Kodak 2010 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

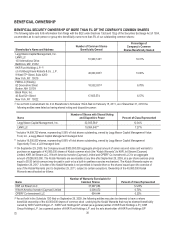

31

Limited); KKR Group Limited (as the sole general partner of KKR Group Holdings L.P.); KKR & Co. L.P. (as the sole shareholder

of KKR Group Limited); KKR Management LLC (as the sole general partner of KKR & Co. L.P.); and Henry R. Kravis and

George R. Roberts (as the designated members of KKR Management LLC).

(4) As set forth in Shareholder’s Schedule 13G filed on February 14, 2011, includes 14,759,457 shares, representing 5.38% of total

shares outstanding, owned by Fidelity Management & Research Company, a wholly owned subsidiary of FMR LLC.

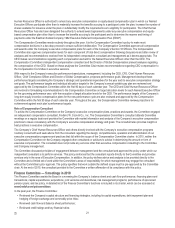

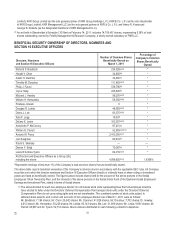

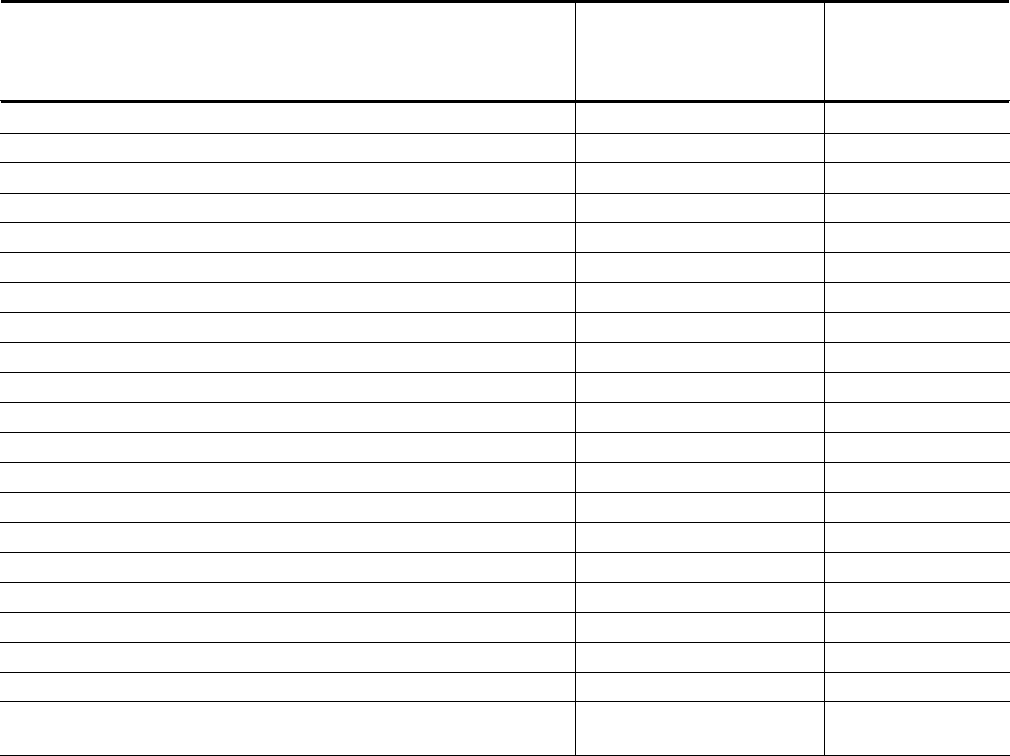

BENEFICIAL SECURITY OWNERSHIP OF DIRECTORS, NOMINEES AND

SECTION 16 EXECUTIVE OFFICERS

Directors, Nominees

and Section 16 Executive Officers

Number of Common Shares

Beneficially Owned on

March 1, 2011

Percentage of

Company’s Common

Shares Beneficially

Owned

Richard S. Braddock

234,328

(a) (b)

*

Herald Y. Chen

34,850

(b)

*

Adam H. Clammer

34,850

(a)

*

Timothy M. Donahue

111,883

(a) (b)

*

Philip J. Faraci

536,796

(b)

*

Joyce Haag

225,845

(b)

*

Michael J. Hawley

98,270

(a) (b)

*

William H. Hernandez

56,550

(a) (b)

*

Pradeep Jotwani

0

*

Douglas R. Lebda

48,953

(a) (b)

*

Debra L. Lee

85,575

(a) (b)

*

Kyle P. Legg

19,337

*

Delano E. Lewis

103,357

(a) (b)

*

Antoinette P. McCorvey

87,451

(b)

*

William G. Parrett

52,953

(a) (b) (d)

*

Antonio M. Perez

2,415,350

(b) (c)

*

Joel Seligman

60,612

(b)

*

Frank S. Sklarsky

—

—

Dennis F. Strigl

79,067

(b)

*

Laura D’Andrea Tyson

64,019

(a) (b)

*

All Directors and Executive Officers as a Group (26),

including the above

4,998,820

(b) (e)

1.8308%

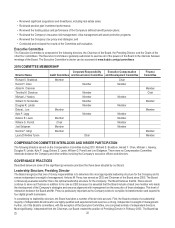

*Represents holdings of less than 1% of the Company’s total common shares that are beneficially owned.

The above table reports beneficial ownership of the Company’s common stock in accordance with the applicable SEC rules. All Company

securities over which the director nominees and Section 16 Executive Officers directly or indirectly have or share voting or investment

power are listed as beneficially owned. The figures above include shares held for the account of the above persons in the Kodak

Employees’ Stock Ownership Plan, and the interests of the above persons in the Kodak Stock Fund of the Eastman Kodak Employees’

Savings and Investment Plan, stated in terms of Kodak shares.

(a) The amounts listed for each non-employee director do not include stock units representing fees that non-employee directors

have elected to defer under the Directors’ Deferred Compensation Plan because stock units under the Directors’ Deferred

Compensation Plan do not carry voting rights and are not transferable. The combined number of stock units subject to

deferred share awards, and in stock unit accounts of non-employee directors as of March 1, 2011 were as follows:

Mr. Braddock: 7,194 shares; Mr. Chen: 25,542 shares; Mr. Clammer: 41,826 shares, Mr. Donahue: 7,702 shares; Dr. Hawley:

4,912 shares; Mr. Hernandez: 54,229 shares; Mr. Lebda: 83,143 shares; Ms. Lee: 31,093 shares; Mr. Lewis: 9,681 shares; Mr.

Parrett: 40,607 and Dr. Tyson: 52,714 shares. Stock units are distributed in cash following a director’s departure.