Kodak 2010 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

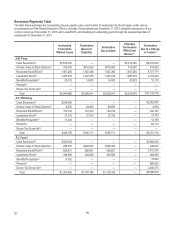

(4) This amount includes the 2008 above-market interest of $2,985, which is also reported in the Summary Compensation Table for

fiscal 2008 (there was no above-market interest in 2009).

(5) This amount reflects gains attributable to the appreciation in the Company’s stock price during fiscal 2010 (i.e. the closing price of

$4.22 as of December 31, 2009 vs. the closing price of $5.36 as of December 31, 2010).

Executive Deferred Compensation Plan

The Company has maintained the Eastman Kodak Company 1982 Executive Deferred Compensation Plan (EDCP) for executives who

participated in the plan prior to 2007. In 2009, the Committee froze the receipt of new monies into the plan, due to its low utilization and its

administrative cost. Prior to 2009, the Committee had made annual decisions to freeze the receipt of new monies in both 2007 and 2008.

The plan’s benefits are neither funded nor secured.

After the period of fixed deferment, any account balance may be paid in a cash lump-sum payment as soon as administratively possible

coincident with a pay cycle in September, after the account is valued in August following the end of the deferment. Upon termination of

employment, for amounts not subject to Section 409A, the Committee has the sole discretion to pay such amounts in a lump sum or in

annual installments, not to exceed 10 annual installments. For amounts subject to Section 409A, most Named Executive Officers elected

to be paid in a lump sum or in installments, provided that payments begin no later than when the executive reaches age 71. If an executive

has not filed an election, then any amounts subject to Section 409A will be paid in a lump sum. Any amounts subject to Section 409A are

subject to a further six-month waiting period following termination of employment in order to ensure compliance with Section 409A.

Withdrawals prior to termination of employment are not permitted under the plan except in cases of severe financial hardship not within the

executive’s control, although amounts not subject to Section 409A may be withdrawn by an executive prior to termination of employment,

provided that 10% of the amount withdrawn will be forfeited by the executive.

Salary and Bonus Deferral Program

To preserve the full deductibility for federal income tax purposes of Mr. Perez’s base salary, he is required to defer that portion of his base

salary that exceeds $1 million. The amount deferred in each pay period bears interest at the same rate as described above for our EDCP.

The deferred amounts and interest earned on these amounts are tracked through a notional account maintained by the Company.

Amounts deferred are payable only upon Mr. Perez’s retirement from the Company, in the form of a lump sum. The notional account is

neither funded nor secured.

Deferral of Stock Awards

Under the Company’s prior equity award programs, Named Executive Officers were at times permitted to defer the receipt of various equity

awards to a future date later than the date that the award vests. Mr. Perez elected to defer awards earned under the Alternative Award of

the Executive Incentive Plan under the 2002 – 2004 performance cycle of the Company’s Performance Stock Program, his Restricted

Stock award granted on October 1, 2003 and the performance stock units earned under the 2004 – 2005 performance cycle of the

Leadership Stock Program. Each of these awards has fully vested as of December 31, 2009.

All of these deferred awards are tracked through notional accounts maintained by the Company. For each share or unit deferred, the

executive receives a phantom unit of our common stock in his account. Any stock dividends or amounts equivalent to dividends paid on

our common stock are added to the executive’s notional account in the form of additional phantom units as they are paid, at the same rate

as dividends are paid on shares of our common stock. For these deferred awards, stock dividends were unrestricted, but are subject to the

original payment terms of the underlying deferred award. The notional accounts are neither funded nor secured.

The payout, withdrawal and distribution terms are generally similar for each deferred award, other than the performance stock units earned

under the 2004 – 2005 performance cycle of the Leadership Stock Program that were deferred by Mr. Perez. Pursuant to his deferral

election, Mr. Perez will be entitled to receive a distribution following his termination of employment of all amounts in his deferred account

attributable to these performance stock units (and any earnings thereon) in a lump-sum payment, in shares, as soon as administratively

practicable in March of the following year after his termination of employment with the Company. If applicable, a six-month waiting period is

required for compliance under Section 409A.

For all other deferred awards, upon termination of employment for any reason other than death, the amounts held in an executive’s

notional accounts will be distributed in a single lump sum or in up to 10 annual installments as the Committee determines at its sole

discretion. The Committee will also have the discretion to pay the amounts in cash or in shares, or in any combination of both. Upon an

executive’s death, the balance of an executive’s deferred account that is not subject to restriction will be paid in a lump-sum cash payment

within 30 days after appointment of a legal representative of the deceased executive.

Withdrawals prior to termination of employment are not permitted under the terms of the deferral program except in cases of severe

financial hardship not within the executive’s control, as determined at the Committee’s sole discretion.