Chrysler 2004 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227

|

|

FIAT GROUP

02

114

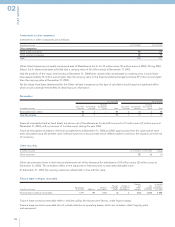

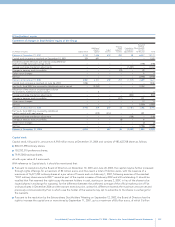

Reserve for pensions and similar obligations

The reserve includes provisions for pensions and similar obligations determined on an actuarial basis, where applicable, and payable

to employees and former employees according to contractual agreements or by law, where applicable.

Income tax reserves

The Deferred income tax reserve at December 31, 2004 includes deferred tax liabilities, net of deferred tax assets, which have been

offset where possible by the individual companies. The Deferred income tax reserve, net of Deferred tax assets recorded under

Receivables (Note 5), is composed as follows:

(in millions of euros) At 12/31/2004 At 12/31/2003 Change

Deferred income tax reserve 197 211 (14)

Deferred tax assets (2,161) (1,879) (282)

Total (1,964) (1,668) (296)

The net change of 296 million euros compared to December 31, 2003 is mainly due to the recording of deferred tax assets (written

down in previous years as the conditions for recording them were not met), the recoverability of which became highly probable in

view of the change in the prospects of future earnings. In particular, due to the settlement paid to Fiat by General Motors in February

2005, deferred tax assets of 277 million euros relating to the benefit of tax loss carryforwards and temporary differences relating to

Fiat S.p.A. became reasonably certain of recovery.

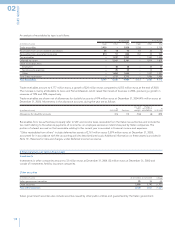

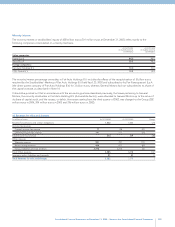

The Deferred income tax reserve, net of Deferred tax assets recorded under Other receivables from others, can be analyzed as

follows:

(in millions of euros) At 12/31/2004 At 12/31/2003

Deferred tax liabilities for:

Accelerated depreciation 402 492

Deferred tax on gains 171 493

Capital investment grants 17 18

Other 694 684

Total Deferred tax liabilities 1,284 1,687

Deferred tax assets for:

Taxed reserves for risks and charges (1,076) (1,021)

Inventories (126) (126)

Taxed allowances for doubtful accounts (137) (86)

Pension funds (338) (289)

Adjustments to financial assets (1,717) (2,056)

Other (812) (680)

Total Deferred tax assets (4,206) (4,258)

Theoretical tax benefit connected to tax loss carryforwards (4,591) (4,313)

Adjustments for assets whose recoverability is not reasonably certain 5,549 5,216

Total Deferred income tax reserve, net of Deferred tax assets (1,964) (1,668)