Kodak 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

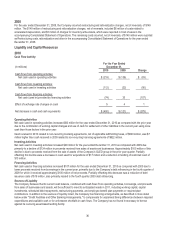

The Company does however face an uncertain business environment, particularly in North America and Europe, and a number of

substantial challenges, including rapidly rising commodity costs and aggressive price competition, and short-term uncertainty relating

to the Company’s intellectual property licensing activities with Apple, Inc. and Research in Motion Ltd. pending the outcome of the

infringement litigation against these companies before the International Trade Commission. The Company is actively addressing

these challenges through a variety of means, including hedge strategies and indexing of new contracts to commodity pricing, and the

introduction of differentiated products.

The Company’s liquidity requirements may make it necessary to incur additional debt. Under the Company’s borrowing

arrangements, additional debt can be incurred to support its ongoing operational needs including additional permitted senior debt of

up to $200 million aggregate principal amount. A substantial portion of the Company’s assets are subject to liens securing

indebtedness, which limits its ability to pledge remaining assets as security for additional secured indebtedness. In light of the above

and the current activity in the capital markets, the Company is considering its alternatives.

Liens on assets under the Company’s borrowing arrangements are not expected to affect the Company’s strategy of divesting non-

core assets.

Refer to Note 8, "Short-Term Borrowings and Long-Term Debt," in the Notes to Financial Statements for further discussion of

sources of liquidity, presentation of long-term debt, related maturities and interest rates as of December 31, 2010 and 2009.

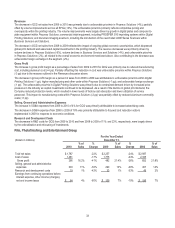

Short-Term Borrowings

As of December 31, 2010, the Company and its subsidiaries, on a consolidated basis, maintained $429 million in committed bank

lines of credit, which include $410 million under the Amended Credit Agreement and $19 million of other committed bank lines of

credit, and $131 million in uncommitted bank lines of credit to ensure continued financial support through letters of credit, bank

guarantees, and similar arrangements, and short-term borrowing capacity.

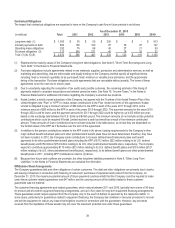

Issuance of Senior Secured Notes due 2018

On March 5, 2010, the Company issued $500 million of aggregate principal amount of 9.75% senior secured notes due March 1,

2018 (the “2018 Senior Secured Notes”). The Company will pay interest at an annual rate of 9.75% of the principal amount at

issuance, payable semi-annually in arrears on March 1 and September 1 of each year, beginning on September 1, 2010.

Upon issuance of the 2018 Senior Secured Notes, the Company received net proceeds of approximately $490 million ($500 million

aggregate principal less $10 million stated discount). The proceeds were used to repurchase all of the 10.5% Senior Secured Notes

due 2017 and to fund the tender of $200 million of the 7.25% Senior Notes due 2013.

In connection with the 2018 Senior Secured Notes, the Company and the subsidiary guarantors entered into an indenture, dated as

of March 5, 2010, with Bank of New York Mellon as trustee and collateral agent (the “Indenture”).

The Indenture contains covenants limiting, among other things, the Company’s ability and the ability of the Company’s restricted

subsidiaries (as defined in the Indenture) to (subject to certain exceptions and qualifications): incur additional debt or issue certain

preferred stock; pay dividends or make distributions in respect of capital stock or make other restricted payments; make principal

payments on, or purchase or redeem subordinated indebtedness prior to any scheduled principal payment or maturity; make certain

investments; sell certain assets; create liens on assets; consolidate, merge, sell or otherwise dispose of all or substantially all of the

Company’s and its subsidiaries’ assets; enter into certain transactions with affiliates; and designate the Company’s subsidiaries as

unrestricted subsidiaries. The Company was in compliance with these covenants as of December 31, 2010.

Refer to Note 8, “Short-Term Borrowings and Long-Term Debt,” in the Notes to Financial Statements for redemption provisions,

guarantees, events of default, and subordination and ranking of the 2018 Senior Secured Notes.

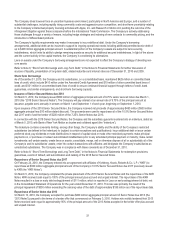

Repurchase of Senior Secured Notes due 2017

On February 24, 2010, the Company entered into an agreement with affiliates of Kohlberg, Kravis, Roberts & Co. L.P. (“KKR”) to

repurchase all $300 million aggregate principal amount of the Company’s 10.5% Senior Secured Notes due 2017 previously issued

to KKR (the “KKR Notes”).

On March 5, 2010, the Company completed the private placement of the 2018 Senior Secured Notes and the repurchase of the KKR

Notes. KKR received cash equal to 100% of the principal amount plus accrued and unpaid interest. The repurchase of the KKR

Notes resulted in a loss on early debt extinguishment of $111 million, which is reported in Loss on early extinguishment of debt, net

in the Consolidated Statement of Operations for the year ended December 31, 2010. This loss was primarily the result of the

principal repayment of $300 million exceeding the carrying value of the debt of approximately $195 million as of the repurchase date.

Repurchase of Senior Notes due 2013

On March 10, 2010, the Company accepted for purchase $200 million aggregate principal amount of Senior Notes due 2013 (the

“2013 Notes”) pursuant to the terms of a tender offer that commenced on February 3, 2010. Holders who validly tendered their 2013

Notes received cash equal to approximately 95% of the principal amount of the 2013 Notes accepted in the tender offer plus accrued

and unpaid interest.