Kodak 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

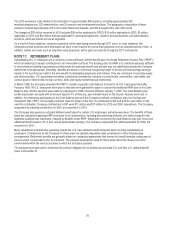

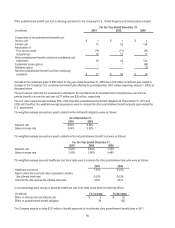

(in millions)

Non-U.S.

Balance at

January 1, 2009

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

December 31, 2009

Inflation-Linked

Bonds

$ 41

$ 16

$ -

$ -

$ 57

Private Equity

223

(5)

24

-

242

Real Estate

140

(15)

(26)

-

99

Total

$ 404

$ (4)

$ (2)

$ -

$ 398

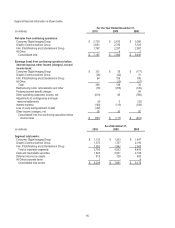

The Company expects to contribute approximately $21 million and $89 million in 2011 for U.S. and Non-U.S. defined benefit pension

plans, respectively.

The following pension benefit payments, which reflect expected future service, are expected to be paid from the plans:

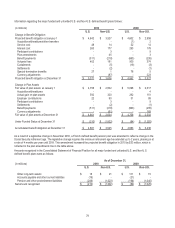

(in millions)

U.S.

Non-U.S.

2011

$ 446

$ 209

2012

417

206

2013

425

204

2014

404

202

2015

399

199

2016-2020

1,924

993

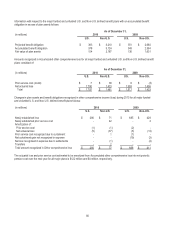

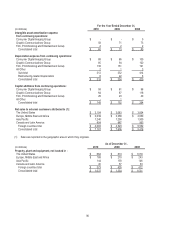

NOTE 18: OTHER POSTRETIREMENT BENEFITS

The Company provides healthcare, dental and life insurance benefits to U.S. eligible retirees and eligible survivors of retirees.

Generally, to be eligible for the plan, individuals retiring prior to January 1, 1996 were required to be 55 years of age with ten years

of service or their age plus years of service must have equaled or exceeded 75. For those retiring after December 31, 1995, the

individuals must be 55 years of age with ten years of service or have been eligible as of December 31, 1995. Based on the eligibility

requirements, these benefits are provided to U.S. retirees who are covered by the Company's KRIP plan and are funded from the

general assets of the Company as they are incurred. However, those under the Cash Balance portion of the KRIP plan would be

required to pay the full cost of their benefits under the plan.

The Company's subsidiaries in the United Kingdom and Canada offer similar postretirement benefits.

On August 1, 2008, the Company adopted and announced certain changes to its U.S. postretirement benefit plan affecting its post-

September 1991 retirees beginning January 1, 2009. For affected participants, the terms of the amendment reduce the Company’s

contribution toward retiree medical coverage from its 2008 level by one percentage point per year for a 10-year period, phase-out

Company contributions for dependent medical coverage over the same 10-year period with access only coverage beginning in 2018,

and discontinue retiree dental coverage and Company-paid life insurance.

The changes made to the plan resulted in the remeasurement of the plan’s obligations as of August 1, 2008, the date the changes

were adopted and announced by the Company. This remeasurement reduced the Company’s other postretirement benefit obligation

by $919 million, of which $772 million is attributable to the plan changes. In addition, the Company recognized a curtailment gain of

$79 million as a result of the amendment. The curtailment gain was included in Cost of sales, Selling, general and administrative

expenses, and Research and development costs in the Consolidated Statement of Operations for the year ended December 31,

2008.

The Company’s benefits to U.S. long-term disability recipients were also amended as described above. These changes resulted in a

reduction in Pension and other postretirement liabilities, and a corresponding gain of $15 million was included in the Cost of sales,

Selling, general and administrative expenses, and Research and development costs in the Consolidated Statement of Operations for

the year ended December 31, 2008.

On October 31, 2009, the Company adopted and announced certain changes to its U.S. postretirement benefit plans effective

January 1, 2010. Modifications were made to certain retiree copays and prescription drug coverage. These changes resulted in the

remeasurement of the plan’s obligations as of October 31, 2009.