Kodak 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

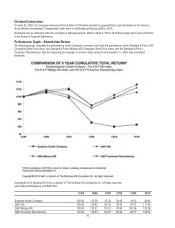

The Company has elected to include the S&P Consumer Discretionary index in the comparison, because it believes this index is

more reflective of the industries in which the Company operates, and therefore provides a better comparison of returns than the

Standard & Poor’s Midcap 400 Composite Stock Price Index or the Standard & Poor’s 500 Composite Stock Price Index.

ITEM 6. SELECTED FINANCIAL DATA

Refer to Summary of Operating Data on page 99.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”) OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help

the reader understand the results of operations and financial condition of Kodak for the three years ended December 31, 2010. All

references to Notes relate to Notes to the Financial Statements in Item 8. “Financial Statements and Supplementary Data.”

Overview

Kodak is the world’s foremost imaging innovator and generates revenue and profits from the sale of products, technology, solutions

and services to consumers, businesses and creative professionals. The Company’s portfolio is broad, including image capture and

output devices, consumables and systems and solutions for consumer, business, and commercial printing applications. Kodak has

three reportable business segments, which are more fully described later in this discussion in “Kodak Operating Model and

Reporting Structure.” The three business segments are: Consumer Digital Imaging Group (“CDG”), Graphic Communications Group

(“GCG”) and Film, Photofinishing and Entertainment Group (“FPEG”).

The Company’s digital growth strategy is centered around exploiting our competitive advantage at the intersection of materials

science and digital imaging science. The Company has leading market positions in large markets including digital printing plates,

scanners, digital still and video cameras, and kiosks. In addition, the Company has been introducing differentiated value propositions

in new growth markets that are in need of transformation. The Company’s four growth initiatives are: consumer inkjet, within CDG,

and commercial inkjet, workflow software and services, and packaging solutions within GCG.

While these four growth initiatives have largely been in an investment mode, revenue in these product lines grew 18% for the full

year. The Company will continue to gain scale in these product lines to enable a more significant and profitable contribution from

them.

Competitive pricing and rising commodity costs negatively impacted results in Kodak’s more mature product lines, including

Prepress Solutions, Digital Capture and Devices, and Entertainment Imaging. The Company is addressing these challenges through

a variety of means including the introduction of new differentiated products and pricing and hedging strategies.

Kodak entered into three significant intellectual property arrangements during the year. Each of these agreements was in line with

the three fundamental objectives of the Company’s intellectual property licensing program, which are design freedom, gaining

access to new markets and partnerships, and generating cash and earnings. The Company recognized revenue amounting to $838

million from these licenses in the year ended December 31, 2010.

Additionally, during 2009 and 2010, the Company took a number of financing actions designed to provide continued financial

flexibility for the Company:

• On March 31, 2009, the Company and its Canadian subsidiary entered into an Amended and Restated Credit Agreement (the

“Amended Credit Agreement”) with its lenders, which provides for an asset-based revolving credit facility of up to $500 million,

under certain conditions, including up to $250 million of availability for letters of credit.

• In September of 2009, the Company issued $300 million of Senior Secured Notes due 2017, with detachable warrants, and $400

million of Convertible Senior Notes due 2017. The combined net proceeds of the two transactions, after transaction costs,

discounts and fees, of approximately $650 million, were used to repurchase $563 million of the Company’s existing $575 million

Convertible Senior Notes Due 2033 in October 2009, as well as for general corporate purposes. Therefore, the new debt

issuances served as a refinancing of the debt structure of the Company.

• In March of 2010, the Company issued $500 million of Senior Secured Notes due 2018. The proceeds from this issuance were

used to repurchase all $300 million of the Senior Secured Notes due 2017, and $200 million of Senior Notes due 2013. This

served as a further refinancing of the debt structure of the Company.