Chrysler 2004 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

189

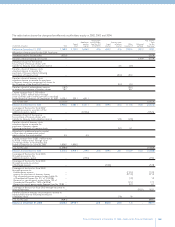

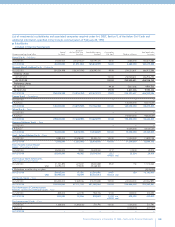

Financial Statements at December 31, 2004 – Notes to the Financial Statements

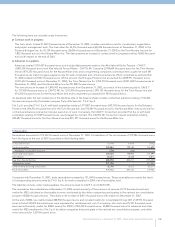

Although they are not included in the memorandum accounts, trade receivables and other receivables due after December 31, 2004

were sold without recourse for a total of 415 million euros (396 million euros in 2003 for receivables due after December 31, 2003).

The turnover of receivables sold without recourse totaled 843 million euros in 2004 (1,471 million euros in 2003).

The net decrease of 3,872,123 thousand euros compared to December 31, 2003, is due mainly to fewer guarantees on behalf of

subsidiaries following the reimbursement of bonds and reduced use of credit facilities.

Upon sale of its controlling interest in the rolling stock activities, Fiat S.p.A. assumed certain obligations towards the purchaser

Alsthom N.V. in guarantee of any breaches of contract occurring prior to the sale. On the basis of due diligence results, it is believed

that Fiat does not face a reasonable likelihood of loss.

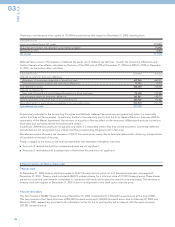

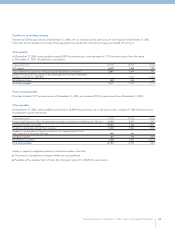

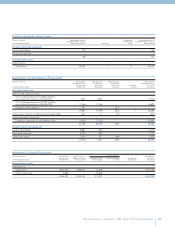

Commitments

Commitments related to supply contracts

This item totaled 10,261,147 thousand euros at December 31, 2004. Of this amount, 3,824,713 thousand euros represent the

commitment (corresponding to the contractual amounts) stemming from the agreement executed on May 7, 1996 and the

supplemental agreements signed by Fiat S.p.A. and Treno Alta Velocità - T. A.V. S.p.A. for the design and construction of the

Bologna-Florence high-speed rail line, 4,455,909 thousand euros for the commitment undertaken pursuant to the agreement of

February 14, 2002 and subsequent supplement agreements for the design and construction of the Turin-Novara line, and 1,980,525

thousand euros for the commitment undertaken pursuant to the agreement of July 21, 2004 for the design and construction of the

Novara-Milan line. The increase of 2,250,219 thousand euros compared with December 31, 2003 includes agreements reached during

2004 regarding the Florence-Bologna line, specifically alterations to the network (95,009 thousand euros), urgent corrective measures

(38,468 thousand euros) and monetary adjustments (53,306 thousand euros), agreements regarding the Turin-Novara line, specifically

relating to alterations (9,662 thousand euros) and monetary adjustments (73,249 thousand euros), and the agreement regarding the

Novara-Milan line (1,976,000 thousand euros) and monetary adjustments (4,525 thousand euros).

Fiat S.p.A. has subcontracted design and construction of the works to the CAV.E.T. and CAV.TO.MI. Consortia.

Fiat S.p.A. provided T.A.V. S.p.A. with bank suretyships totaling 1,971,807 thousand euros as security for contractual advances

received and proper execution of work. These guarantees are not recorded under the Memorandum Accounts since advances are

included under Liabilities - Advances. Likewise, the CAV.E.T. and CAV.TO.MI Consortia provided Fiat S.p.A. with the contractually

envisaged bank suretyships totaling 617,638 thousand euros and 1,278,908 thousand euros, respectively.

Commitments for derivative financial instruments

These totaled 90,398 thousand euros at December 31, 2004, reflecting an increase of 28,668 thousand euros with respect to

December 31, 2003, and refer for 65,830 thousand euros to the equity swap on Fiat shares and for 24,568 thousand euros to Forward

Rate Agreements made to cover the risks connected with changes in the rate of the mandatory convertible facility.

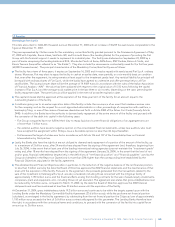

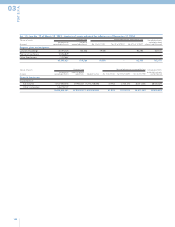

With particular regard to the previously mentioned equity swap arrangements, the amount at December 31, 2004 represents the

notional amount of the equity swap stipulated to hedge the risk of an increase in the Fiat share price above the exercise price of

10,000,000 stock options granted to Mr. Marchionne. In particular, the Board of Directors resolved to grant Mr. Marchionne, as a

portion of his variable compensation as Chief Executive Officer, options for the purchase of 10,670,000 Fiat ordinary shares at the

price of 6.583 euros per share, exercisable from June 1, 2008 to January 1, 2011. In each of the first three years, he accrues the right

to purchase, from June 1, 2008, a maximum of 2,370,000 shares per year and on June 1, 2008 he accrues the right to purchase,

effective that date, the residual portion amounting to 3,560,000 shares. The right to exercise the options related to this last portion

of shares is subject to certain predetermined profitability targets that should be reached during the reference period. The risk of a

significant increase in the Fiat share price above the exercise price for these options has been covered, with reference to 670,000

shares, by treasury stock in portfolio, whereas with reference to the remaining 10,000,000 shares, the aforementioned “Total Return

Equity Swap” agreement was put into place with a reference price of 6.583 euro per share and expiring on July 29, 2005.

In accordance with accounting principles, the aforementioned Equity Swap, despite being entered into for hedging purposes, cannot

be treated in hedge accounting and accordingly is defined as a trading derivative financial instrument. It follows that, in accordance

with the principle of prudence, if during the period of the contract the Fiat shares perform positively, the positive fair value of the

instrument is not recorded in the statement of operations; if, instead, the performance is negative, the negative fair value of the

instrument is recorded immediately as a cost under financial expenses.

At December 31, 2004, the Equity Swap has a negative fair value of 6,830 thousand euros that has therefore been recorded in

the financial statements.