Kodak 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

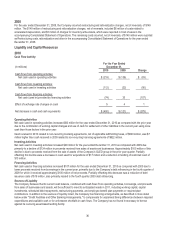

34

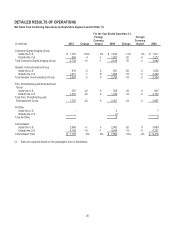

For the Year Ended

December 31,

Change vs. 2009

2010

Amount

Change

vs. 2009

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other Costs

Total net sales

$ 1,767

-21.7%

-20.2%

-1.5%

0.0%

n/a

Gross profit margin

16.2%

-5.2pp

n/a

-1.2pp

0.3pp

-4.3pp

For the Year Ended

December 31,

Change vs. 2008

2009

Amount

Change

vs. 2008

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other Costs

Total net sales

$ 2,257

-24.4%

-18.7%

-2.9%

-2.8%

n/a

Gross profit margin

21.4%

-0.4pp

n/a

-2.4pp

-1.9pp

3.9pp

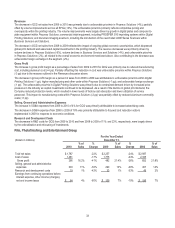

Revenues

The decrease in net sales from 2009 to 2010 for FPEG was primarily driven by volume declines across all SPGs within the segment.

These volume declines in Traditional Photofinishing (-5%) and Film Capture (-3%) were primarily driven by secular declines in the

industry. The volume declines for Entertainment Imaging (-7%) were also largely attributable to secular declines, including the effects

of digital substitution.

The decrease in net sales from 2008 to 2009 was primarily attributable to lower volumes across all SPGs within the segment. The

lower volumes for Film Capture (-5%) were primarily driven by secular declines in the traditional film industry. Lower volumes for

Traditional Photofinishing (-7%) were largely driven by the previously announced closure of the Qualex central lab operations in the

U.S. and Canada at the end of March 2009. Volume declines within Entertainment Imaging (-3%) were due to (1) the uncertainty

around the Screen Actors’ Guild contract, which expired in June 2008 and was not replaced until June 2009, (2) the impact of the

current economic climate on film makers, resulting in lower film production and the use of digital technology, as expected, and (3)

industry shifts in film release strategies and distribution.

Gross Profit

The decrease in FPEG gross profit margin as a percentage of sales from 2009 to 2010 was primarily driven by increased silver and

other commodity costs (-4 pp).

The decrease in gross profit margin as a percentage of sales from 2008 to 2009 was primarily driven by unfavorable price/mix within

Entertainment Imaging (-2 pp), largely as a result of competitive pricing in the market, and unfavorable foreign exchange (-2 pp)

across all SPGs. This was partially offset by lower benefit costs (+1 pp) as a result of amendments made in the third quarter of 2008

to certain of the Company’s U.S. postemployment benefit plans, as well as lower raw material costs (+2 pp).

Selling, General and Administrative Expenses

The decline in SG&A expenses from 2009 to 2010 of 30% for FPEG was primarily attributable to focused cost reduction actions

completed in 2009 that resulted in lower SG&A expenses in 2010.

The decline in SG&A expenses from 2008 to 2009 of 29% was primarily attributable to focused cost reduction actions.

Research and Development Costs

The decrease in R&D costs from 2009 to 2010 of 42% for FPEG was primarily due to focused cost reductions.

The decrease in R&D costs from 2008 to 2009 of 33% was primarily due to focused cost reductions.

Results of Operations – Discontinued Operations

The loss from discontinued operations in 2010 was primarily due to legal costs related to the 2008 tax refund referred to below.

Earnings from discontinued operations in 2009 were primarily driven by the reversal of certain foreign tax reserves which had been

recorded in conjunction with the divestiture of the Health Group in 2007.

Earnings from discontinued operations in 2008 were primarily driven by a tax refund that the Company received from the U.S.

Internal Revenue Service. The refund was related to the audit of certain claims filed for tax years 1993-1998. A portion of the refund

related to past federal income taxes paid in relation to the 1994 sale of a subsidiary, Sterling Winthrop Inc., which was reported in

discontinued operations. Refer to Note 15, “Income Taxes,” in the Notes to Financial Statements for further discussion of the tax

refund.