Kodak 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

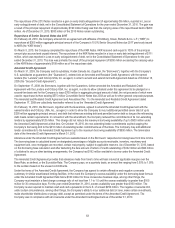

The repurchase of the 2013 Notes resulted in a gain on early debt extinguishment of approximately $9 million, reported in Loss on

early extinguishment of debt, net in the Consolidated Statement of Operations for the year ended December 31, 2010. The gain was

a result of the principal repayment of approximately $190 million being less than the carrying value of the repurchased debt of $200

million. As of December 31, 2010, $300 million of the 2013 Notes remain outstanding.

Repurchase of Senior Secured Notes due 2017

On February 24, 2010, the Company entered into an agreement with affiliates of Kohlberg, Kravis, Roberts & Co. L.P. (“KKR”) to

repurchase all $300 million aggregate principal amount of the Company’s 10.5% Senior Secured Notes due 2017 previously issued

to KKR (the “KKR Notes”).

On March 5, 2010, the Company completed the repurchase of the KKR Notes. KKR received cash equal to 100% of the principal

amount plus accrued and unpaid interest. The repurchase of the KKR Notes resulted in a loss on early debt extinguishment of $111

million, which was reported in Loss on early extinguishment of debt, net in the Consolidated Statement of Operations for the year

ended December 31, 2010. This loss was primarily the result of the principal repayment of $300 million exceeding the carrying value

of the KKR Notes of approximately $195 million as of the repurchase date.

Amended Credit Agreement

On March 31, 2009, the Company and its subsidiary, Kodak Canada Inc. (together, the “Borrowers”), together with the Company’s

U.S. subsidiaries as guarantors (the “Guarantors”), entered into an Amended and Restated Credit Agreement, with the named

lenders (the “Lenders”) and Citicorp USA, Inc. as agent, in order to amend and extend its Credit Agreement dated as of October 18,

2005 (the “Secured Credit Agreement”).

On September 17, 2009, the Borrowers, together with the Guarantors, further amended the Amended and Restated Credit

Agreement with the Lenders and Citicorp USA, Inc. as agent, in order to allow collateral under this agreement to be pledged on a

second-lien basis and for the Company to issue $700 million in aggregate principal amount of debt, the net proceeds of which were

used to repurchase its then existing $575 million Convertible Senior Notes due 2033 as well as for other general corporate purposes.

The Amended and Restated Credit Agreement and Amendment No. 1 to the Amended and Restated Credit Agreement dated

September 17, 2009 are collectively hereinafter referred to as the “Amended Credit Agreement.”

On February 10, 2010, the Borrowers, together with the Guarantors, agreed to amend the Amended Credit Agreement with the

named lenders and Citicorp, USA, Inc., as agent, in order to allow the Company to incur additional permitted senior debt of up to

$200 million aggregate principal amount, and debt that refinances existing debt and permitted senior debt so long as the refinancing

debt meets certain requirements. In connection with the amendment, the Company reduced the commitments of its non-extending

lenders by approximately $125 million. This change did not reduce the maximum borrowing availability of up to $500 million under

the Amended Credit Agreement at that time. On October 18, 2010, the non-extending lender commitments expired capping the

Company’s borrowing limit to the $410 million of extending lender commitments as of that date. The Company may add additional

lender commitments to the Amended Credit Agreement up to the maximum borrowing availability of $500 million. The termination

date of the Amended Credit Agreement is March 31, 2012.

Advances under the Amended Credit Agreement are available based on the Borrowers’ respective borrowing base from time to time.

The borrowing base is calculated based on designated percentages of eligible accounts receivable, inventory, machinery and

equipment and, once mortgages are recorded, certain real property, subject to applicable reserves. As of December 31, 2010, based

on this borrowing base calculation and after deducting the face amount of letters of credit outstanding of $122 million and $90 million

of collateral to secure other banking arrangements, the Company had $192 million available to borrow under the Amended Credit

Agreement.

The Amended Credit Agreement provides that advances made from time to time will bear interest at applicable margins over the

Base Rate, as defined, or the Eurodollar Rate. The Company pays, on a quarterly basis, an annual fee ranging from 0.50% to 1.00%

to the Lenders based on the unused commitments.

Under the terms of the Amended Credit Agreement, the Company has agreed to certain affirmative and negative covenants

customary in similar asset-based lending facilities. In the event the Company’s excess availability under the borrowing base formula

under the Amended Credit Agreement falls below $100 million for three consecutive business days, among other things, the

Company must maintain a fixed charge coverage ratio of not less than 1.1 to 1.0 until the excess availability is greater than $100

million for 30 consecutive days. For the year ended December 31, 2010, excess availability was greater than $100 million. The

Company is also required to maintain cash and cash equivalents in the U.S. of at least $250 million. The negative covenants limit,

under certain circumstances, among other things, the Company’s ability to incur additional debt or liens, make certain investments,

make shareholder distributions or prepay debt, except as permitted under the terms of the Amended Credit Agreement. The

Company was in compliance with all covenants under the Amended Credit Agreement as of December 31, 2010.