Kodak 2010 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

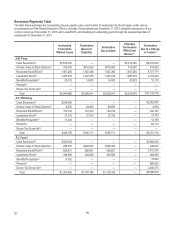

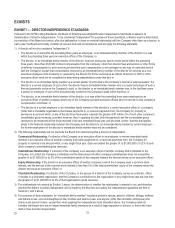

69

Involuntary

Termination

Without Cause

Termination

Based on

Disability

Termination

Due to Death

Voluntary

Termination

With Good

Reason(1)

Termination

Due to a Change

in Control(2)

P. Jotwani

Cash Severance(3)

$1,050,000

—

—

—

$3,150,000

Intrinsic Value of Stock Options(4)

350,000

$350,000

$350,000

—

350,000

Restricted Stock/RSUs(5)

—

—

—

—

536,000

Leadership Stock(6)

—

—

—

—

—

Benefits/Perquisites(7)

5,868

—

—

—

5,608

Pension(8)

—

—

—

—

—

Excise Tax Gross-Up(9)

—

—

—

—

—

Total

$1,405,868

$350,000

$350,000

—

$4,041,608

J.P. Haag

Cash Severance(3)

$1,521,960

—

—

—

—

Intrinsic Value of Stock Options(4)

—

—

—

—

—

Restricted Stock/RSUs(5)

237,318

—

—

—

—

Leadership Stock(6)

107,886

—

—

—

—

Benefits/Perquisites(7)

11,289

—

—

—

—

Pension(8)

—

—

—

—

—

Excise Tax Gross-Up(9)

—

—

—

—

—

Total

$1,878,453

—(10)

—(10)

—

—(10)

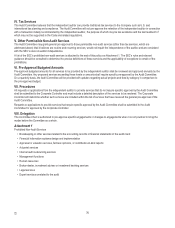

(1) This column includes only Mr. Perez because no other Named Executive Officer will receive severance benefits upon voluntary

termination with good reason. The values in this table were calculated using the same assumptions described above.

(2) Severance benefits under this column apply only to terminations that occur due to a change in control that were without cause or

for good reason or, for Mr. Faraci as President, if a change in control occurs prior to December 23, 2011 and he voluntarily

terminates for any reason during the 30-day period commencing 23 months after the change in control.

(3) The cash severance amounts disclosed above were calculated using target total cash compensation (base salary plus EXCEL

target award) for each Named Executive Officer. For Mr. Perez and Mr. Jotwani, severance for all but the last column was

calculated by multiplying the Named Executive Officer's target total cash compensation by a multiplier set forth in the Named

Executive Officer’s letter agreement(s). Mr. Perez's cash severance equation is two times his target total cash compensation.

Mr. Jotwani’s cash severance equation is one times his target total cash compensation. For Ms. McCorvey and Mr. Faraci,

severance for all but the last column was calculated in accordance with the Company’s Termination Allowance Plan (TAP). Ms.

McCorvey’s severance equation is equal to 16.5 weeks of her target total cash compensation. Mr. Faraci's severance equation is

equal to nine weeks of his target total cash compensation. At the time of separation of a Named Executive Officer, the Committee

may approve severance terms that vary from those provided in the Named Executive Officer’s pre-existing individual

agreement(s), if any, or under TAP, provided that such terms are consistent with the guidelines that the Committee establishes for

executive severance. None of these amounts reflect any offset for Special Termination Program benefits that may be payable from

KRIP. In connection with Ms. Haag’s termination from the Company with approved reason on December 31, 2010, the Committee

approved a severance equation equal to two times her target total cash compensation which exceeds her 43.5 weeks of

severance under TAP by $887,589. This approval was memorialized in a letter agreement between Ms. Haag and the Company

dated November 11, 2010.

The cash severance amounts disclosed above in the last column were calculated for each Named Executive Officer by multiplying

the Named Executive Officer's target total cash compensation by three. These amounts do not reflect any offset for Special

Termination Program benefits that may be payable from KRIP.

(4) This row represents the intrinsic value of all outstanding stock options that would continue to vest following the different scenarios

on December 31, 2010.