Kodak 2010 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

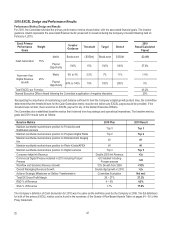

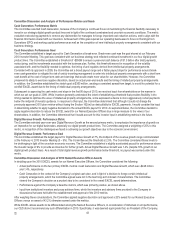

Based on the 2010 Total Segment EFO results of $369 million, which represents a 165% improvement from 2009, the Committee

approved an award of 86.3% of target. In deciding upon this award, the Committee applied negative discretion to remove segment EFO

improvements resulting from the negative discretion applied to EXCEL. Mr. Perez therefore earned the following stock unit award, with

payout contingent on satisfaction of an additional three year cliff vesting requirement.

2010 Initial Performance

Share Allocation

(in stock units)

Percent

Earned

Certified 2010 Award

(in stock units)

cliff vests 12/31/2013

A.M. Perez, Chairman & CEO

287,380

86.3%

248,009

RISK MITIGATING POLICIES

Share Ownership Program

Our Share Ownership Program outlines the Company’s expectation for Kodak stock ownership by our Section 16 Executive Officers. This

program, first introduced in 1992, is intended to closely align the interests of our Section 16 Officers with those of our shareholders by

requiring Section 16 Officers to acquire a significant ownership stake in the Company. Ownership requirements are equal to at least one to

five times base salary amounts, depending on the Section 16 Officer’s position. Shares counting toward the required ownership include

stock acquired upon stock option exercise, Leadership Stock when earned but not vested, Restricted Stock and RSUs, shares held in the

Section 16 Officer’s account under Kodak’s Employee Stock Ownership Plan or Savings and Investment Plan, any “phantom stock”

selected by a Section 16 Officer as an investment option in the Executive Deferred Compensation Plan, and shares owned directly by the

Section 16 Officer and his or her spouse. The program also includes an expectation that Section 16 Officers retain 100% of shares

attributable to the exercise of stock options or the vesting or earn-out of full value shares (such as Restricted Stock, RSUs or Leadership

Stock), net of taxes, until they attain their specified ownership levels. The ownership requirements are as follows:

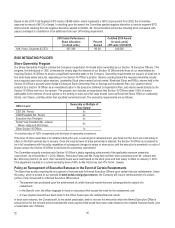

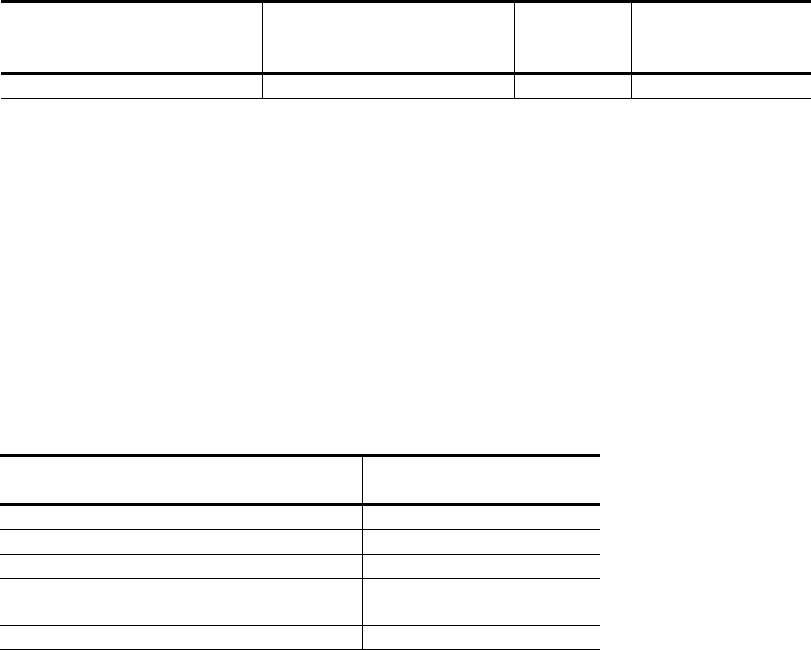

Officer Level

Ownership as Multiple of

Base Salary*

CEO (Mr. Perez)

5x

COO/President (Mr. Faraci)

4x

Executive Vice President

3x

Senior Vice President (Mr. Jotwani,

Mmes. Haag and McCorvey)

2x

Other Section 16 Officer

1x

*A retention ratio of 100% is expected until this level of ownership is achieved.

If the level of share ownership is not attained during the year, a new target is calculated each year based on the stock price and salary in

effect on the first business day in January. Once the required level of share ownership is attained, the Section 16 Officer is considered to

be in full compliance with the policy regardless of subsequent changes to salary or share price, until the executive is promoted or a sale of

shares causes the Section 16 Officer to fall below the ownership requirement.

The Committee annually monitors each Section 16 Officer’s status regarding achievement of the applicable minimum ownership

requirement. As of December 31, 2010, Messrs. Perez and Faraci and Ms. Haag had met their share ownership level. Mr. Jotwani and

Ms. McCorvey had not. As such, their ownership levels were reset based on the stock price and their salary in effect on January 3, 2011.

This adjustment resulted in a current ownership level of 46% for Ms. McCorvey and 47% for Mr. Jotwani.

Policy on Recoupment of Executive Bonuses in the Event of Certain Restatements

The Board has a policy requiring the recoupment of bonuses paid to Named Executive Officers upon certain financial restatements. Under

the policy, which is posted on our website at www.kodak.com/go/governance, the Company will require reimbursement of a certain

portion of any bonus paid to a Named Executive Officer when:

• The payment was predicated upon the achievement of certain financial results that were subsequently the subject of a

restatement;

• In the Board’s view, the officer engaged in fraud or misconduct that caused the need for the restatement; and

• A lower payment would have been made to the officer based upon the restated financial results.

In each such instance, the Company will, to the extent practicable, seek to recover the amount by which the Named Executive Officer’s

annual bonus for the relevant period exceeded the lower payment that would have been made based on the restated financial results, plus

a reasonable rate of interest.