Kodak 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

Critical Accounting Policies and Estimates

The accompanying consolidated financial statements and notes to consolidated financial statements contain information that is

pertinent to management’s discussion and analysis of the financial condition and results of operations. The preparation of financial

statements in conformity with accounting principles generally accepted in the United States of America requires management to

make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and the related

disclosure of contingent assets and liabilities.

The Company believes that the critical accounting policies and estimates discussed below involve the most complex management

judgments due to the sensitivity of the methods and assumptions necessary in determining the related asset, liability, revenue and

expense amounts. Specific risks associated with these critical accounting policies are discussed throughout this MD&A, where such

policies affect our reported and expected financial results. For a detailed discussion of the application of these and other accounting

policies, refer to the Notes to Financial Statements in Item 8.

Revenue Recognition

The Company's revenue transactions include sales of the following: products; equipment; software; services; integrated solutions,

and intellectual property licensing. The Company recognizes revenue when it is realized or realizable and earned. The timing and

the amount of revenue recognized from the licensing of intellectual property depend upon a variety of factors, including the specific

terms of each agreement and the nature of the deliverables and obligations. For the sale of multiple-element arrangements,

including whereby equipment or intellectual property is combined in a revenue generating transaction with other elements, the

Company allocates to, and recognizes revenue from, the various elements based on their fair value. As of January 1, 2011, the

Company will allocate to, and recognize revenue from, the various elements of multiple-element arrangements based on the best

estimate of selling price of a deliverable, using: vendor-specific objective evidence, third-party evidence, and estimated selling price.

At the time revenue is recognized, the Company also records reductions to revenue for customer incentive programs. Such incentive

programs include cash and volume discounts, price protection, promotional, cooperative and other advertising allowances and

coupons. For those incentives that require the estimation of sales volumes or redemption rates, such as for volume rebates or

coupons, the Company uses historical experience and both internal and customer data to estimate the sales incentive at the time

revenue is recognized. In the event that the actual results of these items differ from the estimates, adjustments to the sales incentive

accruals would be recorded.

Valuation of Long-Lived Assets, Including Goodwill and Intangible Assets

The Company tests goodwill for impairment annually on September 30, and whenever events occur or circumstances change that

would more likely than not reduce the fair value of the reporting unit below its carrying amount.

The Company tests goodwill for impairment at a level of reporting referred to as a reporting unit. A reporting unit is an operating

segment or one level below an operating segment (referred to as a component). A component of an operating segment is a reporting

unit if the component constitutes a business for which discrete financial information is available and segment management regularly

reviews the operating results of that component. When two or more components of an operating segment have similar economic

characteristics, the components are aggregated and deemed a single reporting unit. An operating segment is deemed to be a

reporting unit if all of its components are similar, if none of its components is a reporting unit, or if the segment comprises only a

single component.

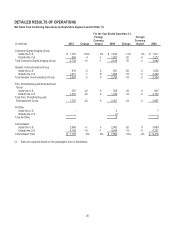

The components of the Film, Photofinishing and Entertainment Group (FPEG) operating segment are similar and, therefore, the

segment meets the requirement of a reporting unit. Likewise, the components of the Consumer Digital Imaging Group (CDG) are

similar and, therefore, the segment meets the definition of a reporting unit. The Graphic Communications Group (GCG) operating

segment has two reporting units: the Business Services and Solutions Group (BSSG) reporting unit and the Commercial Printing

reporting unit (consisting of the Prepress Solutions and Digital Printing Solutions strategic product groups.) The Commercial Printing

reporting unit consists of components that have similar economic characteristics and, therefore, have been aggregated into a single

reporting unit.

The Company’s reporting units changed in 2010 as a result of organizational changes that became effective in the current year.

Image Sensor Solutions (ISS) was a reporting unit in 2009. ISS no longer meets the definition of a component and, therefore, no

longer qualifies as a reporting unit. ISS is now a part of the CDG reporting unit. The ISS reporting unit did not have any goodwill

allocated to it in the prior year. In addition, within the GCG operating segment, the Enterprise Solutions strategic product group

(SPG) was combined with the Document Imaging SPG to form a new SPG called BSSG, which meets the definition of a component

and a reporting unit. The Document Imaging SPG was a reporting unit in the prior year. The remainder of the GCG operating

segment represents the Commercial Printing reporting unit, as noted above. These 2010 reporting structure changes had no impact

on the Company’s segment reporting.