Chrysler 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REPORT ON

OPERATIONS

01

44

TRANSITION TO INTERNATIONAL FINANCIAL

REPORTING STANDARDS (IAS/IFRS)

Following the coming into force of European Regulation No.

1606 dated July 2002, EU companies traded on EU regulated

markets are required to adopt IAS/IFRS (“IFRS”) in the

preparation of their 2005 consolidated financial statements.

This will require a restatement of prior years.

At the present date, Fiat is finalizing its process of transition

to IFRS and will report 2005 First Quarter results and prior

year comparatives in accordance with IFRS.

This note describes the policies that Fiat is adopting in

preparing the IFRS opening consolidated balance sheet at

January 1, 2004, as well as the main differences in relation to

the Italian GAAP used to prepare the consolidated financial

statements until December 31, 2004.

The 2004 IFRS consolidated financial statements will be

prepared in accordance with IFRS 1 – First-time Adoption

of IFRS based on the IFRS applicable from January 1, 2005,

as published as of December 31, 2004.

In particular, the 2004 IFRS financial statements will be prepared

in accordance with:

■IAS 39 – Financial Instruments: Recognition and Measurement

in its entirety. In particular, the Group is adopting

derecognition requirements retrospectively from the date

in which financial assets and financial liabilities had been

derecognized under Italian GAAP.

■IFRS 2 – Share-based Payment, which was published by the

IASB on February 19, 2004 and adopted by the European

Commission on February 7, 2005.

FIRST-TIME ADOPTION OF IFRS

GENERAL PRINCIPLE

The Group is required to apply the accounting standards in

force at the reporting date for its first IFRS financial statements

retrospectively to all periods presented, except for some

exemptions adopted by the Group in accordance with IFRS

1, as described in the following paragraph.

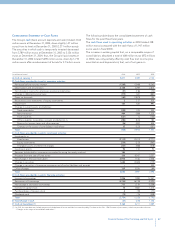

The opening IFRS balance sheet at January 1, 2004 will reflect

the following differences as compared to the consolidated

Italian GAAP balance sheet prepared at December 31, 2003

in accordance with Italian GAAP:

■all assets and liabilities qualifying for recognition under IFRS,

including assets and liabilities that were not recognized under

Italian GAAP, shall be recognized and measured in

accordance with IFRS;

■all assets and liabilities recognized under Italian GAAP that

do not qualify for recognition under IFRS shall be eliminated;

■certain balance sheet items will be reclassified in accordance

with IFRS.

The impact of these adjustments shall be recognized directly

in opening equity at the date of transition to IFRS (January 1,

2004).

OPTIONAL EXEMPTIONS ADOPTED BY THE GROUP

Business combinations – The Group elected not to apply IFRS

3Business Combinations retrospectively to the business

combinations that occurred before the date of transition to

IFRS.

Employee benefits – The Group elected to recognize all

cumulative actuarial gains and losses that existed at January 1,

2004, even if it decided to use the corridor approach for later

actuarial gains and losses.

Cumulative translation differences – The cumulative translation

differences arising from the consolidation of foreign operations

will be set at nil as at January 1, 2004; gains or losses on

subsequent disposal of any foreign operation shall only include

accumulated translation differences after January 1, 2004.

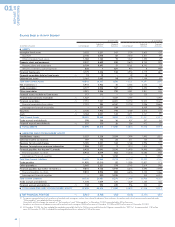

DESCRIPTION OF MAIN DIFFERENCES BETWEEN ITALIAN

GAAP AND IFRS

The following paragraph provide a description of main

differences between Italian GAAP and IFRS that will have effects

on Fiat consolidated financial statements.

A. DEVELOPMENT COSTS

Under Italian GAAP applied research and development costs

may alternatively be capitalized or charged to operations when

incurred. Fiat Group has mainly expensed R&D costs when

incurred. IAS 38 – Intangible Assets requires that research costs

be expensed, whereas development costs that meet the criteria

for capitalization must be capitalized and then amortized from

the start of production over the economic life of the related

products.

The Group will capitalize development costs of the Automobile,

Ferrari – Maserati, Agricultural and Construction Equipment,

Commercial Vehicle and Components Sectors by using the

retrospective approach in compliance with IFRS 1.

In accordance with IAS 36 – Impairment of Assets, impairment

tests will be applied to development costs capitalized as

intangible assets and impairment losses will be recognized if the

recoverable amount of an asset is less than its carrying amount,

as further described in the paragraph “Impairment of assets”.

B. EMPLOYEE BENEFITS

The Group sponsors funded and unfunded defined benefit

pension plans, as well as other long term benefits to employees.