Kodak 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

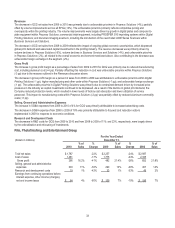

38

The repurchase of the 2013 Notes resulted in a gain on early debt extinguishment of approximately $9 million, reported in Loss on

early extinguishment of debt, net in the Consolidated Statement of Operations for the year ended December 31, 2010. The gain was

a result of the principal repayment of approximately $190 million being less than the carrying value of the repurchased debt of $200

million. $300 million of the 2013 Notes remain outstanding as of December 31, 2010.

Credit Facilities and Other Banking Arrangements

The Company has a revolving asset-based lending facility (the “Amended Credit Agreement”) that provides for a maximum

borrowing availability of up to $500 million. On October 18, 2010, non-extending lender commitments expired capping the

Company’s borrowing limit to the $410 million of extending lender commitments as of that date. The Company may add additional

lender commitments to the Amended Credit Agreement up to the maximum borrowing availability. The termination date of the

Amended Credit Agreement is March 31, 2012. Advances under the Amended Credit Agreement are available based on the

Company’s respective borrowing base from time to time. The borrowing base is calculated based on designated percentages of

eligible accounts receivable, inventory, machinery and equipment and, once mortgages are recorded, certain real property, subject

to applicable reserves. As of December 31, 2010, based on this borrowing base calculation and after deducting the face amount of

letters of credit outstanding of $122 million and $90 million of collateral to secure other banking arrangements, the Company had

$192 million available to borrow under the Amended Credit Agreement. As of December 31, 2010, the Company had no debt for

borrowed money outstanding under the Amended Credit Agreement.

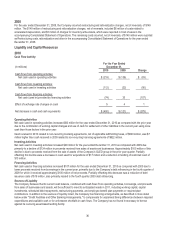

Under the terms of the Amended Credit Agreement, the Company has agreed to certain affirmative and negative covenants

customary in similar asset-based lending facilities. In the event the Company’s excess availability under the borrowing base formula

under the Amended Credit Agreement falls below $100 million for three consecutive business days, among other things, the

Company must maintain a fixed charge coverage ratio of not less than 1.1 to 1.0 until the excess availability is greater than $100

million for 30 consecutive days. For the year ended December 31, 2010, excess availability was greater than $100 million. The

Company is also required to maintain cash and cash equivalents in the U.S. of at least $250 million. The negative covenants limit,

under certain circumstances, among other things, the Company’s ability to incur additional debt or liens, make certain investments,

make shareholder distributions or prepay debt, except as permitted under the terms of the Amended Credit Agreement. The

Company was in compliance with all covenants under the Amended Credit Agreement as of December 31, 2010.

In addition to the Amended Credit Agreement, the Company has other committed and uncommitted lines of credit as of December

31, 2010 totaling $19 million and $131 million, respectively. These lines primarily support operational and borrowing needs of the

Company’s subsidiaries, which include term loans, overdraft coverage, revolving credit lines, letters of credit, bank guarantees and

vendor financing programs. Interest rates and other terms of borrowing under these lines of credit vary from country to country,

depending on local market conditions. As of December 31, 2010, usage under these lines was approximately $51 million, all of which

were supporting non-debt related obligations.

In addition to the lines of credit noted above, there were bank guarantees and letters of credit of $18 million and surety bonds of $23

million outstanding under other banking arrangements primarily to ensure payment of possible casualty and workers’ compensation

claims, environmental liabilities, legal contingencies, rental payments, and to support various customs and trade activities.

Refer to Note 8, “Short-Term Borrowings and Long-Term Debt,” in the Notes to Financial Statements for additional information about

the Company’s credit facilities and other banking arrangements.

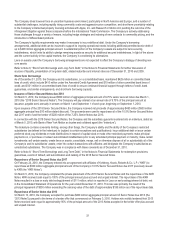

Credit Quality

Moody's and Standard & Poor’s (“S&P”) ratings for the Company, including their outlooks, as of the filing date of this Form 10-K are

as follows:

Corporate

Rating

Secured

Rating

Senior

Unsecured Rating

Outlook

Most

Recent Update

Moody's

B3

Ba3

Caa1

Stable

February 24, 2010

S&P

B-

B-

CCC

Negative

January 26, 2011

On January 26, 2011, S&P placed its B- rating on the Company’s Corporate Rating and all related issue-level ratings, on

CreditWatch with negative implications.

On February 24, 2010, Moody’s issued a rating of Ba3 on the Company’s $500 million 9.75% Senior Secured Notes due 2018.

The Company does not have any rating downgrade triggers that would accelerate the maturity dates of its debt. However, the

Company could be required to increase the dollar amount of its letters of credit or provide other financial support up to an additional

$10 million at the current credit ratings. As of the filing date of this Form 10-K, the Company has not been requested to materially

increase its letters of credit or other financial support. Downgrades in the Company’s credit rating or disruptions in the capital

markets could impact borrowing costs and the nature of its funding alternatives.