Kodak 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.98

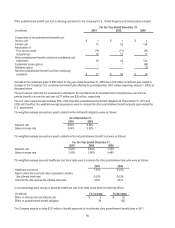

(1) Includes pre-tax restructuring charges of $14 million ($1 million included in Cost of sales and $13 million included in

Restructuring costs, rationalization and other), which decreased net earnings from continuing operations by $12 million; a pre-

tax loss on early extinguishment of debt of $102 million, which decreased net earnings from continuing operations by $102

million; a pre-tax loss on asset sales of $4 million (included in Other operating expenses (income), net), which decreased net

earnings from continuing operations by $4 million; and other discrete tax items, which decreased net earnings from continuing

operations by $19 million.

(2) Includes pre-tax restructuring charges of $11 million (included in Restructuring costs, rationalization and other), which

increased net loss from continuing operations by $11 million; pre-tax legal contingencies and settlements of $19 million ($10

million included in Cost of sales, $3 million included in Interest expense, and $6 million included in Other income (charges),

net), which increased net loss from continuing operations by $19 million; a pre-tax gain on asset sales of $2 million (included in

Other operating expenses (income), net), which decreased net loss from continuing operations by $2 million; and other

discrete tax items, which increased net loss from continuing operations by $3 million.

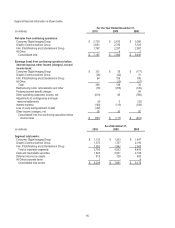

(3) Includes pre-tax restructuring charges of $29 million ($5 million included in Cost of sales and $24 million included in

Restructuring, rationalization and other), which increased net loss from continuing operations by $28 million; a pre-tax gain on

asset sales of $3 million (included in Other operating expenses (income), net), which decreased net loss from continuing

operations by $3 million; and other discrete tax items, which increased net loss from continuing operations by $13 million.

(4) Includes a pre-tax goodwill impairment charge of $626 million (included in Other operating expenses (income), net), which

increased net loss from continuing operations by $624 million, pre-tax restructuring charges of $24 million ($2 million included

in Cost of sales and $22 million included in Restructuring costs, rationalization and other), which increased net loss from

continuing operations by $24 million; a pre-tax foreign contingency of $6 million ($2 million included in Cost of sales, $2 million

in Interest expense, and $2 million in Other income (charges), net), which decreased net loss from continuing operations by $6

million; a pre-tax gain on asset sales of $6 million (included in Other operating expenses (income), net), which decreased net

loss from continuing operations by $6 million; and other discrete tax items, which decreased net loss from continuing

operations by $144 million.

(5) Includes pre-tax restructuring and rationalization charges of $116 million ($7 million included in Cost of sales and $109 million

included in Restructuring costs, rationalization and other), which increased net loss from continuing operations by $108 million;

a pre-tax legal contingency of $5 million (included in Cost of sales), which increased net loss from continuing operations by $5

million; a pre-tax loss on asset sales of $4 million (included in Other operating expenses (income), net), which increased net

loss from continuing operations by $4 million; and other discrete tax items, which reduced net loss from continuing operations

by $12 million.

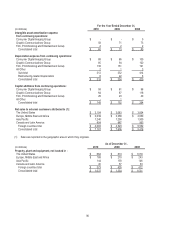

(6) Includes pre-tax restructuring and rationalization charges of $46 million ($9 million included in Cost of sales and $37 million

included in Restructuring costs, rationalization and other), which increased net loss from continuing operations by $42 million;

a pre-tax reversal of negative goodwill of $7 million (included in Research and development costs), which reduced net loss

from continuing operations by $7 million; a pre-tax reversal of a value-added tax reserve of $5 million (included in Interest

expense, and Other income (charges), net), which reduced net loss from continuing operations by $5 million; and other

discrete tax items, which increased net loss from continuing operations by $45 million.

(7) Includes pre-tax restructuring and rationalization charges of $35 million ($2 million included in Cost of sales and $33 million

included in Restructuring, rationalization and other), which increased net loss from continuing operations by $32 million; a pre-

tax loss on asset sales of $10 million (included in Other operating expenses (income), net), which increased net loss from

continuing operations by $10 million; and other discrete tax items, which increased net loss from continuing operations by $6

million.

(8) Includes pre-tax restructuring and rationalization charges of $61 million ($14 million included in Cost of sales and $47 million

included in Restructuring, rationalization and other), which reduced net earnings from continuing operations by $55 million; a

pre-tax asset impairment charge of $6 million (included in Other operating (income) expenses, net), which reduced net

earnings from continuing operations by $6 million; pre-tax gains on sales of assets of $107 million, which increased net

earnings from continuing operations by $107 million; a pre-tax reversal of a value-added tax reserve of $4 million ($2 million

included in Cost of sales, $1 million in Interest expense, and $1 million in Other income (charges), net), which increased net

earnings from continuing operations by $4 million; and other discrete tax items, which increased net earnings from continuing

operations by $40 million.

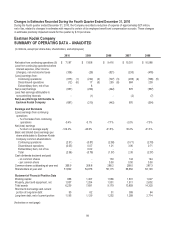

(9) Refer to Note 22, “Discontinued Operations,” in the Notes to Financial Statements for a discussion regarding earnings (loss)

from discontinued operations.

(10) Refer to Note 23, “Extraordinary Item,” in the Notes to Financial Statements.

(11) Each quarter is calculated as a discrete period and the sum of the four quarters may not equal the full year amount. The

Company’s diluted net earnings (loss) per share in the above table may include the effect of convertible debt instruments.