Kodak 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

For a detailed discussion of the components of discontinued operations, refer to Note 22, “Discontinued Operations,” in the Notes to

Financial Statements.

Extraordinary Gain

The terms of the purchase agreement of the 2004 acquisition of NexPress Solutions LLC called for additional consideration to be

paid by the Company if sales of certain products exceeded a stated minimum number of units sold during a five-year period following

the close of the transaction. In May 2009, the earn-out period lapsed with no additional consideration required to be paid by the

Company. Negative goodwill, representing the contingent consideration obligation of $17 million, was therefore reduced to zero. The

reversal of negative goodwill reduced Property, plant and equipment, net by $2 million and Research and development expense by

$7 million and resulted in an extraordinary gain of $6 million, net of tax, during the year ended December 31, 2009.

Net Loss Attributable to Eastman Kodak Company

The Company’s consolidated net loss attributable to Eastman Kodak Company for 2010 was $687 million, or a loss of $2.56 per

basic and diluted share.

The Company’s consolidated net loss attributable to Eastman Kodak Company for 2009 was $210 million, or a loss of $0.78 per

basic and diluted share.

The Company’s consolidated net loss attributable to Eastman Kodak Company for 2008 of $442 million, or a loss of $1.57 per basic

and diluted share,

These changes in net loss are attributable to the reasons outlined above.

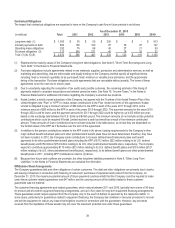

Restructuring Costs, Rationalization and Other

2010

The Company recognizes the need to continually rationalize its workforce and streamline its operations in the face of ongoing

business and economic changes. Charges for restructuring and ongoing rationalization initiatives are recorded in the period in which

the Company commits to a formalized restructuring or ongoing rationalization plan, or executes the specific actions contemplated by

the plans and all criteria for liability recognition under the applicable accounting guidance have been met.

The charges of $78 million recorded in 2010 included $6 million of charges for accelerated depreciation and $2 million for inventory

write-downs, which were reported in Cost of sales in the accompanying Consolidated Statement of Operations for the year ended

December 31, 2010. The remaining $70 million, including $49 million of severance costs, $14 million of exit costs, and $7 million of

long-lived asset impairments, were reported in Restructuring costs, rationalization and other in the accompanying Consolidated

Statement of Operations for the year ended December 31, 2010. Severance and exit costs reserves require the outlay of cash, while

long-lived asset impairments, accelerated depreciation and inventory write-downs represent non-cash items. The Company expects

to utilize the majority of the December 31, 2010 accrual balance in 2011.

During the year ended December 31, 2010, the Company made cash payments related to restructuring and rationalization of

approximately $88 million.

The charges of $78 million recorded in the year ended December 31, 2010 included $38 million applicable to FPEG, $15 million

applicable to GCG, $3 million applicable to CDG, and $22 million that was applicable to manufacturing/service, research and

development, and administrative functions, which are shared across all segments.

The restructuring actions implemented in the year 2010 are expected to generate future annual cash savings of approximately $62

million. These savings are expected to reduce future Cost of sales, SG&A and R&D expenses by $35 million, $25 million, and $2

million, respectively. The Company began realizing these savings in the first quarter of 2010, and expects the majority of the savings

to be realized by the second half of 2011 as most of the actions and severance payouts are completed.

2009

On December 17, 2008, the Company committed to a plan to implement a targeted cost reduction program (the 2009 Program) to

more appropriately size the organization as a result of the current economic environment. The program involved rationalizing selling,

administrative, research and development, supply chain and other business resources in certain areas and consolidating certain

facilities. The execution of the 2009 Program began in January 2009.

For the year ended December 31, 2009, the Company incurred restructuring and rationalization charges, net of reversals, of $258

million. The $258 million of restructuring and rationalization charges, net of reversals, included $22 million of costs related to

accelerated depreciation, and $10 million of charges for inventory write-downs, which were reported in Cost of sales in the

accompanying Consolidated Statement of Operations. The remaining costs incurred, net of reversals, of $226 million were reported

as Restructuring costs, rationalization and other in the accompanying Consolidated Statement of Operations for the year ended

December 31, 2009.