Chrysler 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Financial Review of the Fiat Group and Fiat S.p.A.

FINANCIAL REVIEW OF THE FIAT GROUP

AND FIAT S.P.A.

INTRODUCTION

In order to facilitate the analysis of the results for 2004 and their

comparison with 2003, the most important transactions affecting

the scope of consolidation of the Group in 2004 as compared

with 2003 are illustrated below:

■Fiat Auto Holdings’ retail financing activities in Brazil were

sold to the Itaù banking group at the end of March 2003

and deconsolidated from the same date.

■The agreement to sell the Toro Assicurazioni Group to

the DeAgostini Group was signed on May 2, 2003 and the

relevant operations were deconsolidated as of the same date.

■On May 27, 2003, as part of the agreement signed by Fiat

and Capitalia, Banca Intesa, Sanpaolo IMI and Unicredito

on March 11, 2003, and following approval by the competent

authorities, the sale by Fiat to the Banks of a majority interest

(51%) of Fidis Retail Italia was concluded. At that time, Fidis

Retail Italia controlled part of the European activities of Fiat

Auto Holdings in the field of retail consumer financing for

automobile purchases.

The sale to Fidis Retail Italia of the equity investments in

the other financial companies covered by the agreement

was finalized in October 2003, with the sole exception of the

company active in the United Kingdom, which was sold in 2004.

■In execution of the contract signed on July 1, 2003 and

after having met the conditions precedent, the sale of the

aerospace activities of FiatAvio S.p.A. to Avio Holding S.p.A.,

a company 70% owned by The Carlyle Group and 30% by

Finmeccanica S.p.A., was finalized. Said activities were

deconsolidated effective from the date of the agreement.

■In February 2004, 100% of the interest held in Fiat

Engineering S.p.A. was sold to Maire Investimenti S.p.A.

and the company was therefore deconsolidated as of the

beginning of the year. At the same time, Fiat Partecipazioni

S.p.A. subscribed to a capital increase at Maire Investimenti

S.p.A. and now owns 30% of the capital of this company. On

said 30% interest, both parties hold put and call options that

are exercisable within three years at a predetermined price.

■Effective January 1, 2004, Magneti Marelli consolidated

Magneti Marelli Electronic Systems on a line-by-line basis

following gradual acquisition of actual control over this

strategic supplier of Fiat Auto and other automotive groups.

In 2002 this business had been sold to the Mekfin Group,

which later sold it to the Ixfin Group. So that the company

would punctually respect the commitment it had made to

its customers and continue pursuing its growth strategies,

an agreement was initialed at the end of 2003 between the

Ixfin Group and the Fiat Group, on the basis of which Magneti

Marelli, pursuant to an agreement providing for an usufruct

on the company’s voting shares, started becoming

increasingly involved in the management of the Electronic

Systems activity in 2004. Finally, on July 28, 2004, the Fiat

Group decided to acquire full ownership thereof by exercising

a call option.

■In September, Magneti Marelli sold 100% of the Midas

business (automotive repair and maintenance services)

in Europe and Latin America to the Norauto Group. These

activities were deconsolidated as of September 30, 2004.

To allow a meaningful comparison with prior period data, the

figures for 2003 used in the analyses presented in the following

pages have been prepared on the basis of the “Continuing

Operations”, i.e. excluding data of companies that were sold

in 2003 (Toro Assicurazioni, FiatAvio, Fraikin, IPI, Fidis Retail Italia

and Fiat Auto’s retail financing activities in Brazil).

It should be noted that in 2003, Continuing Operations included

Fiat Engineering, that was deconsolidated effective January 1,

2004 and had reported revenues of 369 million euros and

operating income of 20 million euros in fiscal 2003. Conversely,

the Electronic Systems operations of Magneti Marelli mentioned

above reported revenues of 476 million euros and an operating

income of 26 million euros in 2004.

To provide clearer information on the Group’s operating

performance, the financial figures are illustrated and

commented in the chapter, “Financial Position and Operating

Results by Activity Segment” broken down according to

Industrial Activities and Financial Activities.

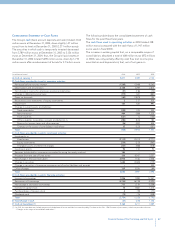

FINANCIAL REVIEW OF THE FIAT GROUP

In a highly competitive market, in 2004 the Group was able

to achieve its stated objective to attain operating breakeven.

Improvements were achieved in all Group Sectors, with the

exception of Fiat Auto whose loss was however reduced by

over 20%.

The net loss was lower than in 2003, when it had benefited

from net capital gains of about 1.7 billion euros mainly on the

disposal of activities.

At December 31, 2004, the Group’s liquidity amounted to 5.3

billion euros, compared with 7 billion euros at the beginning of

2004, despite a gross indebtedness, which fell by approximately

3.4 billion euros as the Group repaid bonds totaling

approximately 2.7 billion euros.

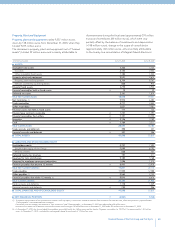

OPERATING PERFORMANCE

Highlights of the Group’s operating performance are illustrated

below. For a more detailed analysis, see the section “Operating

Performance – Sectors of Activity”.