Kodak 2010 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2010 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

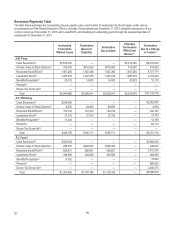

(5) The amounts in this row relating to termination due to a change in control represent the value of unvested shares of Restricted

Stock and RSUs that would be considered an approved reason and to be paid out upon a termination subsequent to a change in

control. The amounts relating to the other identified terminations report the value of unvested shares of Restricted Stock and

RSUs that would continue to vest upon the occurrence of that type of termination.

(6) There was no Leadership Stock grant in 2010. The values in this row reflect a 170% earnout for the 2009 Leadership Stock

performance cycle and a 0% earnout for the 2008 Leadership Stock performance cycle. For Mr. Perez, the value also includes the

earned portion of his 2010 performance stock unit award that would vest upon termination under the different scenarios on

December 31, 2010.

(7) Mr. Perez would be entitled to the benefits/perquisites as described below:

• in the event of involuntary termination, $20,419, which include four months of continued dental and life insurance coverage

valued at $619, outplacement services valued at $5,800 and two years of financial counseling services valued at $7,000 per

year.

• in the event of termination due to disability or death, $14,000, which include two years of financial counseling services

valued at $7,000 per year.

• in the event of voluntary termination with good reason, $20,329, which include four months of continued dental coverage

valued at $529, outplacement services valued at $5,800 and two years of financial counseling services valued at $7,000 per

year.

• in the event of termination due to a change in control, $15,110, which include one year of continued dental coverage valued

at $1,587, life insurance coverage valued at $269 and disability coverage valued at $13,254.

All other Named Executive Officers would be entitled to benefits/perquisites only in the event of involuntary termination without

cause or a termination due to a change in control, as described below:

• Ms. McCorvey’s benefits/perquisites in the event of an involuntary termination without cause would have totaled $11,437,

which include four months of continued medical, dental and life insurance coverage valued at $3,529, outplacement services

valued at $5,800 and financial counseling services valued at $2,108. Her benefits/perquisites in the event of termination due

to a change in control would have totaled $13,189, which include one year of continued medical coverage valued at $8,883,

dental coverage valued at $1,587, life insurance coverage valued at $116 and disability coverage valued at $2,603.

• Mr. Faraci’s benefits/perquisites in the event of an involuntary termination without cause would have totaled $9,152, which

include four months of continued medical, dental and life insurance coverage valued at $3,352 and outplacement services

valued at $5,800. His benefits/perquisites in the event of termination due to a change in control would have totaled $15,942,

which include one year of continued medical coverage valued at $8,883, dental coverage valued at $1,058, life insurance

coverage valued at $116 and disability coverage valued at $5,884.

• Mr. Jotwani’s benefits/perquisites in the event of an involuntary termination without cause would have totaled $5,868, which

include four months of continued life insurance coverage valued at $68 and outplacement services valued at $5,800. His

benefits/perquisites in the event of termination due to a change in control would have totaled $5,608, which include one year

of continued life insurance coverage valued at $203 and disability coverage valued at $5,405.

• Ms. Haag’s benefits/perquisites in the event of an involuntary termination without cause would have totaled $11,289, which

include four months of continued medical, dental and life insurance coverage valued at $3,381, outplacement services

valued at $5,800 and financial counseling services valued at $2,108.

(8) The amounts included in this row report the incremental value of supplemental retirement benefits to which the Named Executive

Officers would have been entitled on the occurrence of the specified termination event. The amounts reported assume that all

affected Named Executive Officers would receive their supplemental retirement benefits in a lump sum.

(9) In 2009, Mr. Perez waived his rights to excise tax gross-up payments under the Executive Protection Plan. Mr. Jotwani waived

his rights to these payments upon hire. Ms. McCorvey waived her rights to these payments by letter dated October 11, 2010. The

plan was amended effective December 23, 2010 to eliminate these payments for all executives, including Mr. Faraci and Ms.

Haag. The plan, however, provides that no amendment adversely impacting the rights of covered executives will be effective for

12 months. Therefore, Mr. Faraci would have been eligible for a payment in the event that a change in control had occurred as of

December 31, 2010. Ms. Haag was ineligible due to her termination from the Company with approved reason on December 31,

2010.

(10) Due to Ms. Haag’s termination from the Company with approved reason on December 31, 2010, she is not eligible for benefits

due to disability, death or change in control.