Chrysler 2004 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

177

Financial Statements at December 31, 2004 – Notes to the Financial Statements

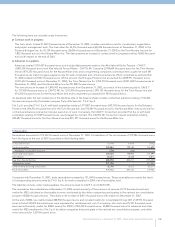

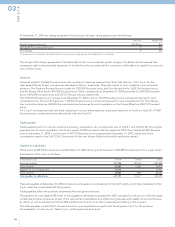

In particular, increases include:

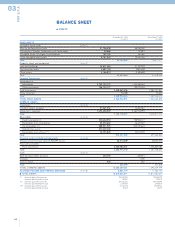

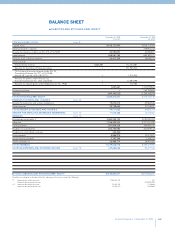

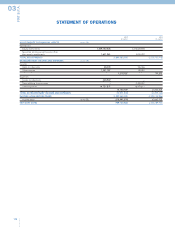

(in thousands of euros)

Acquisitions

Subsidiaries:

100% of Comau S.p.A. from Fiat Partecipazioni S.p.A. 82,413

80.48% of Teksid S.p.A. from Fiat Partecipazioni S.p.A. 96,644

100% of Business Solutions S.p.A. from Fiat Partecipazioni S.p.A. 65,360

Total 244,417

Capital increases

Subsidiaries:

Isvor Fiat Società consortile di sviluppo e addestramento industriale per Azioni 9,547

Total increases 253,964

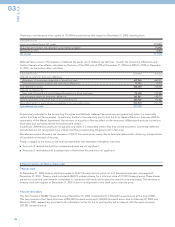

In particular, decreases include:

(in thousands of euros)

Disposals

Subsidiaries:

100% of Fiat International S.p.A. to Fiat Partecipazioni S.p.A. 278

100% of Fiat Oriente S.A.E. in liquidation to Fiat Partecipazioni S.p.A. 7

Total subsidiaries 285

Other companies:

19.35% of Istituto per la Ricerca e la Cura del Cancro S.p.A. to Fiat Partecipazioni S.p.A. 6,197

10.90% of Istituto Europeo di Oncologia S.r.l. to Fiat Partecipazioni S.p.A. 6,148

Total other companies 12,345

Total 12,630

Capital reimbursements

Subsidiaries:

IHF – Internazionale Holding Fiat S.A. 635,453

Writedowns of carrying value

Subsidiaries:

Fiat Partecipazioni S.p.A. (mainly due to the negative performance of the Automobile Sector) 1,623,973

Fiat Finance North America Inc. 3,976

Fiat U.S.A. Inc. 1,657

Isvor Fiat Società consortile di sviluppo e addestramento industriale per Azioni 9,547

Total 1,639,153

Total decreases 2,287,236

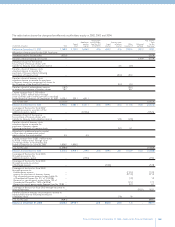

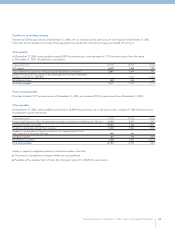

The table at the end of these Notes to the Financial Statements contains a list of equity investments and the additional information

required under Article 2427 of the Italian Civil Code and the supplemental data recommended by CONSOB, including changes in

quantity and value of subsidiaries and associated companies and, for publicly traded companies, a comparison between the book

value and the market value.

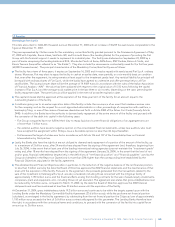

The purchases from and sales to Fiat Partecipazioni S.p.A. of the indicated investments were carried out as part of the ongoing

program to streamline the corporate structure of the Group, aimed at focusing Fiat S.p.A. more on its role as the direct holding

company of the Operating Sectors, with the exclusion of the Automobiles Sector for contingent reasons, while concentrating

portfolio investments or those pertaining to “non-core” activities in other sub-holdings. The acquisitions of investments in Comau

S.p.A., Teksid S.p.A., and Business Solutions S.p.A. were made at a price in line with the value of the relevant stockholders’ equity on

a consolidated basis at December 31, 2004. This amount was considered to be prudently representative of the current value of the

transferred companies in consideration of their current financial situation and the prospects resulting from the plans.

The decrease for the investment in IHF - Internazionale Holding Fiat S.A. is the result of the reduction in the capital stock of the

subsidiary carried out during the fiscal year, from 2 billion Swiss francs to 100 million Swiss francs, through reimbursement of 1.9

billion Swiss francs. This reimbursement involved a 635 million euros reduction in the book value of the investment upon cancellation

of shares, and income of 606 million euros for the remaining part of revenue (note 17).