Kodak 2010 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

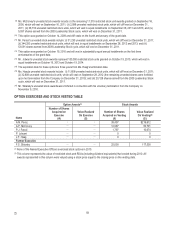

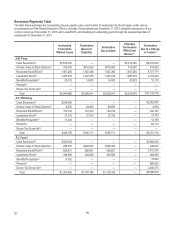

PENSION BENEFITS FOR 2010

The Pension Benefits Table below shows the present value as of December 31, 2010 of the accumulated benefits payable to each of our

Named Executive Officers, including the number of years of service credited to each Named Executive Officer under KRIP, KURIP and,

when applicable, their supplemental individual retirement arrangements. The methods and assumptions for calculating the present value of

accumulated benefits generally follow those set forth in Accounting Standards Codification Topic 715 under GAAP and are consistent with

those used in our financial statements as described in Note 17 to the Notes to the Consolidated Financial Statements to the Company’s

Form 10-K for the year ended December 31, 2010. The present value has been calculated for all Named Executive Officers, with the

exception of Ms. Haag, assuming they will remain in service until the normal retirement age of 65, and that the benefit is payable as a lump

sum. The present value of Ms. Haag’s accumulated benefit assumed a benefit commencement upon completion of 30 years of service

when she would have been age 60 and 4 months. This is the age when she would have been entitled to retire without any benefit

reduction. The present values of Ms. Haag’s accumulated benefits were calculated assuming the form of a straight life annuity for KRIP

and a lump sum for KURIP. For Mr. Sklarsky, the present value of the accumulated benefit reflects the payment to be made to him in June

2011.

Name

Plan Name

Number of Years

of Credited Service

(#)

Present Value of

Accumulated Benefit

($)

Payments During

Last Fiscal Year

($)

A.M. Perez

KRIP

7.75

$86,060

$0

KURIP

7.75

1,261,548

0

Individual Arrangement

25.08(1)

13,313,990

0

A.P. McCorvey

KRIP

11.08

117,210

0

KURIP

11.08

183,210

0

P.J. Faraci

KRIP

6.08

62,879

0

KURIP

6.08

288,539

0

Individual Arrangement

14.77(2)

2,088,259

0

P. Jotwani

KRIP

0.25

5,321

0

KURIP

0.25

0

0

J.P. Haag

KRIP

29.83

1,476,598

0

KURIP

29.83

1,916,429

0

Former Executive

F.S. Sklarsky

KRIP

4.17

0

45,840(3)

KURIP

4.17

194,357

0

Individual Arrangement

4.17

0

0

(1) Mr. Perez has been employed with the Company for 7.75 years as of December 31, 2010. Under his individual arrangement, he

has accumulated 25.08 years, representing a difference of 17.33 years of additional service. Of Mr. Perez’s total accumulated

benefit shown above, $9,200,365 is attributable to his additional credited service as of December 31, 2010.

(2) Mr. Faraci has been employed with the Company for 6.08 years as of December 31, 2010. Under his individual arrangement, he

has accumulated 14.77 years, representing a difference of 8.69 years of additional service. Of Mr. Faraci’s total accumulated

benefit shown above, $1,228,388 is attributable to his additional credited service as of December 31, 2010.

(3) Mr. Sklarsky was paid $45,840 from KRIP during the year. He will be paid a lump sum of $194,357 from KURIP in June 2011. He

terminated voluntarily prior to vesting in his individual arrangement.

Tax-Qualified Retirement Plan (KRIP)

The Company funds a tax-qualified defined benefit pension plan (KRIP) for virtually all U.S. employees. Effective January 1, 2000, the

Company amended the plan to include a cash balance component. KRIP’s cash balance component covers all new employees hired after

March 31, 1999, including Messrs. Perez, Sklarsky, Faraci and Jotwani and Ms. McCorvey. Ms. Haag is the only Named Executive Officer

who participates in KRIP’s traditional defined benefit component.