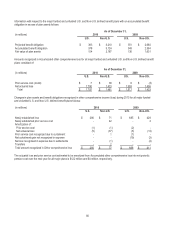

During the fourth quarter of 2010, based on additional positive evidence regarding past earnings and projected future taxable income

from operating activities, the Company determined that it is more likely than not that a portion of the deferred tax assets outside the

U.S. would be realized and accordingly, recorded a tax benefit of $154 million associated with the release of the valuation allowance

on those deferred tax assets.

In June 2008, the Company received a tax refund from the U.S. Internal Revenue Service (“IRS”) of $581 million. The refund is

related to the audit of certain claims filed for tax years 1993-1998, and is composed of a refund of past federal income taxes paid of

$306 million and $275 million of interest earned on the refund. The federal tax refund claim related primarily to a 1994 loss

recognized on the Company’s sale of stock of a subsidiary, Sterling Winthrop Inc., which was originally disallowed under IRS

regulations in effect at that time. The IRS subsequently issued revised regulations that served as the basis for this refund.

The refund had a positive impact of $565 million on the Company’s net earnings for the year ended December 31, 2008. Of the $565

million increase in net earnings, $295 million related to the 1994 sale of Sterling Winthrop Inc., which was reflected in earnings from

discontinued operations, net of income taxes. The balance of $270 million, which represents interest, net of state income tax, was

reflected in loss from continuing operations and is included in the “Tax settlements and adjustments, including interest” line item

above. The difference between the cash refund received of $581 million and the positive net earnings impact of $565 million

represented incremental state tax expense incurred and the release of an existing income tax receivable related to the refund.