Chrysler 2004 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

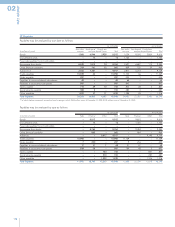

Consolidated Financial Statements at December 31, 2004 – Notes to the Consolidated Financial Statements

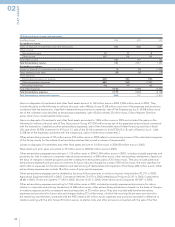

of a high-speed railway lines between Bologna - Florence and Turin - Milan. The increase of 2,250 million euros compared to

December 31, 2003 relates principally to the agreements reached during 2004 regarding the Florence-Bologna section for 187 million

euros; the subsection Turin-Novara for 83 million euros; agreements for the section Novara-Milan for 1,976 million euros and

monetary adjustments for 4 million euros. Fiat S.p.A. in turn assigned the design and construction of these works to the CAV.E.T. and

CAV.TO.MI consortiums. In order to guarantee the contractual advances and the proper execution of the works, Fiat S.p.A. granted

bank suretyships to T.A.V. S.p.A. totaling 1,972 million euros. Similarly, as called for by the contract, the CAV.E.T. and CAV.TO.MI

consortiums granted bank suretyships to Fiat S.p.A. for 617 million euros and 1,279 million euros, respectively. Consequently, the

guarantees granted are substantially covered by the guarantees received.

Other commitments and important contractual rights

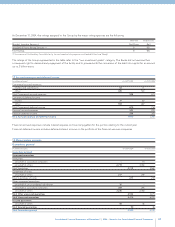

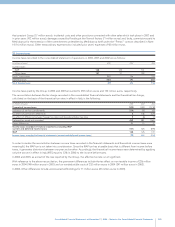

Relations with General Motors

As described in the Report on Operations – Significant events occurring since the end of the fiscal year and business outlook,

on February 13, 2005 Fiat and General Motors signed a “Termination Agreement” to dissolve the Master Agreement and the joint

ventures between the two groups. The agreement calls for the payment by General Motors to Fiat of 1.55 billion euros (of which 1

billion euros was already paid on February 14, 2005) to dissolve the Master Agreement, including the cancellation of the put option

and the unwinding of the joint ventures. This sum will allow Fiat to recover the value of Fiat’s investments in the Fiat-GM Powertrain

and GM-Fiat Purchasing joint ventures recorded in the financial statements, the value of 50 percent of the Bielsko Biala (Poland)

plant, which it will continue to manage, and the value of the JTD engine technology, which will be co-owned with General Motors.

The sum will also entail recognition by Fiat of more than 1 billion euros of compensation to dissolve the alliance and cancel the Put

on Fiat Auto shares.

Ferrari

A summary is presented below of the rights arising from the purchase in 2002 of 34% of the capital stock of Ferrari S.p.A. for 775

million euros by Mediobanca S.p.A., within the framework of a consortium set up for the acquisition and placement of the Ferrari

shares. Fiat realized a gain of 671 million euros on this sale, net of selling expenses. The sale contract sets out the following principal

elements:

■Mediobanca assumed the responsibility of sole Global Coordinator in charge of coordinating and leading the consortium.

■Mediobanca cannot sell its Ferrari shares to another group in the automobile industry as long as the Fiat Group maintains a 51%

controlling interest in Ferrari. Barring certain specific assumptions, the Fiat Group can not reduce its investment in Ferrari below

51% until the end, depending on the case, of the third or fourth year subsequent to signing the contract.

■Fiat holds a call option that allows it to repurchase the Ferrari shares at any time before June 30, 2006 (the original date of June

30, 2005 was extended by one year during the course of 2003, by virtue of the payment of a premium of 16 million euros), except

during the five months subsequent to the presentation of an IPO application to the competent authorities. The option exercise

price is equal to the original price at which the shares were sold plus interest during the period based on the BOT yield plus 4%.

■Mediobanca, moreover, does not hold any put option to resell the purchased Ferrari shares to Fiat, even in the event that the IPO

does not occur or is not completed.

■Fiat may share, in declining percentages, in any gain realized by Mediobanca and the other members of the consortium in the

event of an IPO.

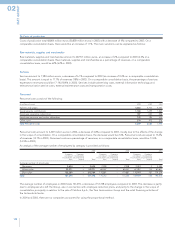

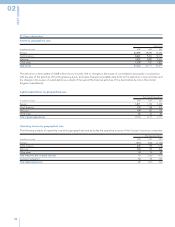

Teksid

Teksid S.p.A. is the object of a Put and Call contract with the partner Norsk Hydro concerning the subsidiary Meridian Technologies

Inc. (held 51% by the Teksid Group and 49% by the Norsk Hydro Group). In particular, should there be a strategic deadlock in the

management of the company (namely in all those cases in which a unanimous vote in favor is not reached by the directors on the

board as regards certain strategic decisions disciplined by the contract between the stockholders), the following rights would arise:

■Put Option of Norsk Hydro with Teksid on the 49% holding: the sale price would be commensurate with the initial investment

made in 1998, revalued pro rata temporis, net of dividends paid.